Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. A large manufacturer of construction equipment has scheduled a purchase of 500 road grader differentials (a differential is part of the axle on a

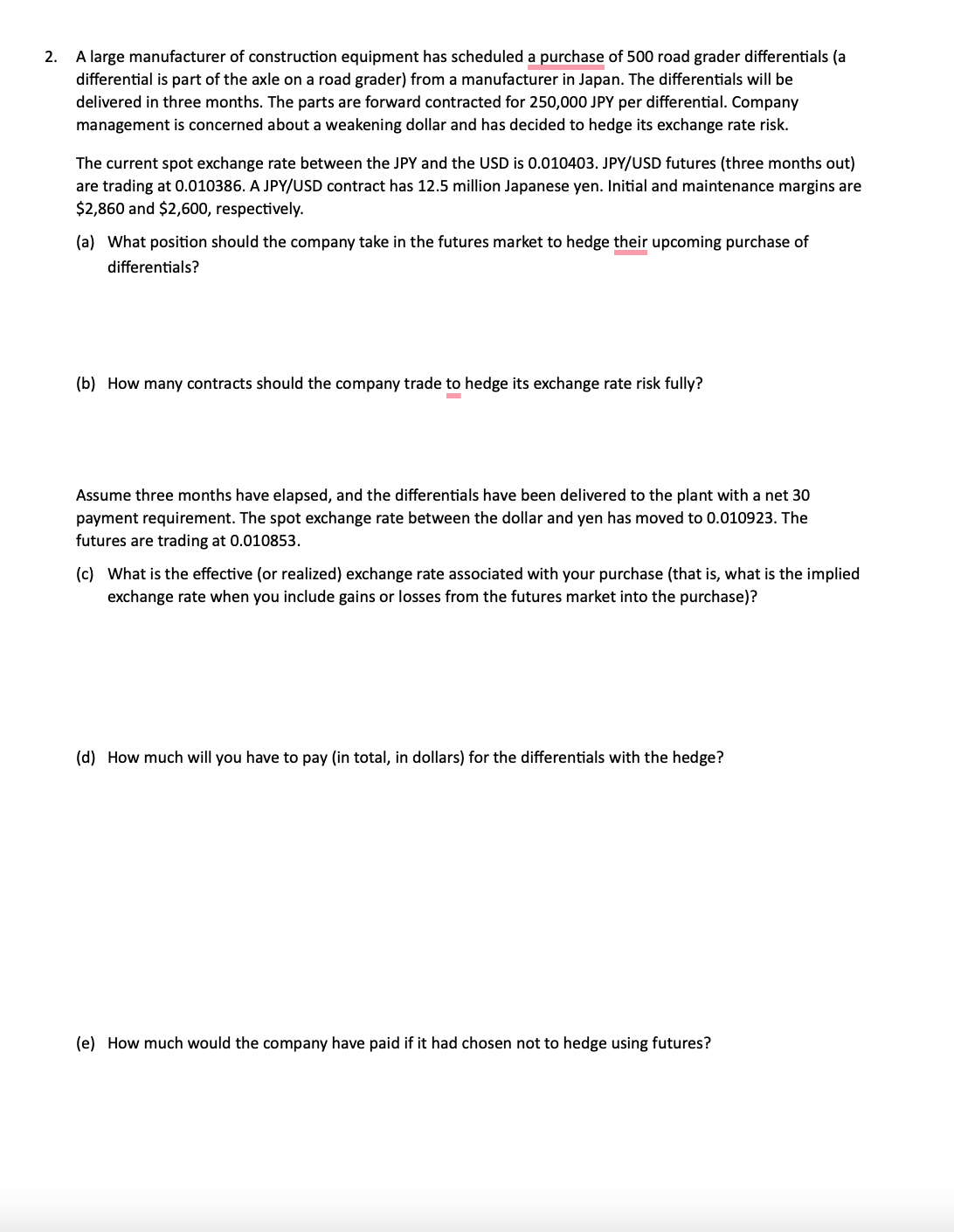

2. A large manufacturer of construction equipment has scheduled a purchase of 500 road grader differentials (a differential is part of the axle on a road grader) from a manufacturer in Japan. The differentials will be delivered in three months. The parts are forward contracted for 250,000 JPY per differential. Company management is concerned about a weakening dollar and has decided to hedge its exchange rate risk. The current spot exchange rate between the JPY and the USD is 0.010403 . JPY/USD futures (three months out) are trading at 0.010386 . A JPY/USD contract has 12.5 million Japanese yen. Initial and maintenance margins are $2,860 and $2,600, respectively. (a) What position should the company take in the futures market to hedge their upcoming purchase of differentials? (b) How many contracts should the company trade to hedge its exchange rate risk fully? Assume three months have elapsed, and the differentials have been delivered to the plant with a net 30 payment requirement. The spot exchange rate between the dollar and yen has moved to 0.010923 . The futures are trading at 0.010853 . (c) What is the effective (or realized) exchange rate associated with your purchase (that is, what is the implied exchange rate when you include gains or losses from the futures market into the purchase)? (d) How much will you have to pay (in total, in dollars) for the differentials with the hedge? (e) How much would the company have paid if it had chosen not to hedge using futures

2. A large manufacturer of construction equipment has scheduled a purchase of 500 road grader differentials (a differential is part of the axle on a road grader) from a manufacturer in Japan. The differentials will be delivered in three months. The parts are forward contracted for 250,000 JPY per differential. Company management is concerned about a weakening dollar and has decided to hedge its exchange rate risk. The current spot exchange rate between the JPY and the USD is 0.010403 . JPY/USD futures (three months out) are trading at 0.010386 . A JPY/USD contract has 12.5 million Japanese yen. Initial and maintenance margins are $2,860 and $2,600, respectively. (a) What position should the company take in the futures market to hedge their upcoming purchase of differentials? (b) How many contracts should the company trade to hedge its exchange rate risk fully? Assume three months have elapsed, and the differentials have been delivered to the plant with a net 30 payment requirement. The spot exchange rate between the dollar and yen has moved to 0.010923 . The futures are trading at 0.010853 . (c) What is the effective (or realized) exchange rate associated with your purchase (that is, what is the implied exchange rate when you include gains or losses from the futures market into the purchase)? (d) How much will you have to pay (in total, in dollars) for the differentials with the hedge? (e) How much would the company have paid if it had chosen not to hedge using futures Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started