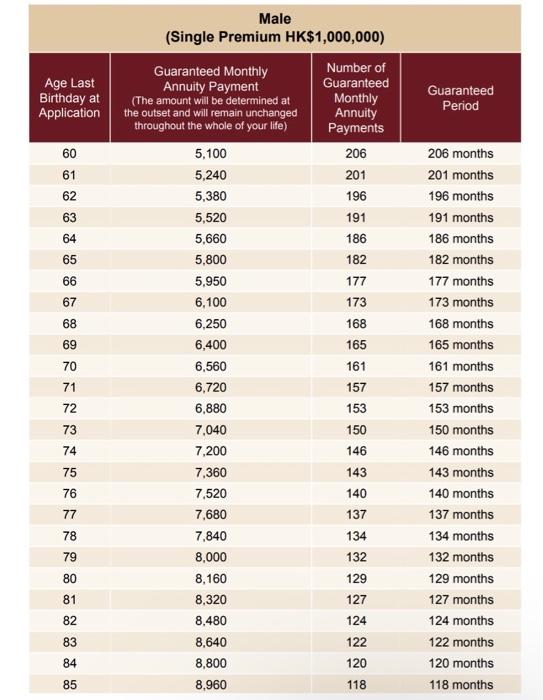

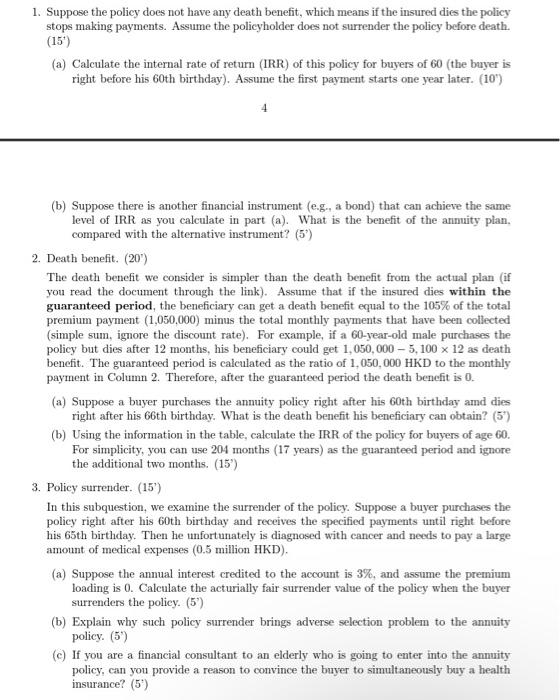

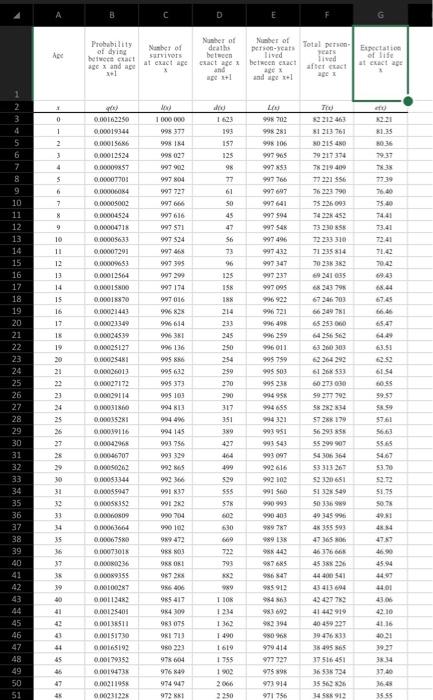

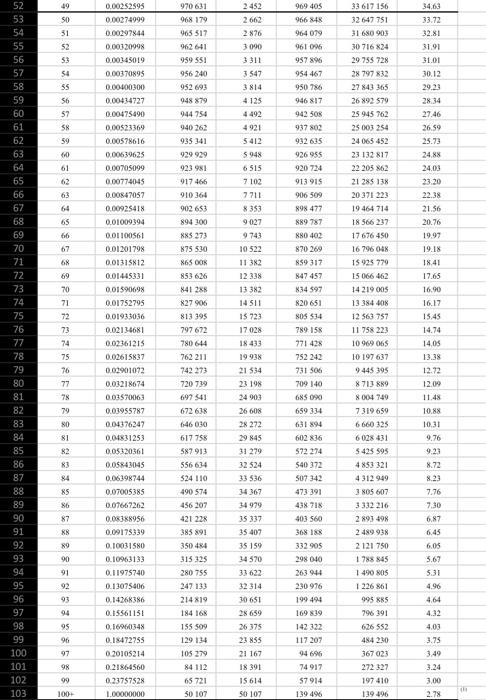

2 Annuity (50) In this exercise, we analyze the HKMC Annuity Plan (simplified). The following table lists infor- mation of this plan. For more details, check this website. In this exercise, we assume the buyer is 3 male. The first column lists the age of the insured at the purchase. The second column lists the guaranteed monthly annuity payment. The third and fourth columns list the number of guaran- teed period of annuity payments, which we will analyze further in subquestions. For simplicity, we assume that payments are made annually. For example, if a 60-year-old buyer buys the annuity, he gets an annual payment of 5100 x 12 at the end of every year if he survives. For simplicity, you don't need to calculate the payment and death probability in each month of the year. The pay- ment ends when the insured is 100 years old. Use the Life Table attached to answer the following questions. Age Last Birthday at Application 2 283 28 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 Male (Single Premium HK$1,000,000) Number of Guaranteed Monthly Annuity Payment Guaranteed Monthly (The amount will be determined at the outset and will remain unchanged throughout the whole of your life) Annuity Payments 5,100 206 5,240 201 5,380 196 5,520 191 5,660 186 5,800 182 5,950 177 6,100 173 6,250 168 6,400 165 6,560 161 6,720 157 6,880 153 7,040 150 7,200 146 7,360 143 7,520 140 7,680 137 7,840 134 8,000 132 8,160 129 8,320 127 8,480 124 8,640 122 8,800 120 8,960 118 Guaranteed Period 206 months 201 months 196 months 191 months 186 months 182 months 177 months 173 months 168 months 165 months 161 months 157 months 153 months 150 months 146 months 143 months 140 months 137 months 134 months 132 months 129 months 127 months 124 months 122 months 120 months 118 months 1. Suppose the policy does not have any death benefit, which means if the insured dies the policy stops making payments. Assume the policyholder does not surrender the policy before death. (15) (a) Calculate the internal rate of return (IRR) of this policy for buyers of 60 (the buyer is right before his 60th birthday). Assume the first payment starts one year later. (10) 4 (b) Suppose there is another financial instrument (e.g., a bond) that can achieve the same level of IRR as you calculate in part (a). What is the benefit of the annuity plan. compared with the alternative instrument? (5') 2. Death benefit. (20) The death benefit we consider is simpler than the death benefit from the actual plan (if you read the document through the link). Assume that if the insured dies within the guaranteed period, the beneficiary can get a death benefit equal to the 105% of the total premium payment (1,050,000) minus the total monthly payments that