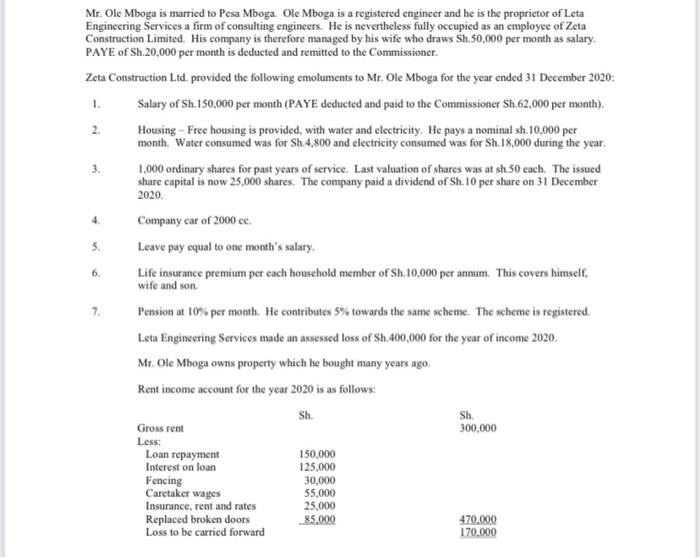

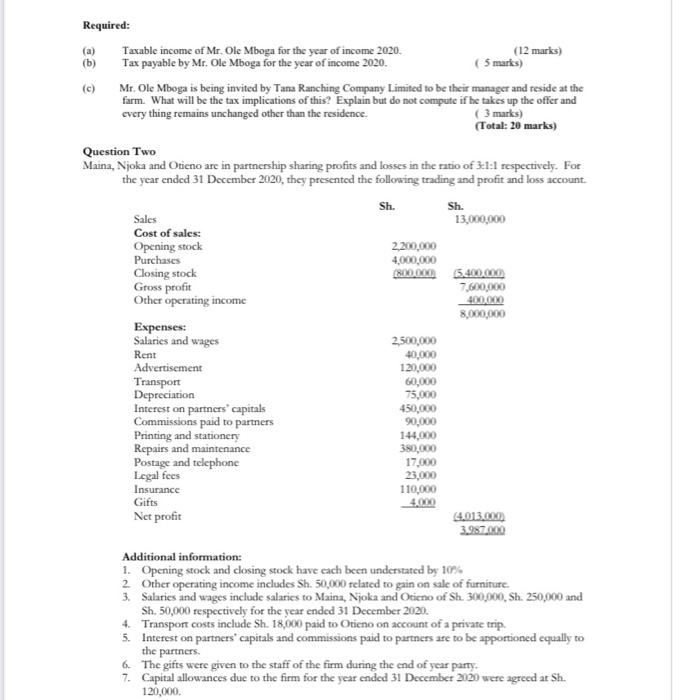

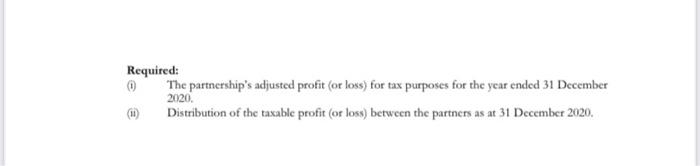

2. 4. Mr. Ole Mboga is married to Pesa Mboga Ole Mboga is a registered engineer and he is the proprietor of Leta Engineering Services a firm of consulting engineers. He is nevertheless fully occupied as an employee of Zeta Construction Limited. His company is therefore managed by his wife who draws Sh.50,000 per month as salary PAYE of Sh.20,000 per month is deducted and remitted to the Commissioner Zeta Construction Ltd. provided the following emoluments to Mr. Ole Mboga for the year ended 31 December 2020: 1. Salary of Sh.150,000 per month (PAYE deducted and paid to the Commissioner Sh.62,000 per month). Housing - Free housing is provided with water and electricity. He pays a nominal sh.10,000 per month. Water consumed was for Sh. 4,800 and electricity consumed was for Sh.18.000 during the year. 3. 1,000 ordinary shares for past years of service. Last valuation of shares was at sh.50 each. The issued share capital is now 25,000 shares. The company paid a dividend of Sh. 10 per share on 31 December 2020. Company car of 2000 cc 5. Leave pay equal to one month's salary. Life insurance premium per each household member of Sh.10,000 per annum. This covers himself, wife and son 7. Pension at 10% per month. He contributes 5% towards the same scheme. The scheme is registered Leta Engineering Services made an assessed loss of Sh.400,000 for the year of income 2020. Mr. Ole Mboga owns property which he bought many years ago Rent income account for the year 2020 is as follows: Sh. Gross rent 300,000 Less: Loan repayment 150,000 Interest on loan 125,000 Fencing 30,000 Caretaker wages 55,000 Insurance, rent and rates 25,000 Replaced broken doors 85.000 470,000 Loss to be carried forward 170.000 6. Sh. (a) Required: Taxable income of Mr. Ole Mboga for the year of income 2020 (12 marks) (b) Tax payable by Mr. Ole Mboga for the year of income 2020. (5 marks) Mr. Ole Mboga is being invited by Tana Ranching Company Limited to be their manager and reside at the farm. What will be the tax implications of this? Explain but do not compute if he takes up the offer and everything remains unchanged other than the residence (3 marks) (Total: 20 marks) Question Two Maina, Njoka and Otieno are in partnership sharing profits and losses in the ratio of 3:1:1 respectively. For the year ended 31 December 2020, they presented the following trading and profit and loss account. Sh. Sh. Sales 13,000,000 Cost of sales Opening stock 2,200,000 Purchases 4,000,000 Closing stock 800.000 5.400.000 Gross profit 7,600,000 Other operating income 400.000 8,000,000 Expenses: Salaries and wages 2,500,000 Rent 40,000 Advertisement 120,000 Transport - 60,000 Depreciation 75,000 Interest on partners' capitals 450,000 Commissions paid to partners 90,000 Printing and stationery 144,000 Repairs and maintenance 380,000 Postage and telephone 17.000 Legal fees 23,000 Insurance 110.000 Gifts 4,000 Net profit 4.013.000) 3.987.000 Additional information: 1. Opening stock and closing stock have cach been understated by 10% 2 Other operating income includes Sh. 50,000 related to gain on sale of furniture. 3. Salaries and wages include salaries to Mains, Njoka and Otieno of Sh 300,000, sh. 250,000 and Sh. 50,000 respectively for the year ended 31 December 2020. 4. Transport costs include Sh. 18.000 paid to Otieno on account of a private trip 5. Interest on partners' capital and commissions paid to partners are to be apportioned equally to the partners. 6. The gifts were given to the staff of the firm during the end of year party. 7. Capital allowances due to the firm for the year ended 31 December 2020 were agreed at Sh. 120,000 Required: () The partnership's adjusted profit (or loss) for tax purposes for the year ended 31 December 2020 Distribution of the taxable profit (or loss) between the partners as at 31 December 2020. 