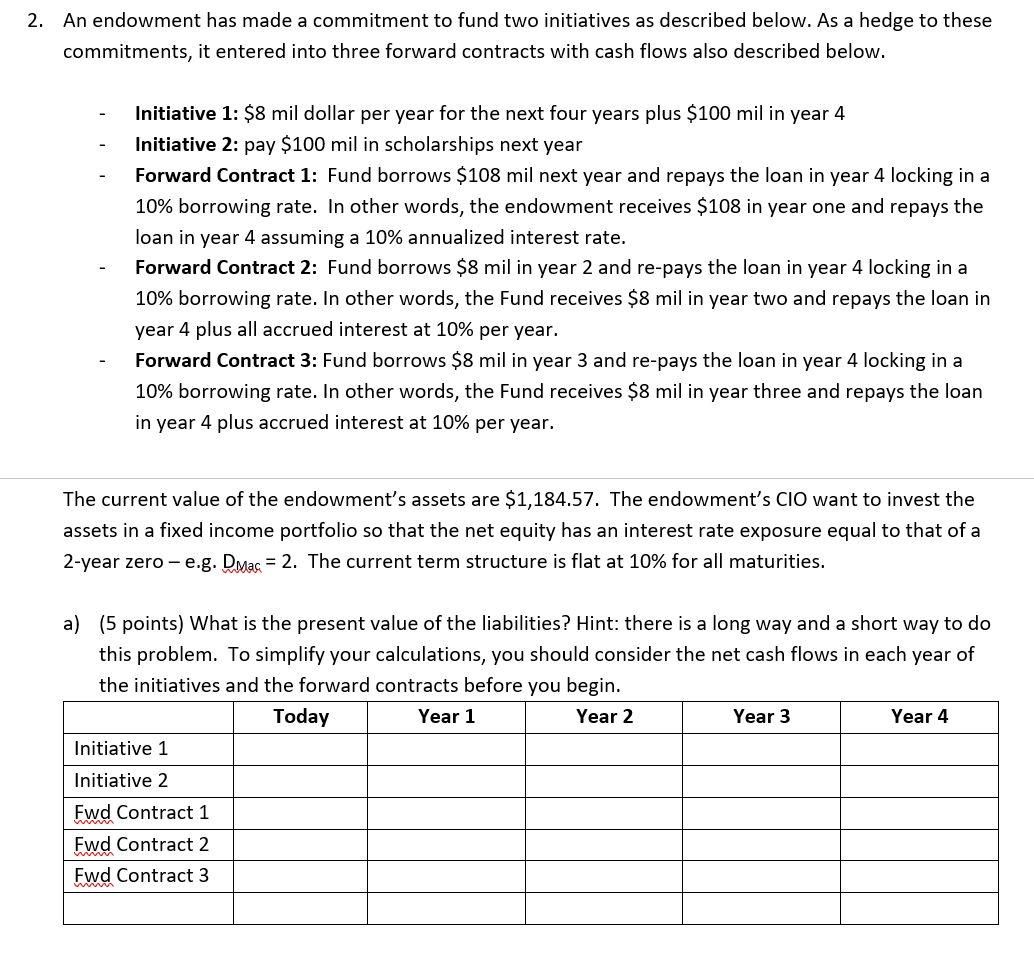

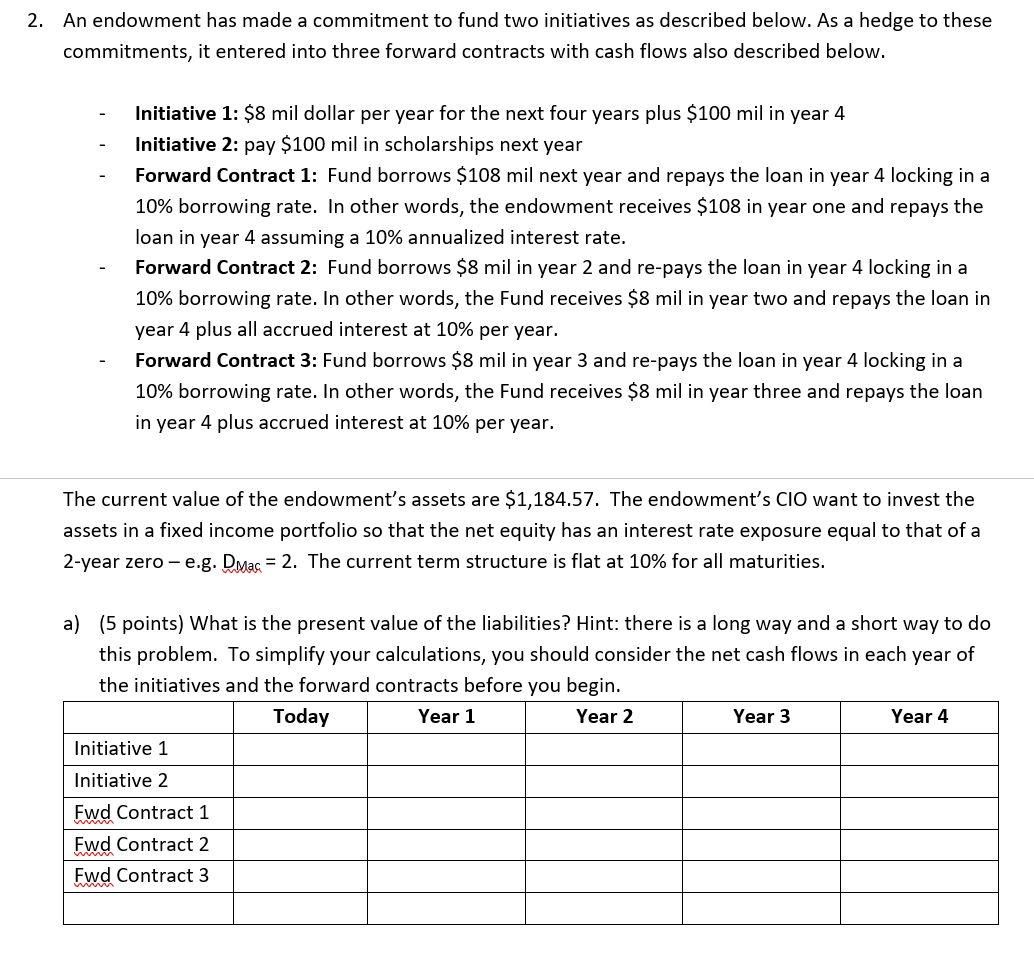

2. An endowment has made a commitment to fund two initiatives as described below. As a hedge to these commitments, it entered into three forward contracts with cash flows also described below. Initiative 1: $8 mil dollar per year for the next four years plus $100 mil in year 4 Initiative 2: pay $100 mil in scholarships next year Forward Contract 1: Fund borrows $108 mil next year and repays the loan in year 4 locking in a 10% borrowing rate. In other words, the endowment receives $108 in year one and repays the loan in year 4 assuming a 10% annualized interest rate. Forward Contract 2: Fund borrows $8 mil in year 2 and re-pays the loan in year 4 locking in a 10% borrowing rate. In other words, the Fund receives $8 mil in year two and repays the loan in year 4 plus all accrued interest at 10% per year. Forward Contract 3: Fund borrows $8 mil in year 3 and re-pays the loan in year 4 locking in a 4 10% borrowing rate. In other words, the Fund receives $8 mil in year three and repays the loan in year 4 plus accrued interest at 10% per year. 4 The current value of the endowment's assets are $1,184.57. The endowment's CIO want to invest the assets in a fixed income portfolio so that the net equity has an interest rate exposure equal to that of a 2-year zero-e.g. DMac = 2. The current term structure is flat at 10% for all maturities. a) (5 points) What is the present value of the liabilities? Hint: there is a long way and a short way to do this problem. To simplify your calculations, you should consider the net cash flows in each year of the initiatives and the forward contracts before you begin. Today Year 1 Year 2 Year 3 Year 4 Initiative 1 Initiative 2 Fwd Contract 1 Fwd Contract 2 Fwd Contract b) (5 points) What is the delta (dollar duration A$) and Macaulay duration (DMac) of the endowment's committed initiatives and three forward contracts? c) (5 points) What is the present value of the endowment less its committed initiatives and forward contracts? d) (5 points) What is the required Macaulay duration of the endowment's fixed income assets in order to achieve the desired Macaulay duration of the net equity? (i.e. Equity Demag = 2). 