Answered step by step

Verified Expert Solution

Question

1 Approved Answer

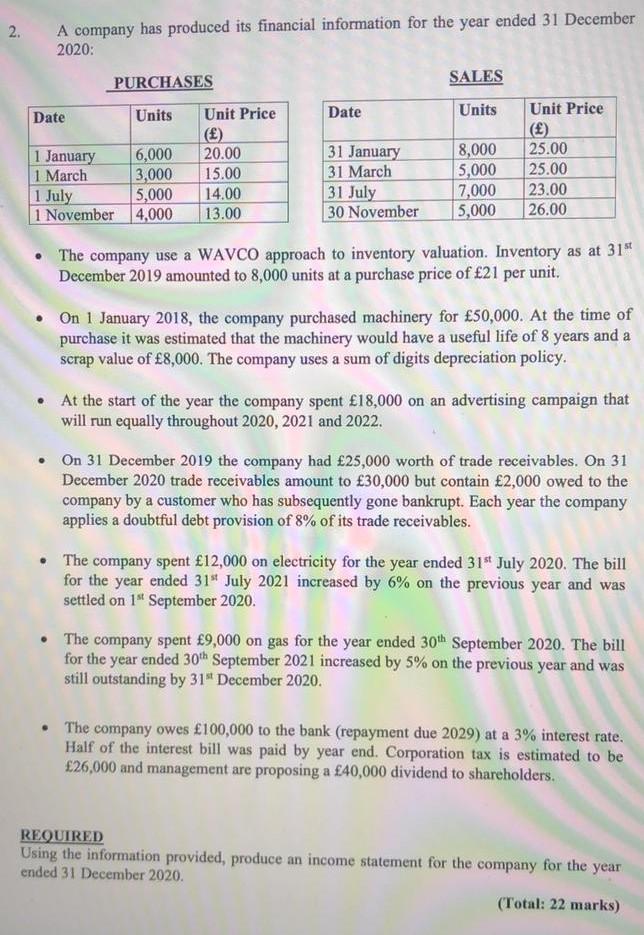

2 . A company has produced its financial information for the year ended 31 December 2020: PURCHASES SALES Date Units Date Units Unit Price 1

2 . A company has produced its financial information for the year ended 31 December 2020: PURCHASES SALES Date Units Date Units Unit Price 1 January 6,000 1 March 3,000 1 July 5,000 1 November 4,000 Unit Price () 20.00 15.00 14.00 13.00 31 January 31 March 31 July 30 November 8,000 5,000 7,000 5,000 25.00 25.00 23.00 26.00 The company use a WAVCO approach to inventory valuation. Inventory as at 31 December 2019 amounted to 8,000 units at a purchase price of 21 per unit. On 1 January 2018, the company purchased machinery for 50,000. At the time of purchase it was estimated that the machinery would have a useful life of 8 years and a scrap value of 8,000. The company uses a sum of digits depreciation policy. At the start of the year the company spent 18,000 on an advertising campaign that will run equally throughout 2020, 2021 and 2022. On 31 December 2019 the company had 25,000 worth of trade receivables. On 31 December 2020 trade receivables amount to 30,000 but contain 2,000 owed to the company by a customer who has subsequently gone bankrupt. Each year the company applies a doubtful debt provision of 8% of its trade receivables. The company spent 12,000 on electricity for the year ended 31* July 2020. The bill for the year ended 31" July 2021 increased by 6% on the previous year and was settled on 1st September 2020. The company spent 9,000 on gas for the year ended 30th September 2020. The bill for the year ended 30th September 2021 increased by 5% on the previous year and was still outstanding by 31" December 2020. The company owes 100,000 to the bank (repayment due 2029) at a 3% interest rate. Half of the interest bill was paid by year end. Corporation tax is estimated to be 26,000 and management are proposing a 40,000 dividend to shareholders. REQUIRED Using the information provided, produce an income statement for the company for the year ended 31 December 2020. (Total: 22 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started