Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (a) Assume that there is perfect capital mobility between the U.S. and Japan. Latest data show that economic growth in the U.S. was

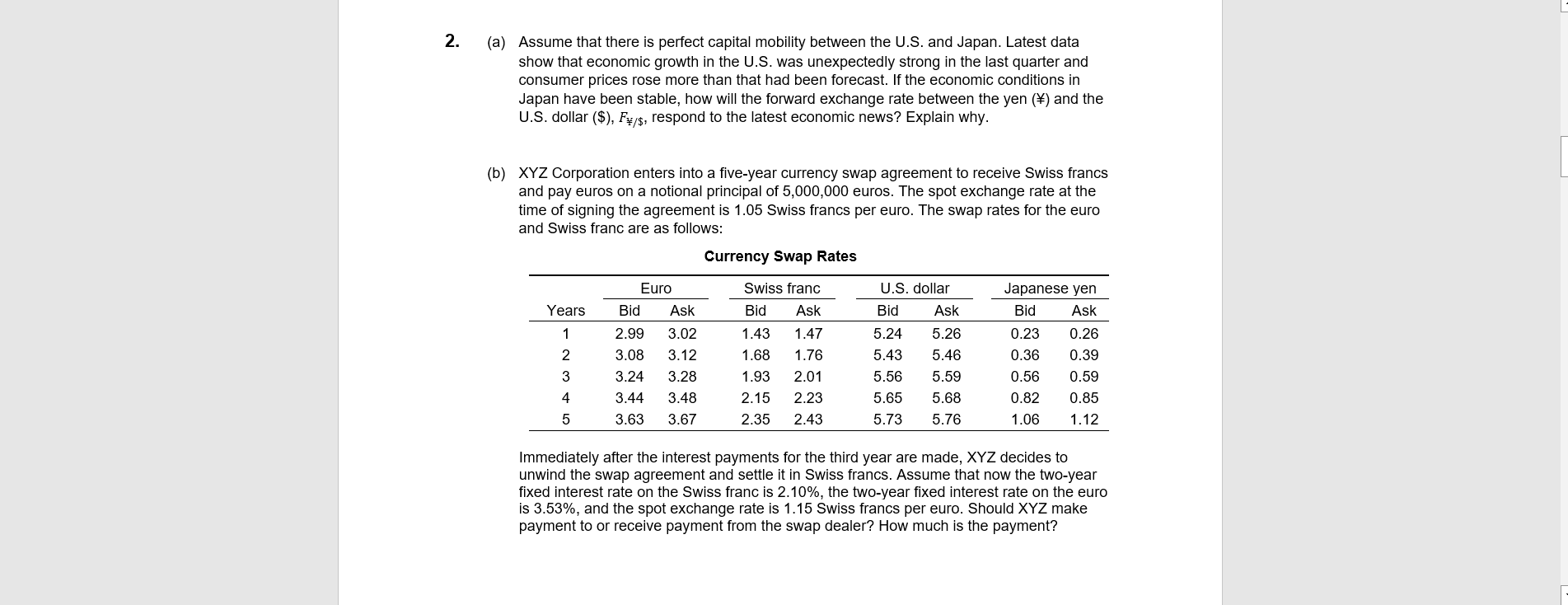

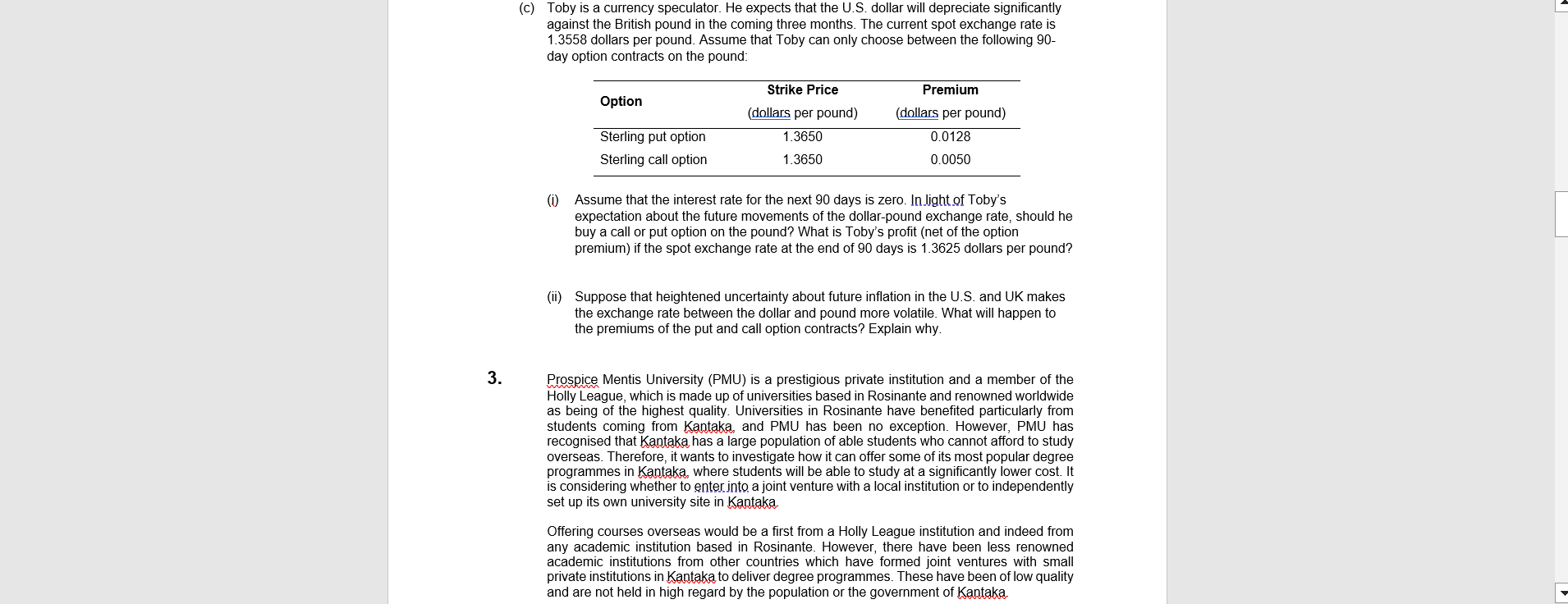

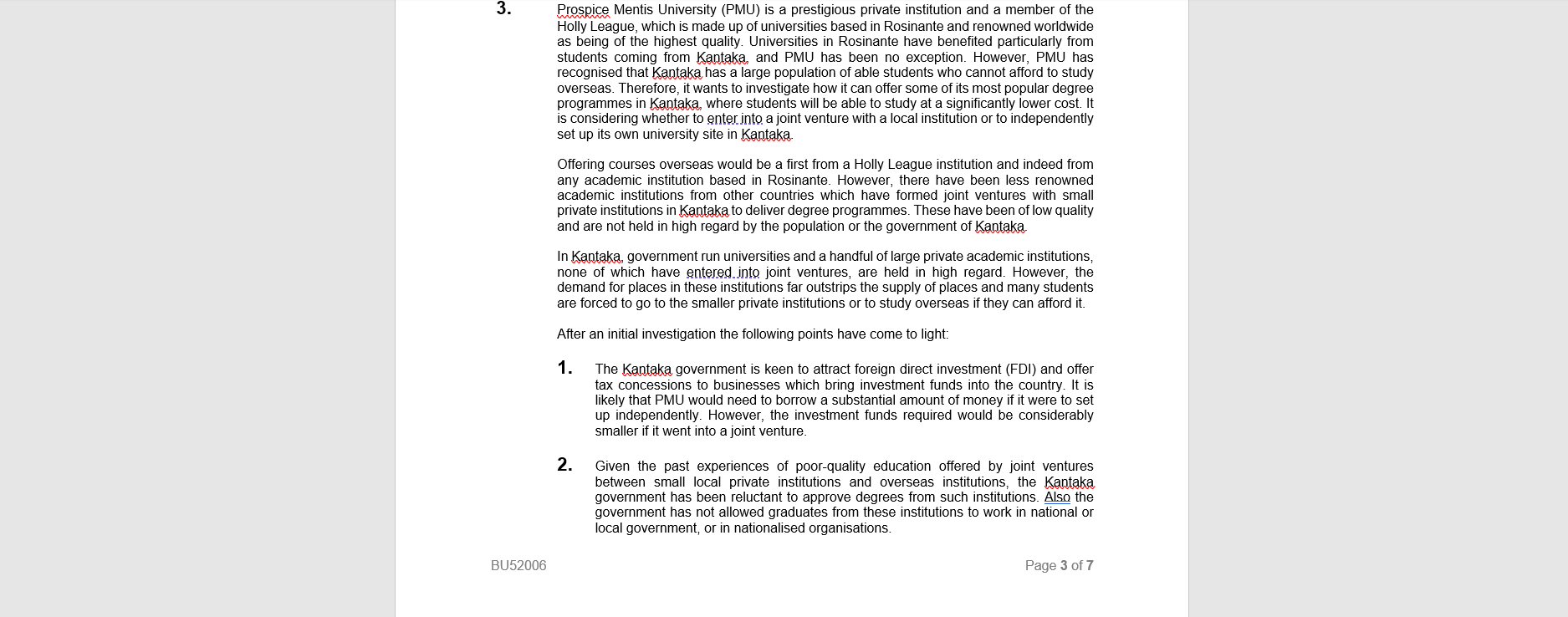

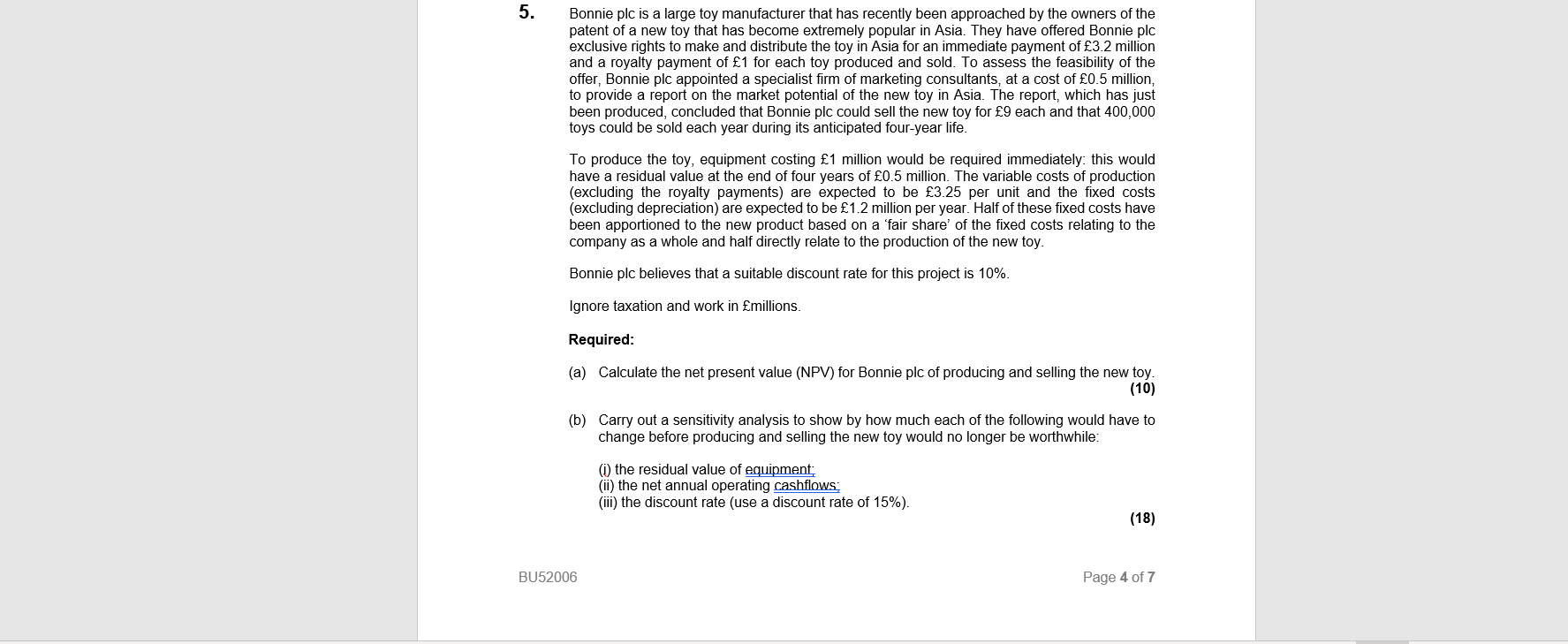

2. (a) Assume that there is perfect capital mobility between the U.S. and Japan. Latest data show that economic growth in the U.S. was unexpectedly strong in the last quarter and consumer prices rose more than that had been forecast. If the economic conditions in Japan have been stable, how will the forward exchange rate between the yen () and the U.S. dollar ($), F#/$, respond to the latest economic news? Explain why. (b) XYZ Corporation enters into a five-year currency swap agreement to receive Swiss francs and pay euros on a notional principal of 5,000,000 euros. The spot exchange rate at the time of signing the agreement is 1.05 Swiss francs per euro. The swap rates for the euro and Swiss franc are as follows: Years 1 2 3 4 5 Euro Bid Ask 2.99 3.02 3.08 3.12 3.24 3.28 3.44 3.48 3.63 3.67 Currency Swap Rates Swiss franc Bid Ask 1.43 1.47 1.68 1.76 1.93 2.01 2.15 2.23 2.35 2.43 Ask U.S. dollar Bid 5.24 5.43 5.56 5.59 5.26 5.46 5.65 5.68 5.73 5.76 Japanese yen Bid Ask 0.23 0.26 0.36 0.39 0.56 0.59 0.82 0.85 1.06 1.12 Immediately after the interest payments for the third year are made, XYZ decides to unwind the swap agreement and settle it in Swiss francs. Assume that now the two-year fixed interest rate on the Swiss franc is 2.10%, the two-year fixed interest rate on the euro is 3.53%, and the spot exchange rate is 1.15 Swiss francs per euro. Should XYZ make payment to or receive payment from the swap dealer? How much is the payment? 