2. An endowment has made a commitment to fund two initiatives as described below. As a hedge to these commitments, it entered into three forward contracts with cash flows also described below. Initiative 1: $8 mil dollar per year for the next four years plus $100 mil in year 4 Initiative 2: pay $100 mil in scholarships next year Forward Contract 1: Fund borrows $108 mil next year and repays the loan in year 4 locking in a 10% borrowing rate. In other words, the endowment receives $108 in year one and repays the loan in year 4 assuming a 10% annualized interest rate. Forward Contract 2: Fund borrows $8 mil in year 2 and re-pays the loan in year 4 locking in a 10% borrowing rate. In other words, the Fund receives $8 mil in year two and repays the loan in year 4 plus all accrued interest at 10% per year. Forward Contract 3: Fund borrows $8 mil in year 3 and re-pays the loan in year 4 locking in a 4 10% borrowing rate. In other words, the Fund receives $8 mil in year three and repays the loan in year 4 plus accrued interest at 10% per year. 4 The current value of the endowment's assets are $1,184.57. The endowment's CIO want to invest the assets in a fixed income portfolio so that the net equity has an interest rate exposure equal to that of a 2-year zero-e.g. DMac = 2. The current term structure is flat at 10% for all maturities. a) (5 points) What is the present value of the liabilities? Hint: there is a long way and a short way to do this problem. To simplify your calculations, you should consider the net cash flows in each year of the initiatives and the forward contracts before you begin. Today Year 1 Year 2 Year 3 Year 4 Initiative 1 Initiative 2 Fwd Contract 1 Fwd Contract 2 Fwd Contract b) (5 points) What is the delta (dollar duration A$) and Macaulay duration (DMac) of the endowment's committed initiatives and three forward contracts? c) (5 points) What is the present value of the endowment less its committed initiatives and forward contracts? d) (5 points) What is the required Macaulay duration of the endowment's fixed income assets in order to achieve the desired Macaulay duration of the net equity? (i.e. Equity Demag = 2)