Answered step by step

Verified Expert Solution

Question

1 Approved Answer

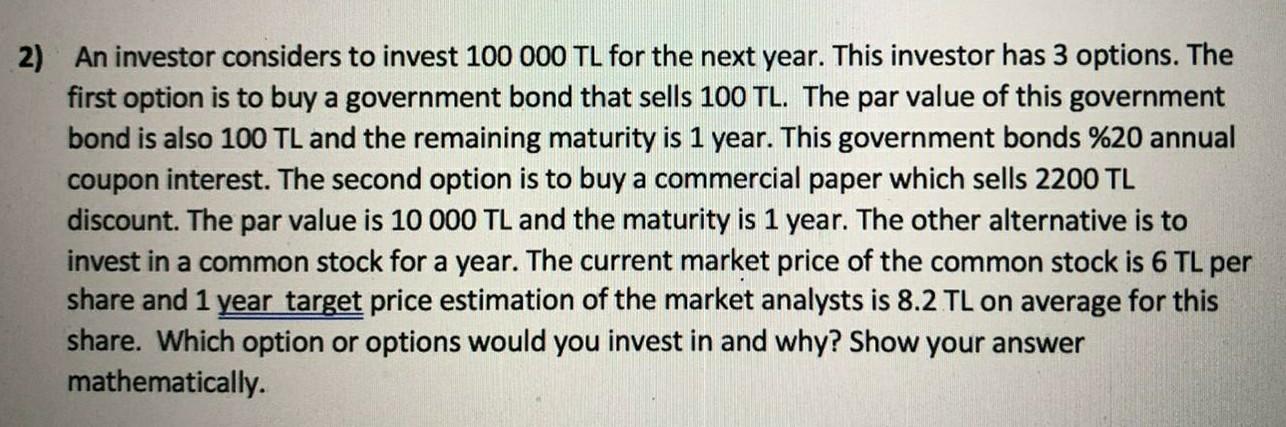

2) An investor considers to invest 100 000 TL for the next year. This investor has 3 options. The first option is to buy a

2) An investor considers to invest 100 000 TL for the next year. This investor has 3 options. The first option is to buy a government bond that sells 100 TL. The par value of this government bond is also 100 TL and the remaining maturity is 1 year. This government bonds %20 annual coupon interest. The second option is to buy a commercial paper which sells 2200 TL discount. The par value is 10 000 TL and the maturity is 1 year. The other alternative is to invest in a common stock for a year. The current market price of the common stock is 6 TL per share and 1 year target price estimation of the market analysts is 8.2 TL on average for this share. Which option or options would you invest in and why? Show your answer mathematically

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started