3. (c) Toby is a currency speculator. He expects that the U.S. dollar will depreciate significantly against the British pound in the coming three months. The current spot exchange rate is 1.3558 dollars per pound. Assume that Toby can only choose between the following 90- day option contracts on the pound: Option Sterling put option Sterling call option Strike Price (dollars per pound) 1.3650 1.3650 Premium (dollars per pound) 0.0128 0.0050 (1) Assume that the interest rate for the next 90 days is zero. In light of Toby's expectation about the future movements of the dollar-pound exchange rate, should he buy a call or put option on the pound? What is Toby's profit (net of the option premium) if the spot exchange rate at the end of 90 days is 1.3625 dollars per pound? (ii) Suppose that heightened uncertainty about future inflation in the U.S. and UK makes the exchange rate between the dollar and pound more volatile. What will happen to the premiums of the put and call option contracts? Explain why. Prospice Mentis University (PMU) is a prestigious private institution and a member of the Holly League, which is made up of universities based in Rosinante and renowned worldwide as being of the highest quality. Universities in Rosinante have benefited particularly from students coming from Kantaka, and PMU has been no exception. However, PMU has recognised that Kantaka has a large population of able students who cannot afford to study overseas. Therefore, it wants to investigate how it can offer some of its most popular degree programmes in Kantaka, where students will be able