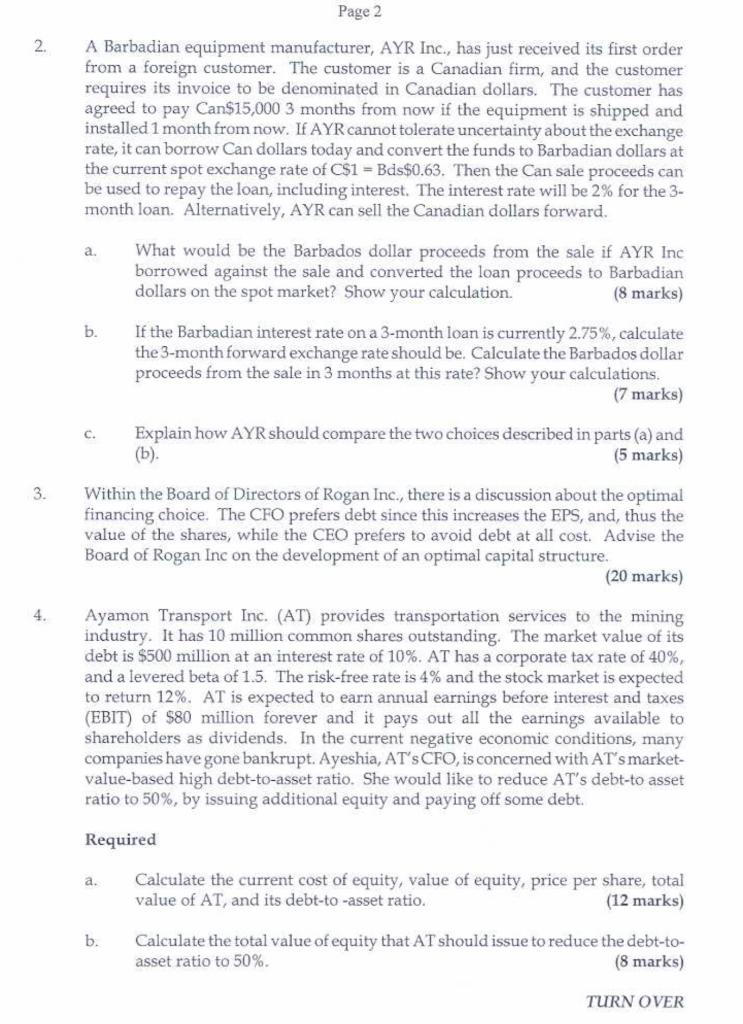

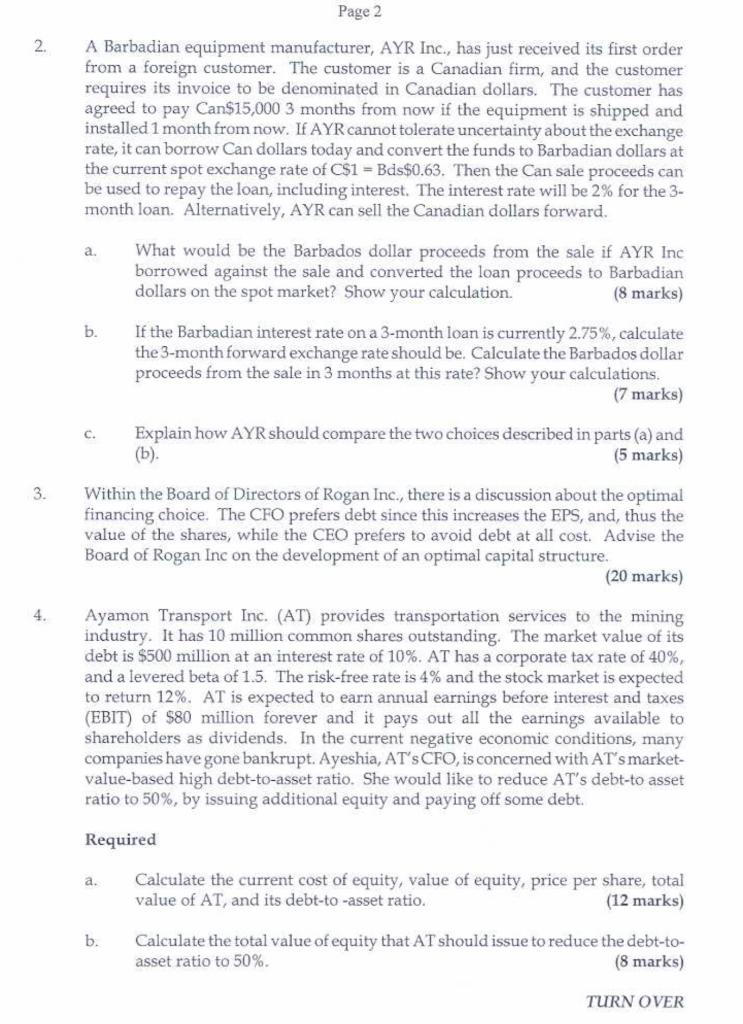

2. A Barbadian equipment manufacturer, AYR Inc., has just received its first order from a foreign customer. The customer is a Canadian firm, and the customer requires its invoice to be denominated in Canadian dollars. The customer has agreed to pay Can $15,0003 months from now if the equipment is shipped and installed 1 month from now. If AYR cannot tolerate uncertainty about the exchange rate, it can borrow Can dollars today and convert the funds to Barbadian dollars at the current spot exchange rate of C$1=Bds$0.63. Then the Can sale proceeds can be used to repay the loan, including interest. The interest rate will be 2% for the 3 month loan. Alternatively, AYR can sell the Canadian dollars forward. a. What would be the Barbados dollar proceeds from the sale if AYR Inc borrowed against the sale and converted the loan proceeds to Barbadian dollars on the spot market? Show your calculation. (8 marks) b. If the Barbadian interest rate on a 3-month loan is currently 2.75%, calculate the 3-month forward exchange rate should be. Calculate the Barbados dollar proceeds from the sale in 3 months at this rate? Show your calculations. (7 marks) c. Explain how AYR should compare the two choices described in parts (a) and (b). (5 marks) 3. Within the Board of Directors of Rogan Inc., there is a discussion about the optimal financing choice. The CFO prefers debt since this increases the EPS, and, thus the value of the shares, while the CEO prefers to avoid debt at all cost. Advise the Board of Rogan Inc on the development of an optimal capital structure. (20 marks) 4. Ayamon Transport Inc. (AT) provides transportation services to the mining industry. It has 10 million common shares outstanding. The market value of its debt is $500 million at an interest rate of 10%. AT has a corporate tax rate of 40%, and a levered beta of 1.5 . The risk-free rate is 4% and the stock market is expected to return 12%. AT is expected to earn annual earnings before interest and taxes (EBIT) of $80 million forever and it pays out all the earnings available to shareholders as dividends. In the current negative economic conditions, many companies have gone bankrupt. Ayeshia, AT's CFO, is concerned with AT's marketvalue-based high debt-to-asset ratio. She would like to reduce AT's debt-to asset ratio to 50%, by issuing additional equity and paying off some debt. Required a. Calculate the current cost of equity, value of equity, price per share, total value of AT, and its debt-to -asset ratio. (12 marks) b. Calculate the total value of equity that AT should issue to reduce the