2

2

3

3

this question is clearly

this question is clearly

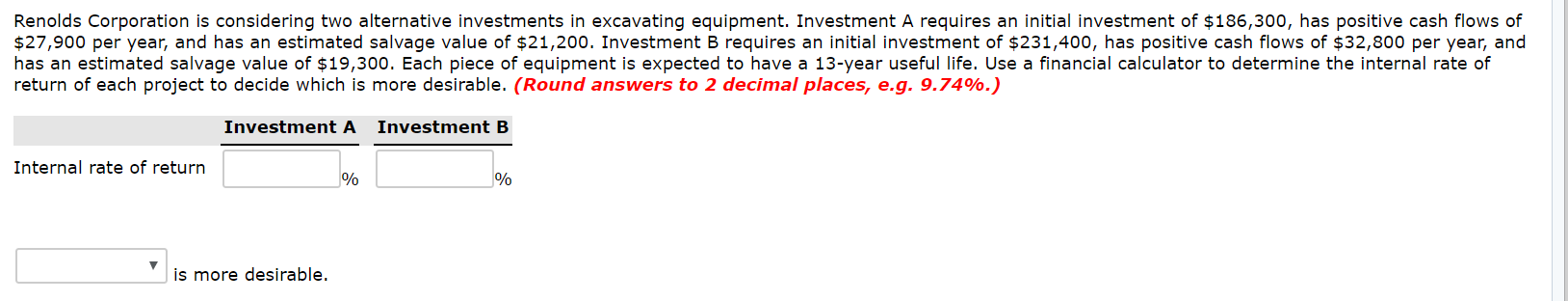

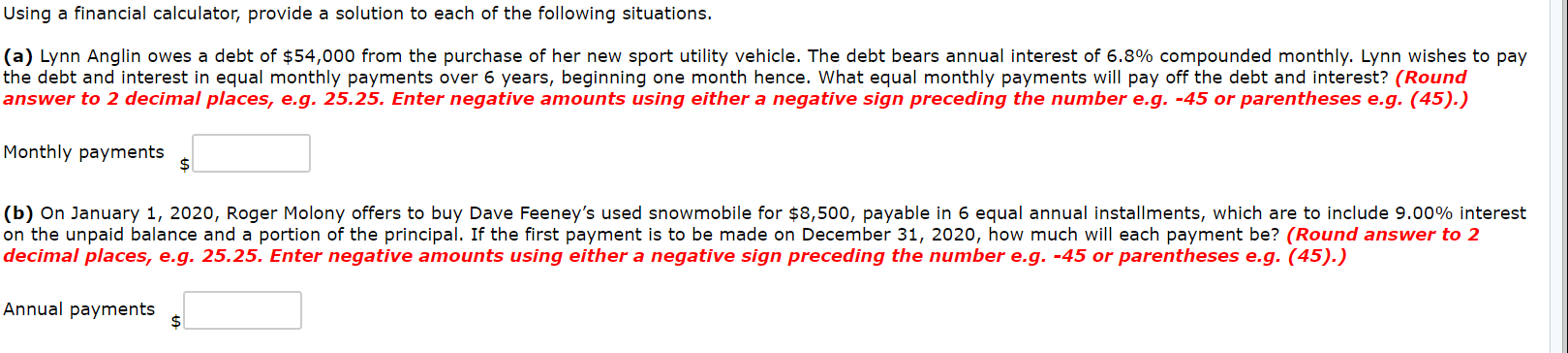

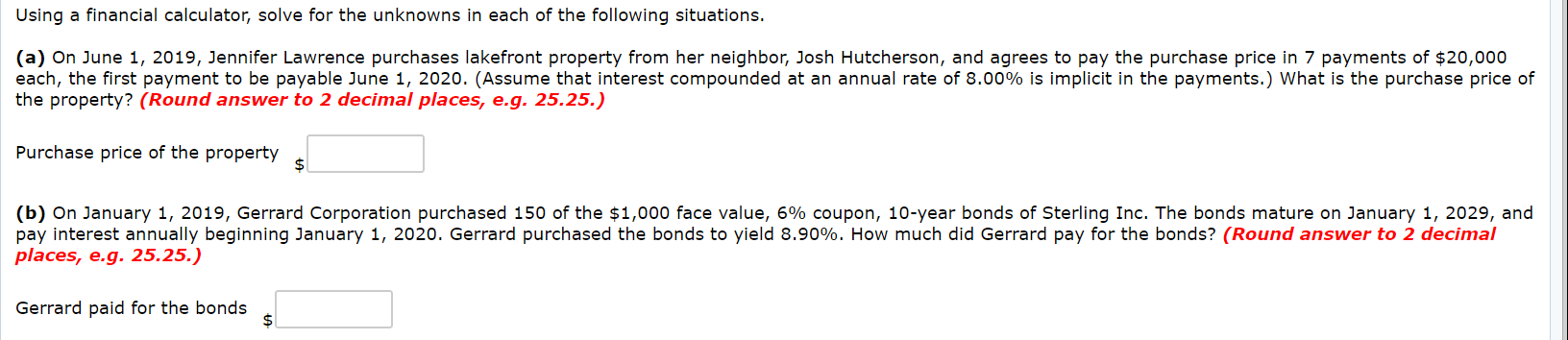

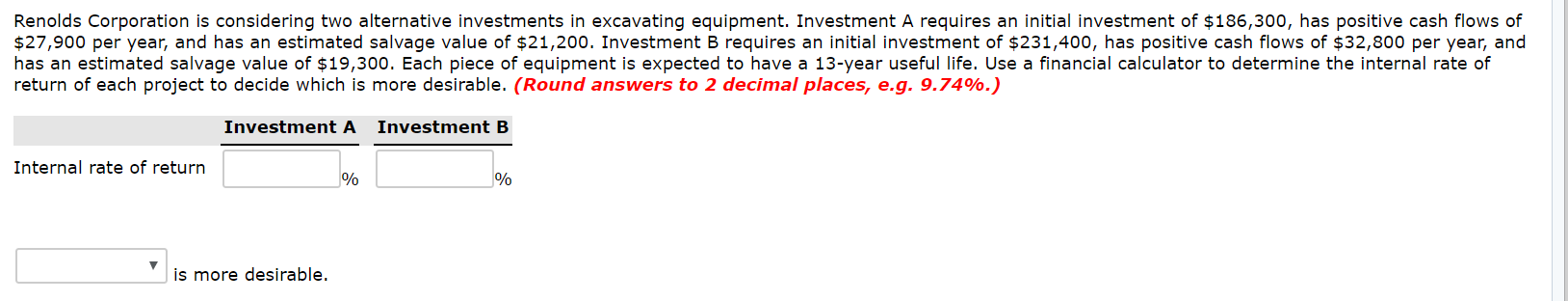

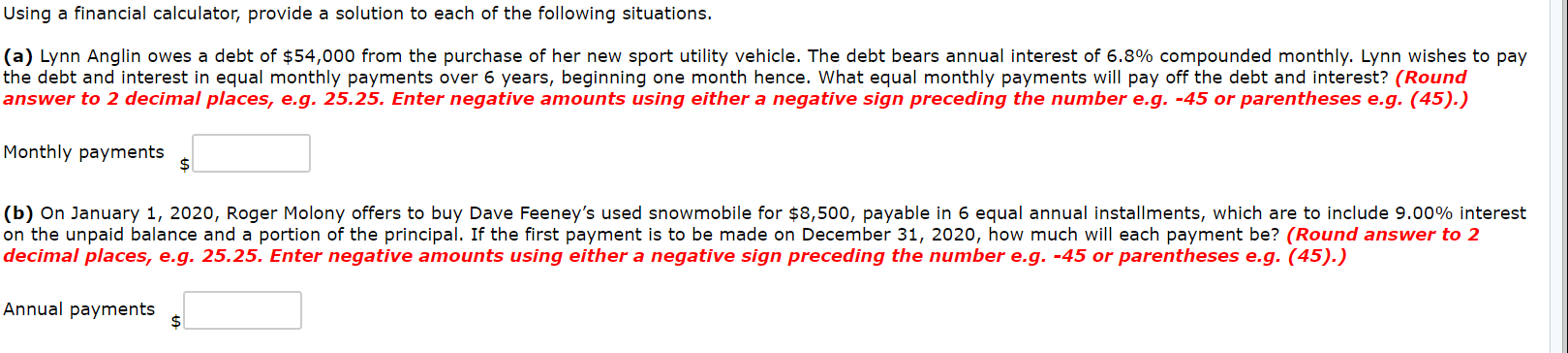

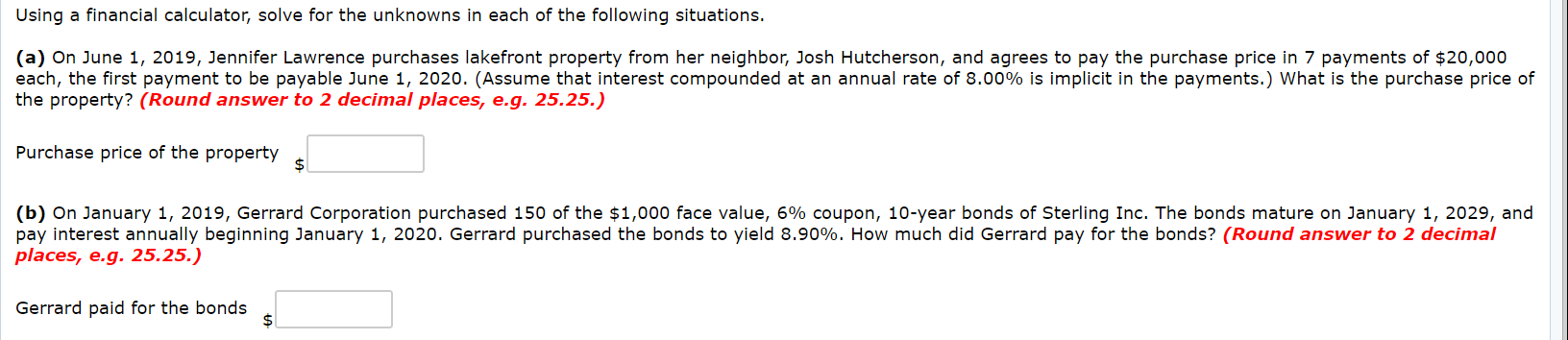

Renolds Corporation is considering two alternative investments in excavating equipment. Investment A requires an initial investment of $186,300, has positive cash flows of $27,900 per year, and has an estimated salvage value of $21,200. Investment B requires an initial investment of $231,400, has positive cash flows of $32,800 per year, and has an estimated salvage value of $19,300. Each piece of equipment is expected to have a 13-year useful life. Use a financial calculator to determine the internal rate of return of each project to decide which is more desirable. (Round answers to 2 decimal places, e.g. 9.74%.) Investment A Investment B Internal rate of return % % is more desirable. Using a financial calculator, provide a solution to each of the following situations. (a) Lynn Anglin owes a debt of $54,000 from the purchase of her new sport utility vehicle. The debt bears annual interest of 6.8% compounded monthly. Lynn wishes to pay the debt and interest in equal monthly payments over 6 years, beginning one month hence. What equal monthly payments will pay off the debt and interest? (Round answer to 2 decimal places, e.g. 25.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Monthly payments (b) on January 1, 2020, Roger Molony offers to buy Dave Feeney's used snowmobile for $8,500, payable in 6 equal annual installments, which are to include 9.00% interest on the unpaid balance and a portion of the principal. If the first payment is to be made on December 31, 2020, how much will each payment be? (Round answer to 2 decimal places, e.g. 25.