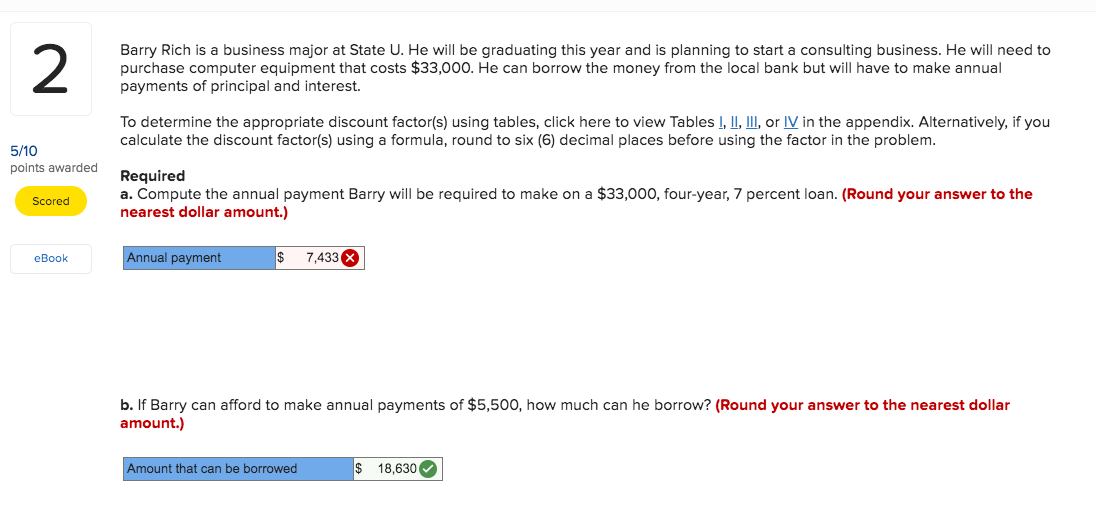

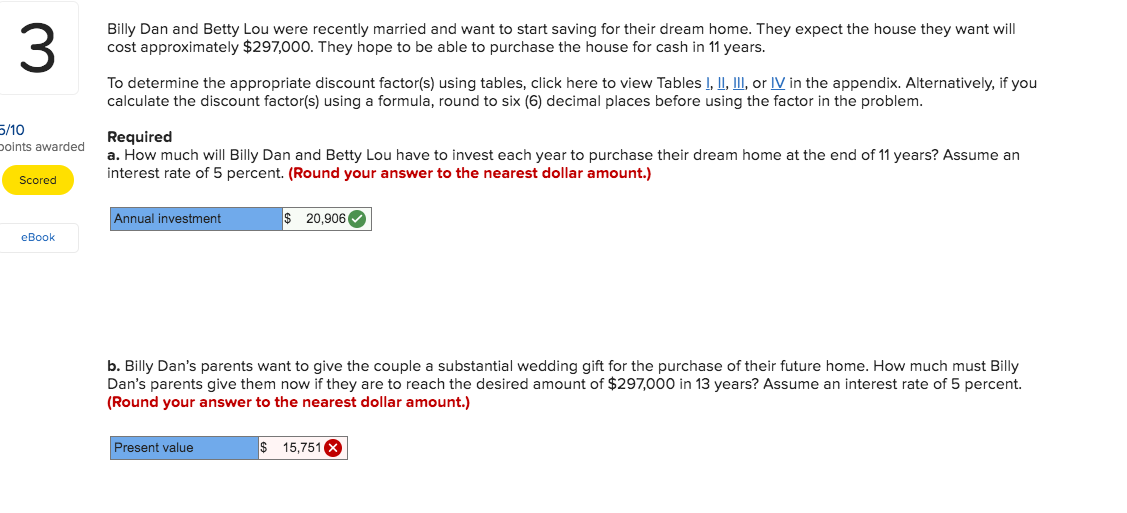

2 Barry Rich is a business major at State U. He will be graduating this year and is planning to start a consulting business. He will need to purchase computer equipment that costs $33,000. He can borrow the money from the local bank but will have to make annual payments of principal and interest. To determine the appropriate discount factor(s) using tables, click here to view Tables I, II, III, or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. 5/10 points awarded Required a. Compute the annual payment Barry will be required to make on a $33,000, four-year, 7 percent loan. (Round your answer to the nearest dollar amount.) Scored eBook Annual payment 7,433 X b. If Barry can afford to make annual payments of $5,500, how much can he borrow? (Round your answer to the nearest dollar amount.) Amount that can be borrowed $ 18,630 3 Billy Dan and Betty Lou were recently married and want to start saving for their dream home. They expect the house they want will cost approximately $297,000. They hope to be able to purchase the house for cash in 11 years. To determine the appropriate discount factor(s) using tables, click here to view Tables I, II, III, or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. 5/10 points awarded Required a. How much will Billy Dan and Betty Lou have to invest each year to purchase their dream home at the end of 11 years? Assume an interest rate of 5 percent. (Round your answer to the nearest dollar amount.) Scored Annual investment $ 20,906 eBook b. Billy Dan's parents want to give the couple a substantial wedding gift for the purchase of their future home. How much must Billy Dan's parents give them now if they are to reach the desired amount of $297,000 in 13 years? Assume an interest rate of 5 percent. (Round your answer to the nearest dollar amount.) Present value $ 15,751 X