have been collected (simple sum, ignore the discount rate). For example, if a 60-year-old male purchases the policy but dies after 12 months, his beneficiary could get 1,050,000-5, 100 x 12 as death benefit. The guaranteed period is calculated as the ratio of 1,050, 000 HKD to the monthly payment in Column 2. Therefore, after the guaranteed period the death benefit is 0. (a) Suppose a buyer purchases the annuity policy right after his 60th birthday amd dies right after his 66th birthday. What is the death benefit his beneficiary can obtain? (5') (b) Using the information in the table, calculate the IRR of the policy for buyers of age 60. For simplicity, you can use 204 months (17 years) as the guaranteed period and ignore the additional two months. (15') 3. Policy surrender. (15') In this subquestion, we examine the surrender of the policy. Suppose a buyer purchases the policy right after his 60th birthday and receives the specified payments until right before his 65th birthday. Then he unfortunately is diagnosed with cancer and needs to pay a large amount of medical expenses (0.5 million HKD). (a) Suppose the annual interest credited to the account is 3%, and assume the premium loading is 0. Calculate the acturially fair surrender value of the policy when the buyer surrenders the policy. (5') (b) Explain why such policy surrender brings adverse selection problem to the annuity policy. (5) (c) If you are a financial consultant to an elderly who is going to enter into the annuity policy, can you provide a reason to convince the buyer to simultaneously buy a health insurance? (5) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 ng bahRARASYwwwwwwwwNNNNNNNG555 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 44 45 46 47 48 49 50 51 Age X 0 1 2 3 4 5 6 7 8 6 10 11 12 13 14 SI 5222287285AASER= 16 17 18 19 20 21 23 24 26 29 30 38 32 33 34 35 36 37. 38 39 28403935N 41 17 44 ST 46 47 C Probability of dying between exact age x and age x+1 Number of survivors at exact age 100 0.00162250 1000000 0.00019344 998 377 0.00015686 998 184 0.00012524 998 027 0.00009857 997 902 0.00007701 997 804 0.00006084 997 727 0.00005002 997 666 997 616 0.00004524 0.00004718 997 571 0.00005633 997 524 997 468 0.00007291 0.00009653 997 395 0.00012564 997 299 0.00015800 997 174 997 016 0.00015870 0.00021443 0.00023349 996 828 996 614 0.00024539 0.00025127 996 381 996 136 995 886 0.00025481 0.00026013 0.00027172 995 632 995 373 995 103 994 813 0.00029114 0.00031860 0.00035281 0.00039116 994 496 994 145 993 756 0.00042968 0.00046707 993 329 992 865 992 366 991 837 991 282 0.00050262 0.00053344 0.00055947 0.00058352 0.00060809 0.00063664 0.00067580 0.00073018 990 704 990 102 989 472 988803 988 081 0.00080236 0.00089355 0.00100287 987 288 986 406 0.00112482 985 417 984 309 0.00125401 0.00138511 983 075 981 713 0.00151730 0.00165192 960 223 0.00179352 978604 0.00194738 976 849 