debt-toasset ratio to 50%. ( 8 marks) TURN OVER 2. A Barbadian equipment manufacturer, AYR Inc., has just received its first order from a foreign customer. The customer is a Canadian firm, and the customer requires its invoice to be denominated in Canadian dollars. The customer has agreed to pay Can $15,0003 months from now if the equipment is shipped and installed 1 month from now. If AYR cannot tolerate uncertainty about the exchange rate, it can borrow Can dollars today and convert the funds to Barbadian dollars at the current spot exchange rate of C$1=Bds$0.63. Then the Can sale proceeds can be used to repay the loan, including interest. The interest rate will be 2% for the 3 month loan. Alternatively, AYR can sell the Canadian dollars forward. a. What would be the Barbados dollar proceeds from the sale if AYR Inc borrowed against the sale and converted the loan proceeds to Barbadian dollars on the spot market? Show your calculation. (8 marks) b. If the Barbadian interest rate on a 3-month loan is currently 2.75%, calculate the 3-month forward exchange rate should be. Calculate the Barbados dollar proceeds from the sale in 3 months at this rate? Show your calculations. (7 marks) c. Explain how AYR should compare the two choices described in parts (a) and (b). (5 marks) 3. Within the Board of Directors of Rogan Inc., there is a discussion about the optimal financing choice. The CFO prefers debt since this increases the EPS, and, thus the value of the shares, while the CEO prefers to avoid debt at all cost. Advise the Board of Rogan Inc on the development of an optimal capital structure. (20 marks) 4. Ayamon Transport Inc. (AT) provides transportation services to the mining industry. It has 10 million common shares outstanding. The market value of its debt is $500 million at an interest rate of 10%. AT has a corporate tax rate of 40%, and a levered beta of 1.5 . The risk-free rate is 4% and the stock market is expected to return 12%. AT is expected to earn annual earnings before interest and taxes (EBIT) of $80 million forever and it pays out all the earnings available to shareholders as dividends. In the current negative economic conditions, many companies have gone bankrupt. Ayeshia, AT's CFO, is concerned with AT's marketvalue-based high debt-to-asset ratio. She would like to reduce AT's debt-to asset ratio to 50%, by issuing additional equity and paying off some debt. Required a. Calculate the current cost of equity, value of equity, price per share, total value of AT, and its debt-to -asset ratio. (12 marks) b. Calculate the total value of equity that AT should issue to reduce the debt-toasset ratio to 50%. ( 8 marks) TURN OVER