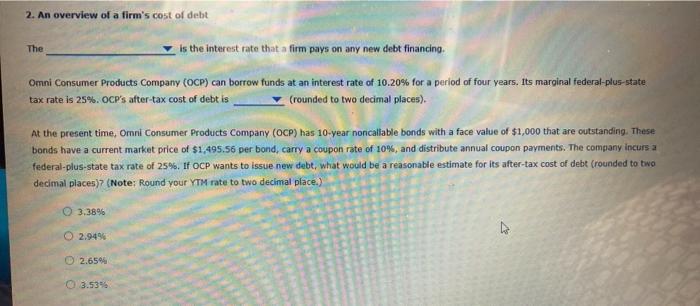

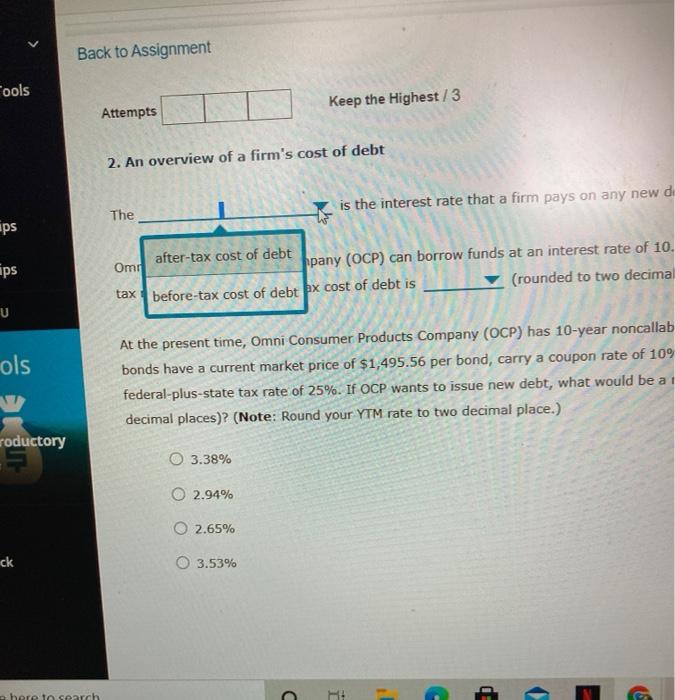

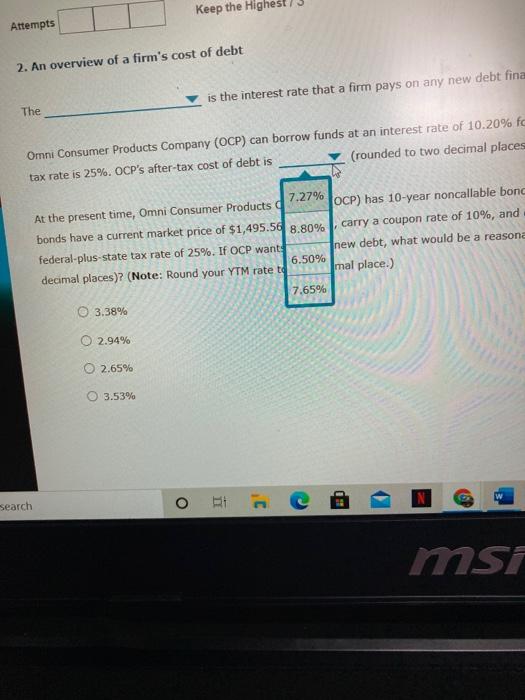

2. An overview of a firm's cost of debt The Is the interest rate that a firm pays on any new debt financing Omni Consumer Products Company (OCP) can borrow funds at an interest rate of 10.20% for a period of four years. Its marginal federal-plus-state tax rate is 25%. OCP's after-tax cost of debt is (rounded to two decimal places). At the present time, Omni Consumer Products Company (OCP) has 10-year noncaltable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,495.56 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company Incurs a federal-plus-state tax rate of 25%. If OCP wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)7 (Note: Round your YTM rate to two decimal place.) 3.38% O 2.9496 0 2.6594 Back to Assignment Cools Keep the Highest/3 Attempts 2. An overview of a firm's cost of debt is the interest rate that a firm pays on any new di The ips Ips after-tax cost of debt Omi hpany (OCP) can borrow funds at an interest rate of 10. tax before-tax cost of debt x cost of debt is (rounded to two decimal U ols At the present time, Omni Consumer Products Company (OCP) has 10-year noncallab bonds have a current market price of $1,495.56 per bond, carry a coupon rate of 10% federal-plus-state tax rate of 25%. If OCP wants to issue new debt, what would be a decimal places)? (Note: Round your YTM rate to two decimal place.) roductory 0 3.38% 0 2.94% O 2.65% ck 3.53% 1 here to search HE C E Keep the Highes Attempts 2. An overview of a firm's cost of debt is the interest rate that a firm pays on any new debt fina The Omni Consumer Products Company (OCP) can borrow funds at an interest rate of 10.20% fc tax rate is 25%. OCP's after-tax cost of debt is (rounded to two decimal places 7.27% At the present time, Omni Consumer Products OCP) has 10-year noncallable bond bonds have a current market price of $1,495.56 8.80% carry a coupon rate of 10%, and federal-plus-state tax rate of 25%. If OCP wants new debt, what would be a reasona 6.50% decimal places)? (Note: Round your YTM rate to mal place.) 7.65% O 3.38% O 2.94% 2.65% 3.53% search NO o C ms