0.00211958 974 947 0.00231228 972 8K1 D Number of deaths between exact age x and age x+1 doo 1623 193 157 125 98 FR2=====838388 77 47 56 73 96 125 158 214 245 250 254 259 270 290 317 351 68E 427 464 499 529 555 578 602 630 669 722 793 882 989 801 1 1234 1362 1490 6191 1755 1902 2066 2250 Number of person-years lived between exact age x and age x+1 077 998 702 998 281 998 106 997965 997 853 997 766 997 697 997641 997 594 997 54K 997 496 997 432 997 347 997 237 997 095 996 922 996 721 996 498 996 299 996 011 995 759 995503 995 238 994 958 994 655 994 321 993 951 993 543 993 097 992 616 992 102 991 560 990 993 990 403 989 787 989 138 988 442 987 685 986 847 985 912 984 863 983692 982 394 980 968 979 414 977 727 975 898 973 914 971 756 G Total person Expectation years of life lived after exact at exact age age x TOU ett 82212 463 82.21 81 213 761 81.35 80.36 80215 480 79 217 374 79.37 78.38 78 219 409 77 221 556 76 223 790 77.39 76.40 75.40 75 226 093 74228 452 74.41 73 230 858 73.41 72 233 310 72.41 71235814 71.42 70 238 382 70.42 69241035 69.43 68 243 798 68.44 67 246 703 67.45 66 249 781 66.46 65253 060 65.47 64 256 562 64.49 63 260 303 63.51 62 264 292 62.52 61 268 533 61.54 60273 030 59 277 792 58 282 834 57 288 179 56 293 858 55 299 907 54 306 364 53 313 267 52 320 651 51 328 549 336 989 50 49 345 996 48 355 593 47365806 46376668 45 388 226 44 400 541 43413694 42 427 782 41 442 919 40-459227 39 476 833 38 495 865 37 516 451 36 538 724 35 562 826 34 588 912 55:09 59.57 $8.59 57.61 56.63 55.65 54.67 53.70 52.72 51.75 50,78 49.81 48.84 47.87 46.90 45.94 44.97 44.01 43.06 42.10 41.36 40.21 38:34 37,40 36:48 35.55 C28363338688RANAKKERR 52 53 54 55 56 57 58 59 60 61 64 65 67 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 52525283- 49 50 51 54 56 57 58 59 60 61 62 63 64 65 66 67 68 SPFRPZPR FARS 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100+ 0.00252595 0.00274999 0.00297844 0.00320998 0.00345019 0.00370895 0.00400300 0.00434727 0.00475490 0.00523369 0.00578616 0.00639625 0.00705099 0.00774045 0.00847057 0.00925418 0.01009394 0.01100561 0.01201798 0.01315812 0.01445331 0.01590698 0.01752795 0.01933036 0.02134681 0.02361215 0.02615837 0.02901072 0.03218674 0.03570063 0.03955787 0.04376247 0.04831253 0.05320361 0.05843045 0.06398744 0.07005385 0.07667262 0.08388956 0.09175339 0.10031580 0.10963133 0.11975740 0.13075406 0.14268386 0.15561151 0.16960348 0.18472755 0.20105214 0.21864560 0.23757528 1.00000000 970 631 968 179 965 517 962 641 959 551 956 240 952 693 948 879 944 754 940 262 935 341 929 929 923 981 917 466 910 364 902 653 894 300 885 273 875 530 865 008 853 626 841 288 827 906 813 395 797 672 780 644 762 211 742 273 720 739 697 541 672 638 646 030 617 758 587 913 556 634 524 110 490 574 456 207 421 228 385 891 350 484 315 325 280 755 247 133 214 819 184 168 155 509 129 134 105 279 84 112 65 721 50 107 2452 2662 2-876 3090 3311 