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Annual payments Using a financial calculator, solve for the unknowns in each of the following situations. (a) on June 1, 2019, Jennifer Lawrence purchases lakefront property from her neighbor, Josh Hutcherson, and agrees to pay the purchase price in 7 payments of $20,000 each, the first payment to be payable June 1, 2020. (Assume that interest compounded at an annual rate of 8.00% is implicit in the payments.) What is the purchase price of the property? (Round answer to 2 decimal places, e.g. 25.25.) Purchase price of the property (b) on January 1, 2019, Gerrard Corporation purchased 150 of the $1,000 face value, 6% coupon, 10-year bonds of Sterling Inc. The bonds mature on January 1, 2029, and pay interest annually beginning January 1, 2020. Gerrard purchased the bonds to yield 8.90%. How much did Gerrard pay for the bonds? (Round answer to 2 decimal places, e.g. 25.25.) Gerrard paid for the bonds Renolds Corporation is considering two alternative investments in excavating equipment. Investment A requires an initial investment of $186,300, has positive cash flows of $27,900 per year, and has an estimated salvage value of $21,200. Investment B requires an initial investment of $231,400, has positive cash flows of $32,800 per year, and has an estimated salvage value of $19,300. Each piece of equipment is expected to have a 13-year useful life. Use a financial calculator to determine the internal rate of return of each project to decide which is more desirable. (Round answers to 2 decimal places, e.g. 9.74%.) Investment A Investment B Internal rate of return % % is more desirable. Using a financial calculator, provide a solution to each of the following situations. (a) Lynn