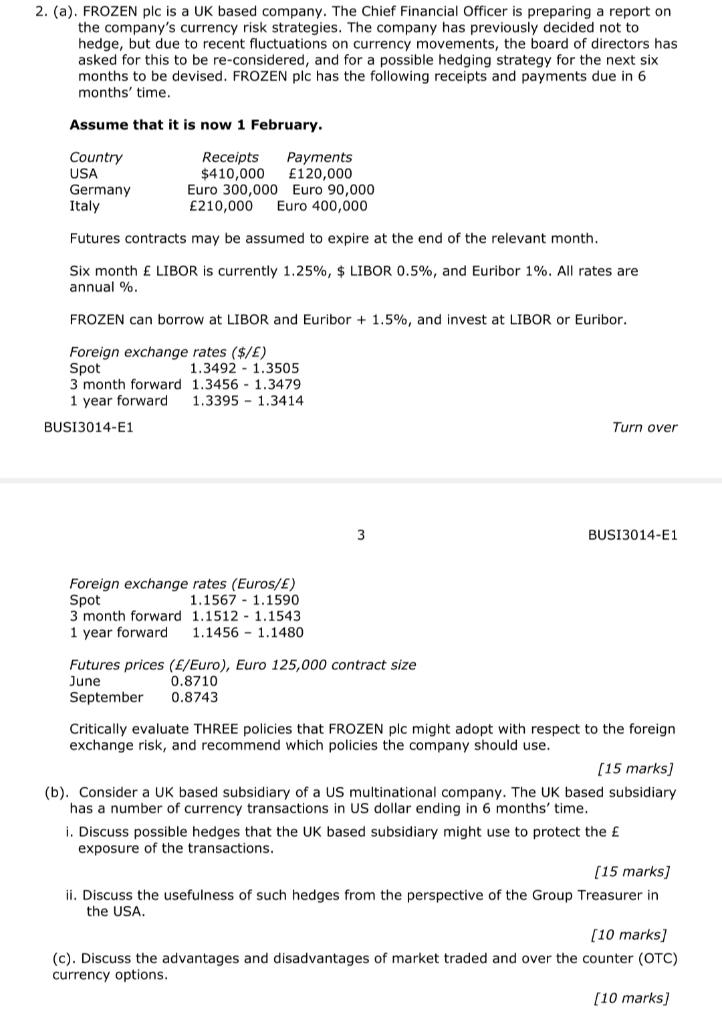

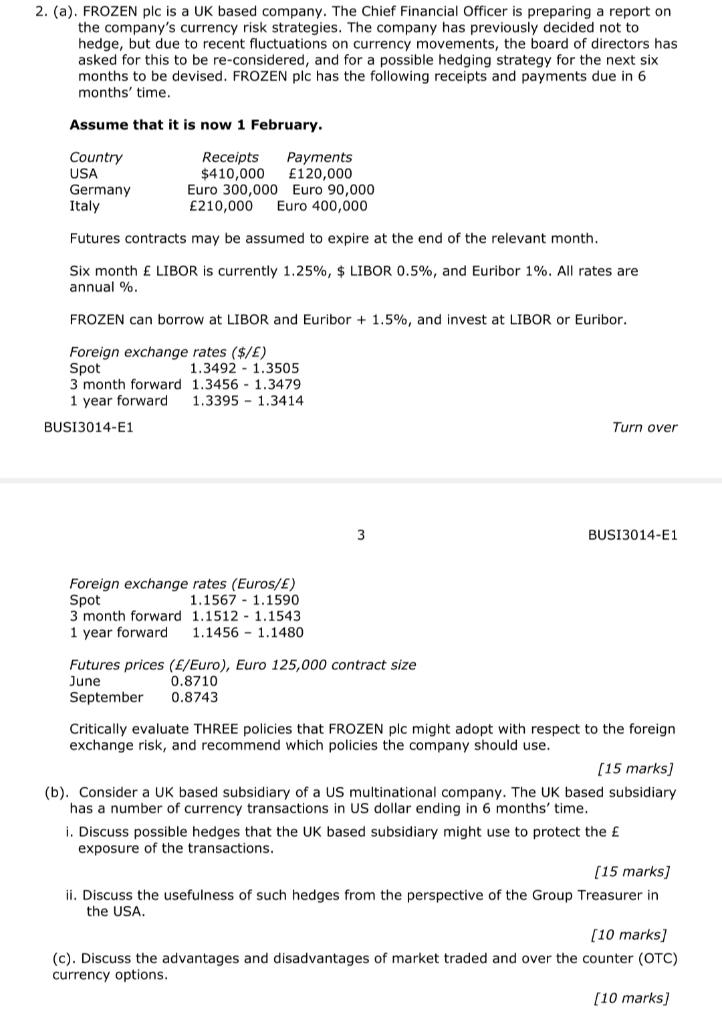

2. (a). FROZEN plc is a UK based company. The Chief Financial Officer is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but due to recent fluctuations on currency movements, the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. FROZEN plc has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country USA Germany Italy Receipts Payments $410,000 120,000 Euro 300,000 Euro 90,000 210,000 Euro 400,000 Futures contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. FROZEN can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates ($/) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 BUSI3014-E1 Turn over 3 BUSI3014-E1 Foreign exchange rates (Euros/) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 Futures prices (E/Euro), Euro 125,000 contract size June 0.8710 September 0.8743 Critically evaluate THREE policies that FROZEN plc might adopt with respect to the foreign exchange risk, and recommend which policies the company should use. (15 marks] (b). Consider a UK based subsidiary of a US multinational company. The UK based subsidiary has a number of currency transactions in US dollar ending in 6 months' time. 1. Discuss possible hedges that the UK based subsidiary might use to protect the exposure of the transactions. (15 marks] ii. Discuss the usefulness of such hedges from the perspective of the Group Treasurer in the USA. (10 marks) (c). Discuss the advantages and disadvantages of market traded and over the counter (OTC) currency options. (10 marks) 2. (a). FROZEN plc is a UK based company. The Chief Financial Officer is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but due to recent fluctuations on currency movements, the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. FROZEN plc has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country USA Germany Italy Receipts Payments $410,000 120,000 Euro 300,000 Euro 90,000 210,000 Euro 400,000 Futures contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. FROZEN can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates ($/) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 BUSI3014-E1 Turn over 3 BUSI3014-E1 Foreign exchange rates (Euros/) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 Futures prices (E/Euro), Euro 125,000 contract size June 0.8710 September 0.8743 Critically evaluate THREE policies that FROZEN plc might adopt with respect to the foreign exchange risk, and recommend which policies the company should use. (15 marks] (b). Consider a UK based subsidiary of a US multinational company. The UK based subsidiary has a number of currency transactions in US dollar ending in 6 months' time. 1. Discuss possible hedges that the UK based subsidiary might use to protect the exposure of the transactions. (15 marks] ii. Discuss the usefulness of such hedges from the perspective of the Group Treasurer in the USA. (10 marks) (c). Discuss the advantages and disadvantages of market traded and over the counter (OTC) currency options. (10 marks)