Answered step by step

Verified Expert Solution

Question

1 Approved Answer

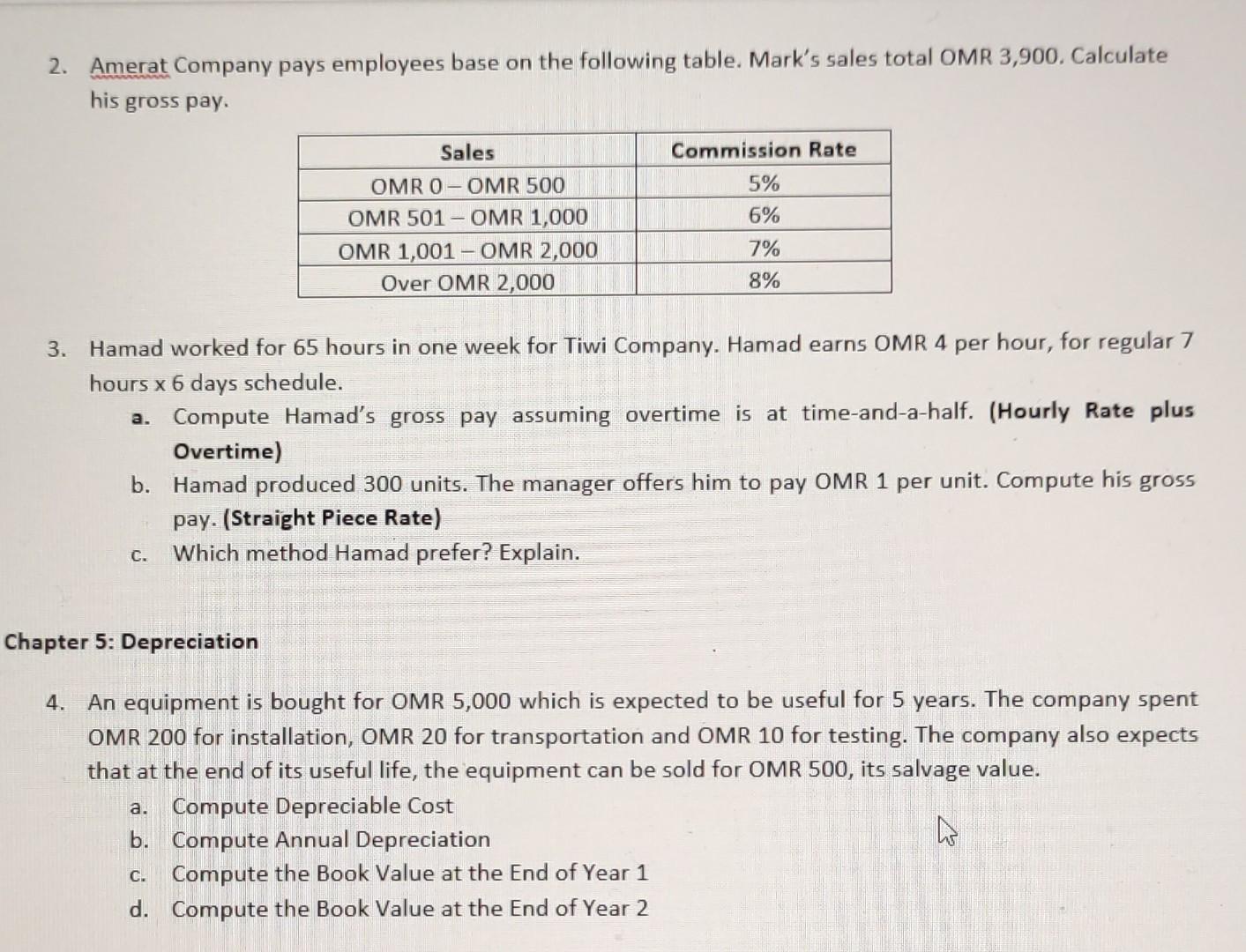

2. Amerat Company pays employees base on the following table. Mark's sales total OMR 3,900. Calculate his gross pay. Sales Commission Rate OMR 0-OMR

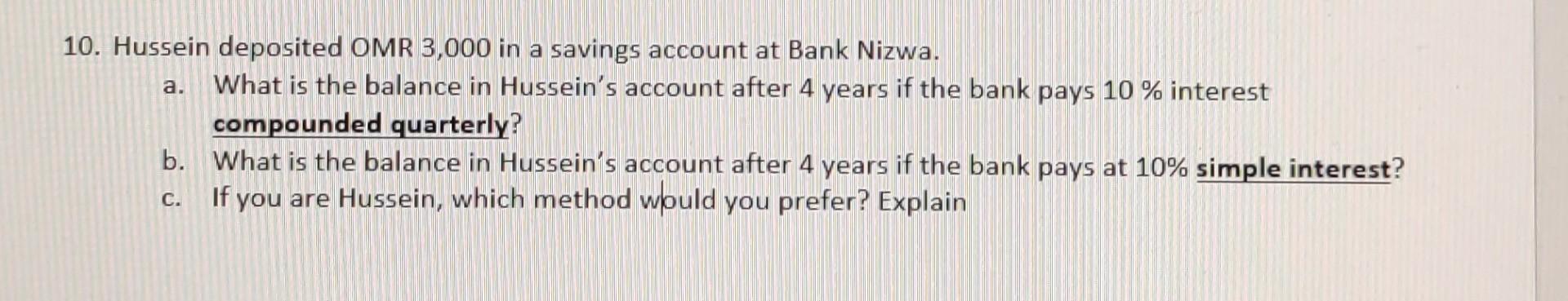

2. Amerat Company pays employees base on the following table. Mark's sales total OMR 3,900. Calculate his gross pay. Sales Commission Rate OMR 0-OMR 500 5% OMR 501 - OMR 1,000 6% OMR 1,001 - OMR 2,000 7% Over OMR 2,000 8% 3. Hamad worked for 65 hours in one week for Tiwi Company. Hamad earns OMR 4 per hour, for regular 7 hours x 6 days schedule. a. Compute Hamad's gross pay assuming overtime is at time-and-a-half. (Hourly Rate plus Overtime) b. Hamad produced 300 units. The manager offers him to pay OMR 1 per unit. Compute his gross pay. (Straight Piece Rate) Which method Hamad prefer? Explain. . Chapter 5: Depreciation 4. An equipment is bought for OMR 5,000 which is expected to be useful for 5 OMR 200 for installation, OMR 20 for transportation and OMR 10 for testing. The company also expects that at the end of its useful life, the equipment can be sold for OMR 500, its salvage value. years. The company spent a. Compute Depreciable Cost b. Compute Annual Depreciation c. Compute the Book Value at the End of Year 1 d. Compute the Book Value at the End of Year 2 10. Hussein deposited OMR 3,000 in a savings account at Bank Nizwa. a. What is the balance in Hussein's account after 4 years if the bank pays 10 % interest compounded quarterly? b. What is the balance in Hussein's account after 4 years if the bank pays at 10% simple interest? If you are Hussein, which method would you prefer? Explain .

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The answer provided below has been developed in a clear step by step manner 2 Marks sales tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started