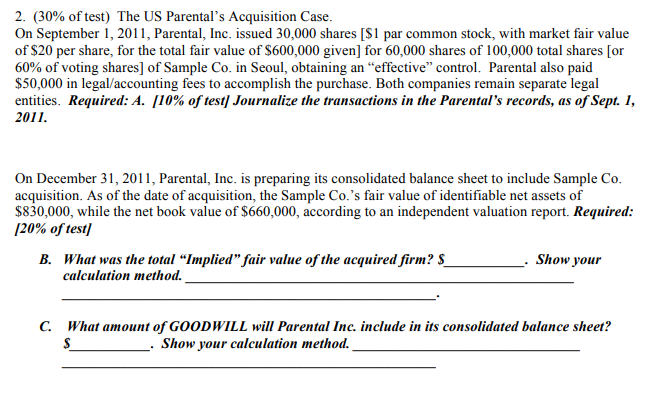

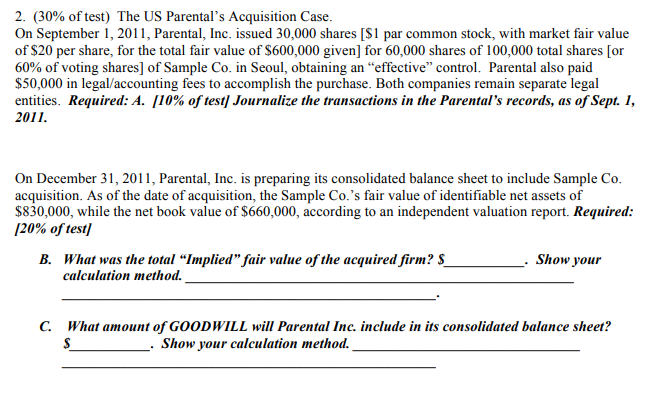

2. (30% of test) The US Parental's Acquisition Case. On September 1, 2011, Parental, Inc. issued 30,000 shares [$1 par common stock, with market fair value of $20 per share, for the total fair value of $600,000 given] for 60,000 shares of 100,000 total shares [or 60% of voting shares] of Sample Co. in Seoul, obtaining an "effective" control. Parental also paid $50,000 in legal/accounting fees to accomplish the purchase. Both companies remain separate legal entities. Required: A. [10% of test] Journalize the transactions in the Parental's records, as of Sept. 1, 2011. On December 31, 2011, Parental, Inc. is preparing its consolidated balance sheet to include Sample Co. acquisition. As of the date of acquisition, the Sample Co.'s fair value of identifiable net assets of $830,000, while the net book value of $660,000, according to an independent valuation report. Required: [20% of test) B. What was the total Implied" fair value of the acquired firm? $ Show your calculation method. C. What amount of GOODWILL will Parental Inc. include in its consolidated balance sheet? S Show your calculation method. 2. (30% of test) The US Parental's Acquisition Case. On September 1, 2011, Parental, Inc. issued 30,000 shares [$1 par common stock, with market fair value of $20 per share, for the total fair value of $600,000 given] for 60,000 shares of 100,000 total shares [or 60% of voting shares] of Sample Co. in Seoul, obtaining an "effective" control. Parental also paid $50,000 in legal/accounting fees to accomplish the purchase. Both companies remain separate legal entities. Required: A. [10% of test] Journalize the transactions in the Parental's records, as of Sept. 1, 2011. On December 31, 2011, Parental, Inc. is preparing its consolidated balance sheet to include Sample Co. acquisition. As of the date of acquisition, the Sample Co.'s fair value of identifiable net assets of $830,000, while the net book value of $660,000, according to an independent valuation report. Required: [20% of test) B. What was the total Implied" fair value of the acquired firm? $ Show your calculation method. C. What amount of GOODWILL will Parental Inc. include in its consolidated balance sheet? S Show your calculation method