3.547 3814 4125 4492 4921 5412 5948 6515 7 102 7711 8.353 9:027 9743 10 522 11 382 12 338 13 382 14 511 15 723 17.028 18 433 19 938 21 534 23 198 24 903 26 608 28 272 29 845 31 279 32 524 33 536 34 367 34 979 35 337 35 407 35 159 34 570 33 622 32 314 30 651 28 659 26.375 23 855 21 167 18 391 15 614 50 107 969 405 966 848 964 079 961 096 957 896 954 467 950 786 946 817 942 508 937 802 932 635 926 955 920 724 913 915 906 509 898 477 889 787 880 402 870 269 859 317 847 457 834 597 820 651 805 534 789 158 771-428 752 242 731 506 709 140 685 090 659 334 631 894 602 836 572 274 540 372 507 342 473 391 438 718 403 560 368 188 332 905 298 040 263 944 230 976 199 494 169 839 142 322 117 207 94 696 74 917 $7.914 139 496 33 617 156 32 647 751 31 680 903 30 716 824 29 755 728 28 797 832 27 843 365 26 892 579 25 945 762 25 003 254 24 065 452 23 132 817 22 205 862 21 285 138 20 371 223 19 464 714 18 566 237 17 676 450 16 796 048 15 925 779 15 066 462 14 219 005 13 384 408 12 563 757 11 758 223 10 969 065 10 197 637 9445 395 8 713 889 8004 749 7319 659 6660 325 6028 431 5425 595 4 853 321 4 312 949 3 805 607 3 332 216 2 893 498 2 489 938 2 121 750 1788 845 1490 805 1 226 861 995 885 796 391 626 552 484 230 367 023 272 327 197 410 139 496 34.63 33.72 32.81 31.91 31.01 30.12 29.23 28.34 27.46 26.59 25.73 24.88 24.03 23.20 22.38 21.56 20.76 19.97 19.18 18.41 17.65 16.90 16.17 15.45 14.74 14.05 13.38 12.72 12.09 11.48 10.88 10.31 9.76 9.23 8.72 8.23 7.76 7.30 6.87 6.45 6.05 5.67 5.31 4.96 4.64 4.32 4.03 3.75 3.49 3.24 3.00 2.78 U 2 Annuity (50) In this exercise, we analyze the HKMC Annuity Plan (simplified). The following table lists infor- mation of this plan. For more details, check this website. In this exercise, we assume the buyer is 3 male. The first column lists the age of the insured at the purchase. The second column lists the guaranteed monthly annuity payment. The third and fourth columns list the number of guaran- teed period of annuity payments, which we will analyze further in subquestions. For simplicity, we assume that payments are made annually. For example, if a 60-year-old buyer buys the annuity, he gets an annual payment of 5100 x 12 at the end of every year if he survives. For simplicity, you don't need to calculate the payment and death probability in each month of the year. The pay- ment ends when the insured is 100 years old. Use the Life Table attached to answer the following questions. Age Last Birthday at Application 2 283 28 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 Male (Single Premium HK$1,000,000) Number of Guaranteed Monthly Annuity Payment Guaranteed Monthly (The amount will be determined at the outset and will remain unchanged throughout the whole of your life) Annuity Payments 5,100 206 5,240 201 5,380 196 5,520 191 5,660 186 5,800 182 5,950 177 6,100 173 6,250 168 6,400 165 6,560 161 6,720 157 6,880 153 7,040 150 7,200 146 