to study at a significantly lower cost. It is considering whether to enter into a joint venture with a local institution or to independently set up its own university site in Kantaka. Offering courses overseas would be a first from a Holly League institution and indeed from any academic institution based in Rosinante. However, there have been less renowned academic institutions from other countries which have formed joint ventures with small private institutions in Kantak to deliver degree programmes. These have been of low quality and are not held in high regard by the population or the government of Kantaka 3. BU52006 Prospice Mentis University (PMU) is a prestigious private institution and a member of the Holly League, which is made up of universities based in Rosinante and renowned worldwide as being of the highest quality. Universities in Rosinante have benefited particularly from students coming from Kantaka, and PMU has been no exception. However, PMU has recognised that Kantaka, has a large population of able students who cannot afford to study overseas. Therefore, it wants to investigate how it can offer some of its most popular degree programmes in Kantaka, where students will be able to study at a significantly lower cost. It is considering whether to enter into a joint venture with a local institution or to independently set up its own university site in Kantaka Offering courses overseas would be a first from a Holly League institution and indeed from any academic institution based in Rosinante. However, there have been less renowned academic institutions from other countries which have formed joint ventures with small private institutions in Kantak to deliver degree programmes. These have been of low quality and are not held in high regard by the population or the government of Kantaka. In Kantaka, government run universities and a handful of large private academic institutions, none of which have entered into joint ventures, are held in high regard. However, the demand for places in these institutions far outstrips the supply of places and many students are forced to go to the smaller private institutions or to study overseas if they can afford it. After an initial investigation the following points have come to light: 1. 2. The Kantaka government is keen to attract foreign direct investment (FDI) and offer tax concessions to businesses which bring investment funds into the country. It is likely that PMU would need to borrow a substantial amount of money if it were to set up independently. However, the investment funds required would be considerably smaller if it went into a joint venture. Given the past experiences of poor-quality education offered by joint ventures between small local private institutions and overseas institutions, the Kantaka government has been reluctant to approve degrees from such institutions. Also the government has not allowed graduates from these institutions to work in national or local government, or in nationalised organisations. Page 3 of 7 5. Bonnie plc is a large toy manufacturer that has recently been approached by the owners of the patent of a new toy that has become extremely popular in Asia. They have offered Bonnie plc exclusive rights to make and distribute the toy in Asia for an immediate payment of 3.2 million and a royalty payment of 1 for each toy produced and sold. To assess the feasibility