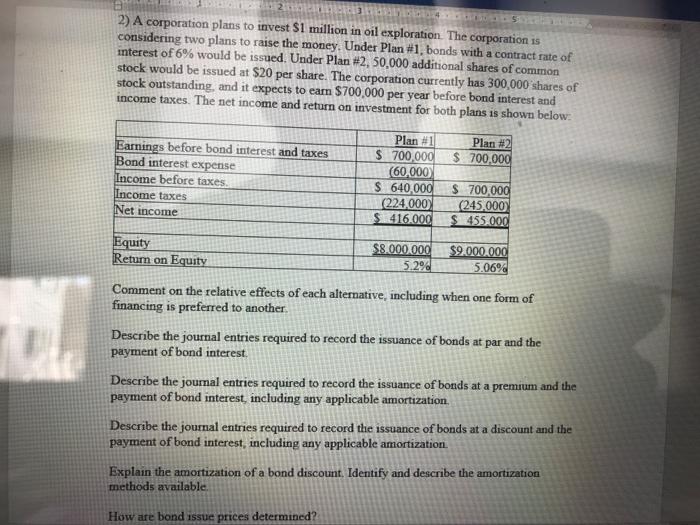

2) A corporation plans to invest $1 million in oil exploration. The corporation is considering two plans to raise the money. Under Plan #1, bonds with a contract rate of interest of 6% would be issued. Under Plan #2, 50,000 additional shares of common stock would be issued at $20 per share. The corporation currently has 300,000 shares of stock outstanding, and it expects to earn $700,000 per year before bond interest and income taxes. The net income and return on investment for both plans is shown below: Plan #2 $ 700.000 Earnings before bond interest and takes Bond interest expense Income before taxes Income taxes Net income Plan #1 $ 700.000 60.000 $ 640.000 (224,000) S416.000 $ 700,000 (245.000 $ 455.000 Equity $8.000.000 $9.000.000 Return on Equity 5.290 5.06% Comment on the relative effects of each alternative, including when one form of financing is preferred to another Describe the journal entries required to record the issuance of bonds at par and the payment of bond interest Describe the journal entries required to record the issuance of bonds at a premium and the payment of bond interest, including any applicable amortization Describe the journal entries required to record the issuance of bonds at a discount and the payment of bond interest, including any applicable amortization Explain the amortization of a bond discount. Identify and describe the amortization methods available. How are bond issue prices determined? Word ces Mailings Review View Help Tell me what you want to do 2 - - 1 Explain the amortization of a bond premium. Identify and describe the amortization methods available. What are methods that a company may use to retire its bonds? Describe the recording procedures for the issuance, retirement, and payment of interest for installment notes (Ctrl) 2) A corporation plans to invest $1 million in oil exploration. The corporation is considering two plans to raise the money. Under Plan #1, bonds with a contract rate of interest of 6% would be issued. Under Plan #2, 50,000 additional shares of common stock would be issued at $20 per share. The corporation currently has 300,000 shares of stock outstanding, and it expects to earn $700,000 per year before bond interest and income taxes. The net income and return on investment for both plans is shown below: Plan #2 $ 700.000 Earnings before bond interest and takes Bond interest expense Income before taxes Income taxes Net income Plan #1 $ 700.000 60.000 $ 640.000 (224,000) S416.000 $ 700,000 (245.000 $ 455.000 Equity $8.000.000 $9.000.000 Return on Equity 5.290 5.06% Comment on the relative effects of each alternative, including when one form of financing is preferred to another Describe the journal entries required to record the issuance of bonds at par and the payment of bond interest Describe the journal entries required to record the issuance of bonds at a premium and the payment of bond interest, including any applicable amortization Describe the journal entries required to record the issuance of bonds at a discount and the payment of bond interest, including any applicable amortization Explain the amortization of a bond discount. Identify and describe the amortization methods available. How are bond issue prices determined? Word ces Mailings Review View Help Tell me what you want to do 2 - - 1 Explain the amortization of a bond premium. Identify and describe the amortization methods available. What are methods that a company may use to retire its bonds? Describe the recording procedures for the issuance, retirement, and payment of interest for installment notes (Ctrl)