7,360 143 7,520 140 7,680 137 7,840 134 8,000 132 8,160 129 8,320 127 8,480 124 8,640 122 8,800 120 8,960 118 Guaranteed Period 206 months 201 months 196 months 191 months 186 months 182 months 177 months 173 months 168 months 165 months 161 months 157 months 153 months 150 months 146 months 143 months 140 months 137 months 134 months 132 months 129 months 127 months 124 months 122 months 120 months 118 months 1. Suppose the policy does not have any death benefit, which means if the insured dies the policy stops making payments. Assume the policyholder does not surrender the policy before death. (15) (a) Calculate the internal rate of return (IRR) of this policy for buyers of 60 (the buyer is right before his 60th birthday). Assume the first payment starts one year later. (10) 4 (b) Suppose there is another financial instrument (e.g., a bond) that can achieve the same level of IRR as you calculate in part (a). What is the benefit of the annuity plan. compared with the alternative instrument? (5') 2. Death benefit. (20) The death benefit we consider is simpler than the death benefit from the actual plan (if you read the document through the link). Assume that if the insured dies within the guaranteed period, the beneficiary can get a death benefit equal to the 105% of the total premium payment (1,050,000) minus the total monthly payments that have been collected (simple sum, ignore the discount rate). For example, if a 60-year-old male purchases the policy but dies after 12 months, his beneficiary could get 1,050,000-5, 100 x 12 as death benefit. The guaranteed period is calculated as the ratio of 1,050, 000 HKD to the monthly payment in Column 2. Therefore, after the guaranteed period the death benefit is 0. (a) Suppose a buyer purchases the annuity policy right after his 60th birthday amd dies right after his 66th birthday. What is the death benefit his beneficiary can obtain? (5') (b) Using the information in the table, calculate the IRR of the policy for buyers of age 60. For simplicity, you can use 204 months (17 years) as the guaranteed period and ignore the additional two months. (15') 3. Policy surrender. (15') In this subquestion, we examine the surrender of the policy. Suppose a buyer purchases the policy right after his 60th birthday and receives the specified payments until right before his 65th birthday. Then he unfortunately is diagnosed with cancer and needs to pay a large amount of medical expenses (0.5 million HKD). (a) Suppose the annual interest credited to the account is 3%, and assume the premium loading is 0. Calculate the acturially fair surrender value of the policy when the buyer surrenders the policy. (5') (b) Explain why such policy surrender brings adverse selection problem to the annuity policy. (5) (c) If you are a financial consultant to an elderly who is going to enter into the annuity policy, can you provide a reason to convince the buyer to simultaneously buy a health insurance? (5) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 ng bahRARASYwwwwwwwwNNNNNNNG555 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 44 45 46 47 48 49 50 51 Age X 0 1 2 3 4 5 6 7 8 6 10 11 12 13 14 SI 5222287285AASER= 16 17 18 19 20 21 23 24 26 29 30 38 32 33 34 35 36 37. 