of the offer, Bonnie plc appointed a specialist firm of marketing consultants, at a cost of 0.5 million, to provide a report on the market potential of the new toy in Asia. The report, which has just been produced, concluded that Bonnie plc could sell the new toy for 9 each and that 400,000 toys could be sold each year during its anticipated four-year life. To produce the toy, equipment costing 1 million would be required immediately: this would have a residual value at the end of four years of 0.5 million. The variable costs of production (excluding the royalty payments) are expected to be 3.25 per unit and the fixed costs (excluding depreciation) are expected to be 1.2 million per year. Half of these fixed costs have been apportioned to the new product based on a 'fair share' of the fixed costs relating to the company as a whole and half directly relate to the production of the new toy. Bonnie plc believes that a suitable discount rate for this project is 10%. Ignore taxation and work in millions. Required: (a) Calculate the net present value (NPV) for Bonnie plc of producing and selling the new toy. (10) (b) Carry out a sensitivity analysis to show by how much each of the following would have to change before producing and selling the new toy would no longer be worthwhile: BU52006 (i) the residual value of equipment; (ii) the net annual operating cashflows: (iii) the discount rate (use a discount rate of 15%). (18) Page 4 of 7

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each part of the question one by one 2 a Forward Exchange Rate Given that economic conditions in the US have improved unexpectedly with s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started