Question

2. Accounting for Equity Securities (15 points) On its 31 December 2022 balance sheet, Buff Company appropriately reported a $8,500 credit balance in its Fair

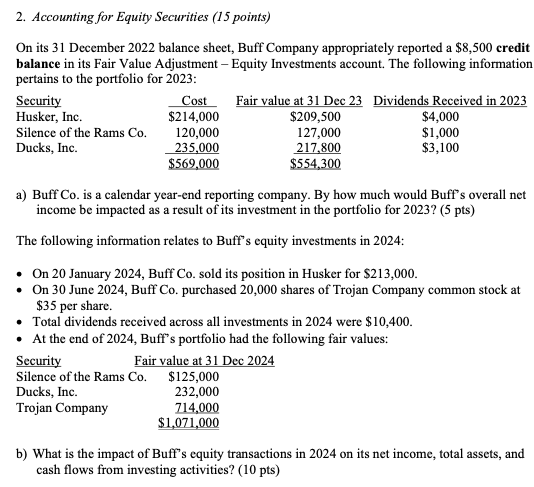

2. Accounting for Equity Securities (15 points)

On its 31 December 2022 balance sheet, Buff Company appropriately reported a $8,500 credit balance in its Fair Value Adjustment Equity Investments account. The following information pertains to the portfolio for 2023:

Security Husker, Inc. Silence of the Rams Co. Ducks, Inc.

Cost Fair value at 31 Dec 23 $214,000 $209,500 120,000 127,000 235,000 217,800 $569,000 $554,300

Dividends Received in 2023 $4,000

$1,000 $3,100

a) Buff Co. is a calendar year-end reporting company. By how much would Buffs overall net income be impacted as a result of its investment in the portfolio for 2023? (5 pts)

The following information relates to Buffs equity investments in 2024:

On 20 January 2024, Buff Co. sold its position in Husker for $213,000.

On 30 June 2024, Buff Co. purchased 20,000 shares of Trojan Company common stock at

$35 per share.

Total dividends received across all investments in 2024 were $10,400.

At the end of 2024, Buffs portfolio had the following fair values:

Security Fair value at 31 Dec 2024

Silence of the Rams Co. Ducks, Inc. Trojan Company

b) What is the impact of Buffs equity transactions in 2024 on its net income, total assets, and cash flows from investing activities? (10 pts)

2. Accounting for Equity Securities (15 points) On its 31 December 2022 balance sheet, Buff Company appropriately reported a $8,500 credit balance in its Fair Value Adjustment - Equity Investments account. The following information pertains to the portfolio for 2023 : a) Buff Co. is a calendar year-end reporting company. By how much would Buff's overall net income be impacted as a result of its investment in the portfolio for 2023 ? (5 pts) The following information relates to Buff's equity investments in 2024: - On 20 January 2024, Buff Co. sold its position in Husker for $213,000. - On 30 June 2024, Buff Co. purchased 20,000 shares of Trojan Company common stock at $35 per share. - Total dividends received across all investments in 2024 were $10,400. - At the end of 2024, Buff's portfolio had the following fair values: b) What is the impact of Buff's equity transactions in 2024 on its net income, total assets, and cash flows from investing activities? (10 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started