38 39 28403935N 41 17 44 ST 46 47 C Probability of dying between exact age x and age x+1 Number of survivors at exact age 100 0.00162250 1000000 0.00019344 998 377 0.00015686 998 184 0.00012524 998 027 0.00009857 997 902 0.00007701 997 804 0.00006084 997 727 0.00005002 997 666 997 616 0.00004524 0.00004718 997 571 0.00005633 997 524 997 468 0.00007291 0.00009653 997 395 0.00012564 997 299 0.00015800 997 174 997 016 0.00015870 0.00021443 0.00023349 996 828 996 614 0.00024539 0.00025127 996 381 996 136 995 886 0.00025481 0.00026013 0.00027172 995 632 995 373 995 103 994 813 0.00029114 0.00031860 0.00035281 0.00039116 994 496 994 145 993 756 0.00042968 0.00046707 993 329 992 865 992 366 991 837 991 282 0.00050262 0.00053344 0.00055947 0.00058352 0.00060809 0.00063664 0.00067580 0.00073018 990 704 990 102 989 472 988803 988 081 0.00080236 0.00089355 0.00100287 987 288 986 406 0.00112482 985 417 984 309 0.00125401 0.00138511 983 075 981 713 0.00151730 0.00165192 960 223 0.00179352 978604 0.00194738 976 849 0.00211958 974 947 0.00231228 972 8K1 D Number of deaths between exact age x and age x+1 doo 1623 193 157 125 98 FR2=====838388 77 47 56 73 96 125 158 214 245 250 254 259 270 290 317 351 68E 427 464 499 529 555 578 602 630 669 722 793 882 989 801 1 1234 1362 1490 6191 1755 1902 2066 2250 Number of person-years lived between exact age x and age x+1 077 998 702 998 281 998 106 997965 997 853 997 766 997 697 997641 997 594 997 54K 997 496 997 432 997 347 997 237 997 095 996 922 996 721 996 498 996 299 996 011 995 759 995503 995 238 994 958 994 655 994 321 993 951 993 543 993 097 992 616 992 102 991 560 990 993 990 403 989 787 989 138 988 442 987 685 986 847 985 912 984 863 983692 982 394 980 968 979 414 977 727 975 898 973 914 971 756 G Total person Expectation years of life lived after exact at exact age age x TOU ett 82212 463 82.21 81 213 761 81.35 80.36 80215 480 79 217 374 79.37 78.38 78 219 409 77 221 556 76 223 790 77.39 76.40 75.40 75 226 093 74228 452 74.41 73 230 858 73.41 72 233 310 72.41 71235814 71.42 70 238 382 70.42 69241035 69.43 68 243 798 68.44 67 246 703 67.45 66 249 781 66.46 65253 060 65.47 64 256 562 64.49 63 260 303 63.51 62 264 292 62.52 61 268 533 61.54 60273 030 59 277 792 58 282 834 57 288 179 56 293 858 55 299 907 54 306 364 53 313 267 52 320 651 51 328 549 336 989 50 49 345 996 48 355 593 47365806 46376668 45 388 226 44 400 541 43413694 42 427 782 41 442 919 40-459227 39 476 833 38 495 865 37 516 451 36 538 724 35 562 826 34 588 912 55:09 59.57 $8.59 57.61 56.63 55.65 54.67 53.70 