Question

2. An investment company is considering building a 25-unit apartment complex in a growing town. Because of the long-term growth potential of the town, it

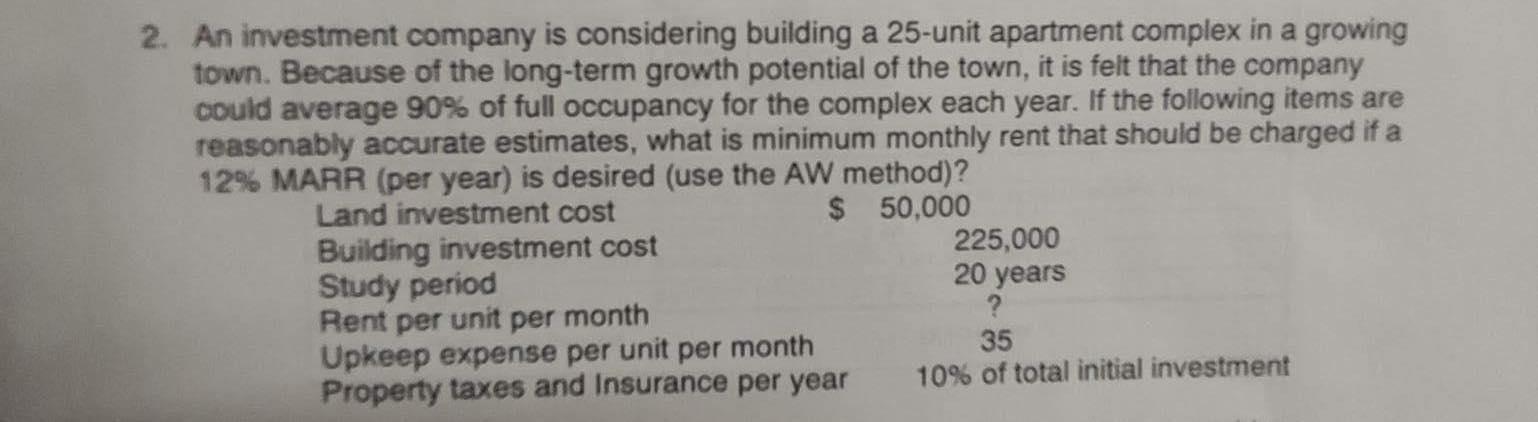

2. An investment company is considering building a 25-unit apartment complex in a growing town. Because of the long-term growth potential of the town, it is felt that the company could average 90% of full occupancy for the complex each year. If the following items are reasonably accurate estimates, what is minimum monthly rent that should be charged if a 12% MARR (per year) is desired (use the AW method)? Land investment cost 50,000 Building investment cost 225,000 Study period 20 years Rent per unit per month Upkeep expense per unit per month ? Property taxes and insurance per year 35 10% of total initial investment

SOLUTION PLS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started