Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. 3. 4. please Tupan the observe the follow. and sale of wheat yob offer yar ond.com London The curre Should you changer between power

2. 3. 4. please

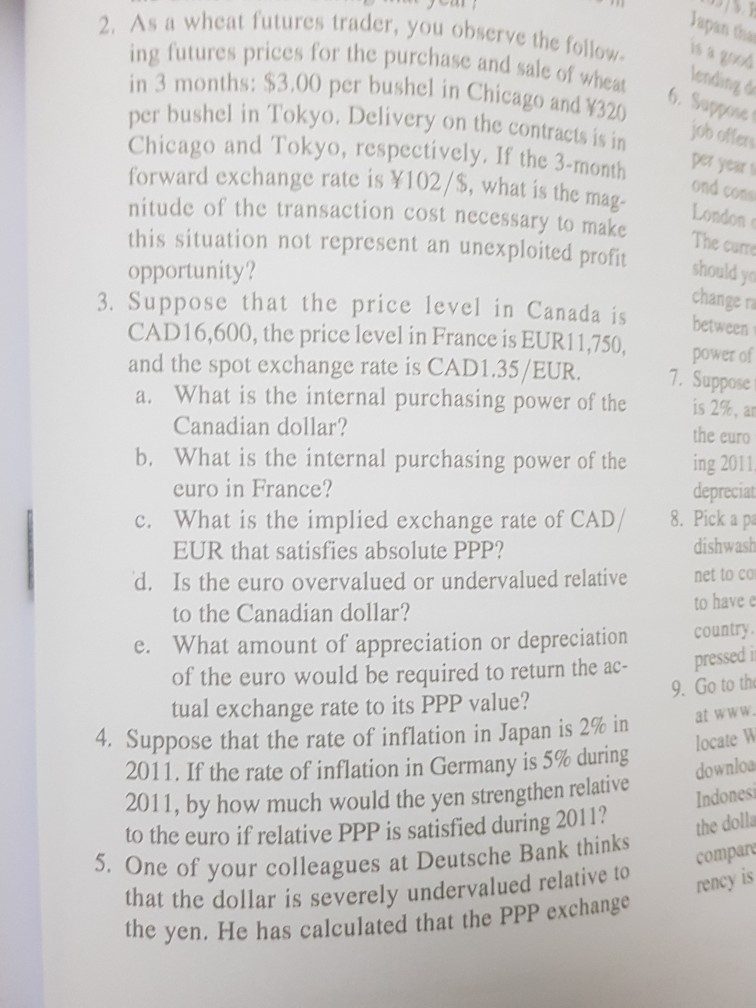

Tupan the observe the follow. and sale of wheat yob offer yar ond.com London The curre Should you changer between power of 7. Suppose 2. As a wheat futures trader, you observe the ing futures prices for the purchase and sale or in 3 months: $3,00 per bushel in Chicago and a per bushel in Tokyo, Delivery on the contracts is Chicago and Tokyo, respectively, If the 3-month forward exchange rate is 102/$, what is the mag. nitude of the transaction cost necessary to make this situation not represent an unexploited profit opportunity? 3. Suppose that the price level in Canada is CAD16,600, the price level in France is EUR 11,750, and the spot exchange rate is CAD1.35/EUR. a. What is the internal purchasing power of the Canadian dollar? b. What is the internal purchasing power of the euro in France? c. What is the implied exchange rate of CAD EUR that satisfies absolute PPP? d. Is the euro overvalued or undervalued relative to the Canadian dollar? e. What amount of appreciation or depreciation of the euro would be required to return the ac- tual exchange rate to its PPP value? 4. Suppose that the rate of inflation in Japan is 2% in 2011. If the rate of inflation in Germany is 5% during 2011, by how much would the yen strengthen relative to the euro if relative PPP is satisfied during 2011? 5. One of your colleagues is 2%, a the euro ing 2011 depreciat 8. Pick a pa dishwash net to co to have c country pressed 9. Go to the at www. locate downloa Indones the dolla compare rency is of your colleagues at Deutsche Bank thinks that the dollar is severely undervalued relative to the yen. He has calculated that the PPP exchangeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started