52.72 51.75 50,78 49.81 48.84 47.87 46.90 45.94 44.97 44.01 43.06 42.10 41.36 40.21 38:34 37,40 36:48 35.55 C28363338688RANAKKERR 52 53 54 55 56 57 58 59 60 61 64 65 67 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 52525283- 49 50 51 54 56 57 58 59 60 61 62 63 64 65 66 67 68 SPFRPZPR FARS 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100+ 0.00252595 0.00274999 0.00297844 0.00320998 0.00345019 0.00370895 0.00400300 0.00434727 0.00475490 0.00523369 0.00578616 0.00639625 0.00705099 0.00774045 0.00847057 0.00925418 0.01009394 0.01100561 0.01201798 0.01315812 0.01445331 0.01590698 0.01752795 0.01933036 0.02134681 0.02361215 0.02615837 0.02901072 0.03218674 0.03570063 0.03955787 0.04376247 0.04831253 0.05320361 0.05843045 0.06398744 0.07005385 0.07667262 0.08388956 0.09175339 0.10031580 0.10963133 0.11975740 0.13075406 0.14268386 0.15561151 0.16960348 0.18472755 0.20105214 0.21864560 0.23757528 1.00000000 970 631 968 179 965 517 962 641 959 551 956 240 952 693 948 879 944 754 940 262 935 341 929 929 923 981 917 466 910 364 902 653 894 300 885 273 875 530 865 008 853 626 841 288 827 906 813 395 797 672 780 644 762 211 742 273 720 739 697 541 672 638 646 030 617 758 587 913 556 634 524 110 490 574 456 207 421 228 385 891 350 484 315 325 280 755 247 133 214 819 184 168 155 509 129 134 105 279 84 112 65 721 50 107 2452 2662 2-876 3090 3311 3.547 3814 4125 4492 4921 5412 5948 6515 7 102 7711 8.353 9:027 9743 10 522 11 382 12 338 13 382 14 511 15 723 17.028 18 433 19 938 21 534 23 198 24 903 26 608 28 272 29 845 31 279 32 524 33 536 34 367 34 979 35 337 35 407 35 159 34 570 33 622 32 314 30 651 28 659 26.375 23 855 21 167 18 391 15 614 50 107 969 405 966 848 964 079 961 096 957 896 954 467 950 786 946 817 942 508 937 802 932 635 926 955 920 724 913 915 906 509 898 477 889 787 880 402 870 269 859 317 847 457 834 597 820 651 805 534 789 158 771-428 752 242 731 506 709 140 685 090 659 334 631 894 602 836 572 274 540 372 507 342 473 391 438 718 403 560 368 188 332 905 298 040 263 944 230 976 199 494 169 839 142 322 117 207 94 696 74 917 $7.914 139 496 33 617 156 32 647 751 31 680 903 30 716 824 29 755 728 28 797 832 27 843 365 26 892 579 25 945 762 25 003 254 24 065 452 23 132 817 22 205 862 21 285 138 20 371 223 19 464 714 18 566 237 17 676 450 16 796 048 15 925 779 15 066 462 14 219 005 13 384 408 12 563 757 11 758 223 10 969 065 10 197 637 9445 395 8 713 889 8004 749 7319 659 6660 325 6028 431 5425 595 4 853 321 4 312 949 3 805 607 3 332 216 2 893 498 2 489 938 2 121 750 1788 845 1490 805 1 226 861 995 885 796 391 626 552 484 230 367 023 272 327 197 410 139 496 34.63 33.72 32.81 31.91 31.01 30.12 29.23 28.34 27.46 26.59 25.73 24.88 24.03 23.20 22.38 21.56 20.76 19.97 19.18 18.41 17.65 16.90 16.17 15.45 14.74 14.05 13.38 12.72 12.09 11.48 10.88 10.31 9.76 9.23 8.72 8.23 7.76 7.30 6.87 6.45 6.05 5.67 5.31 4.96 4.64 4.32 4.03 3.75 3.49 3.24 3.00 2.78 U