2. 4. Mr. Ole Mboga is married to Pesa Mboga Ole Mboga is a registered engineer and he is the proprietor of Leta Engineering Services a firm of consulting engineers. He is nevertheless fully occupied as an employee of Zeta Construction Limited. His company is therefore managed by his wife who draws Sh.50,000 per month as salary PAYE of Sh.20,000 per month is deducted and remitted to the Commissioner Zeta Construction Ltd. provided the following emoluments to Mr. Ole Mboga for the year ended 31 December 2020: 1. Salary of Sh.150,000 per month (PAYE deducted and paid to the Commissioner Sh.62,000 per month). Housing - Free housing is provided with water and electricity. He pays a nominal sh.10,000 per month. Water consumed was for Sh. 4,800 and electricity consumed was for Sh.18.000 during the year. 3. 1,000 ordinary shares for past years of service. Last valuation of shares was at sh.50 each. The issued share capital is now 25,000 shares. The company paid a dividend of Sh. 10 per share on 31 December 2020. Company car of 2000 cc 5. Leave pay equal to one month's salary. Life insurance premium per each household member of Sh.10,000 per annum. This covers himself, wife and son 7. Pension at 10% per month. He contributes 5% towards the same scheme. The scheme is registered Leta Engineering Services made an assessed loss of Sh.400,000 for the year of income 2020. Mr. Ole Mboga owns property which he bought many years ago Rent income account for the year 2020 is as follows: Sh. Gross rent 300,000 Less: Loan repayment 150,000 Interest on loan 125,000 Fencing 30,000 Caretaker wages 55,000 Insurance, rent and rates 25,000 Replaced broken doors 85.000 470,000 Loss to be carried forward 170.000 6. Sh. (a) Required: Taxable income of Mr. Ole Mboga for the year of income 2020 (12 marks) (b) Tax payable by Mr. Ole Mboga for the year of income 2020. (5 marks) Mr. Ole Mboga is being invited by Tana Ranching Company Limited to be their manager and reside at the farm. What will be the tax implications of this? Explain but do not compute if he takes up the offer and everything remains unchanged other than the residence (3 marks) (Total: 20 marks) Question Two Maina, Njoka and Otieno are in partnership sharing profits and losses in the ratio of 3:1:1 respectively. For the year ended 31 December 2020, they presented the following trading and profit and loss account. Sh. Sh. Sales 13,000,000 Cost of sales Opening stock 2,200,000 Purchases 4,000,000 Closing stock 800.000 5.400.000 Gross profit 7,600,000 Other operating income 400.000 8,000,000 Expenses: Salaries and wages 2,500,000 Rent 40,000 Advertisement 120,000 Transport - 60,000 Depreciation 75,000 Interest on partners' capitals 450,000 Commissions paid to partners 90,000 Printing and stationery 144,000 Repairs and maintenance 380,000 Postage and telephone 17.000 Legal fees 23,000 Insurance 110.000 Gifts 4,000 Net profit 4.013.000) 3.987.000 Additional information: 1. Opening stock and closing stock have cach been understated by 10% 2 Other operating income includes Sh. 50,000 related to gain on sale of furniture. 3. Salaries and wages include salaries to Mains, Njoka and Otieno of Sh 300,000, sh. 250,000 and Sh. 50,000 respectively for the year ended 31 December 2020. 4. Transport costs include Sh. 18.000 paid to Otieno on account of a private trip 5. Interest on partners' capital and commissions paid to partners are to be apportioned equally to the partners. 6. The gifts were given to the staff of the firm during the end of year party. 7. Capital allowances due to the firm for the year ended 31 December 2020 were agreed at Sh. 120,000 Required: () The partnership's adjusted profit (or loss) for tax purposes for the year ended 31 December 2020 Distribution of the taxable profit (or loss) between the partners as at 31 December 2020