Anglin owes a debt of $54,000 from the purchase of her new sport utility vehicle. The debt bears annual interest of 6.8% compounded monthly. Lynn wishes to pay the debt and interest in equal monthly payments over 6 years, beginning one month hence. What equal monthly payments will pay off the debt and interest? (Round answer to 2 decimal places, e.g. 25.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Monthly payments (b) on January 1, 2020, Roger Molony offers to buy Dave Feeney's used snowmobile for $8,500, payable in 6 equal annual installments, which are to include 9.00% interest on the unpaid balance and a portion of the principal. If the first payment is to be made on December 31, 2020, how much will each payment be? (Round answer to 2 decimal places, e.g. 25.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Annual payments Using a financial calculator, solve for the unknowns in each of the following situations. (a) on June 1, 2019, Jennifer Lawrence purchases lakefront property from her neighbor, Josh Hutcherson, and agrees to pay the purchase price in 7 payments of $20,000 each, the first payment to be payable June 1, 2020. (Assume that interest compounded at an annual rate of 8.00% is implicit in the payments.) What is the purchase price of the property? (Round answer to 2 decimal places, e.g. 25.25.) Purchase price of the property (b) on January 1, 2019, Gerrard Corporation purchased 150 of the $1,000 face value, 6% coupon, 10-year bonds of Sterling Inc. The bonds mature on January 1, 2029, and pay interest annually beginning January 1, 2020. Gerrard purchased the bonds to yield 8.90%. How much did Gerrard pay for the bonds? (Round answer to 2 decimal places, e.g. 25.25.) Gerrard paid for the bonds

2

2 3

3 this question is clearly

this question is clearly