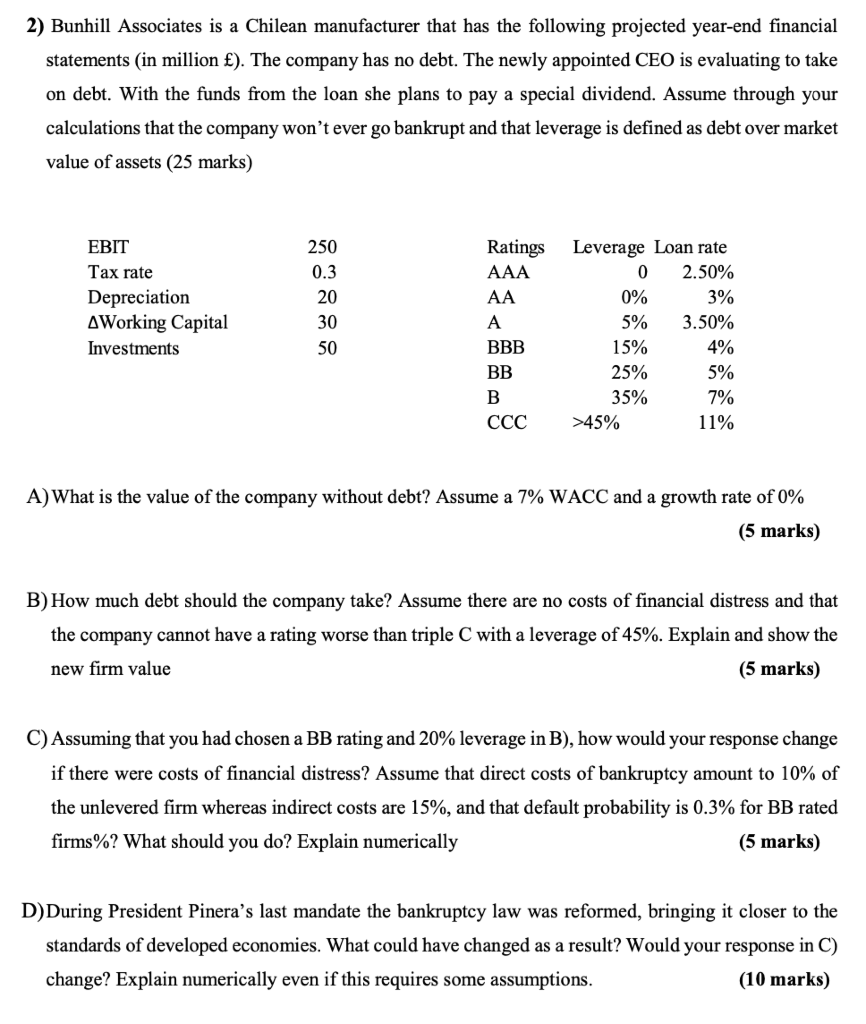

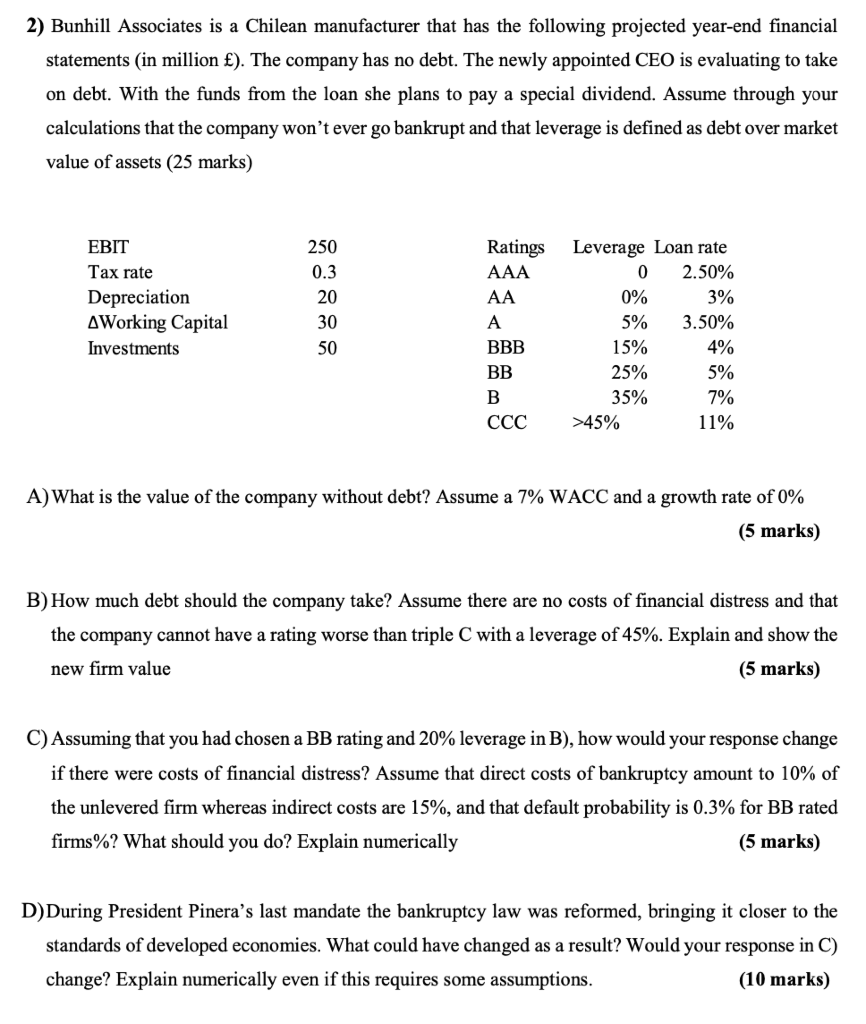

2) Bunhill Associates is a Chilean manufacturer that has the following projected year-end financial statements (in million ). The company has no debt. The newly appointed CEO is evaluating to take on debt. With the funds from the loan she plans to pay a special dividend. Assume through your calculations that the company won't ever go bankrupt and that leverage is defined as debt over market value of assets (25 marks) EBIT Tax rate Depreciation AWorking Capital Investments 250 0.3 20 30 50 Ratings AAA AA A BBB BB B CCC Leverage Loan rate 0 2.50% 0% 3% 5% 3.50% 15% 4% 25% 5% 35% 7% >45% 11% A) What is the value of the company without debt? Assume a 7% WACC and a growth rate of 0% (5 marks) B) How much debt should the company take? Assume there are no costs of financial distress and that the company cannot have a rating worse than triple C with a leverage of 45%. Explain and show the new firm value (5 marks) C) Assuming that you had chosen a BB rating and 20% leverage in B), how would your response change if there were costs of financial distress? Assume that direct costs of bankruptcy amount to 10% of the unlevered firm whereas indirect costs are 15%, and that default probability is 0.3% for BB rated firms%? What should you do? Explain numerically (5 marks) D)During President Pinera's last mandate the bankruptcy law was reformed, bringing it closer to the standards of developed economies. What could have changed as a result? Would your response in C) change? Explain numerically even if this requires some assumptions. (10 marks) 2) Bunhill Associates is a Chilean manufacturer that has the following projected year-end financial statements (in million ). The company has no debt. The newly appointed CEO is evaluating to take on debt. With the funds from the loan she plans to pay a special dividend. Assume through your calculations that the company won't ever go bankrupt and that leverage is defined as debt over market value of assets (25 marks) EBIT Tax rate Depreciation AWorking Capital Investments 250 0.3 20 30 50 Ratings AAA AA A BBB BB B CCC Leverage Loan rate 0 2.50% 0% 3% 5% 3.50% 15% 4% 25% 5% 35% 7% >45% 11% A) What is the value of the company without debt? Assume a 7% WACC and a growth rate of 0% (5 marks) B) How much debt should the company take? Assume there are no costs of financial distress and that the company cannot have a rating worse than triple C with a leverage of 45%. Explain and show the new firm value (5 marks) C) Assuming that you had chosen a BB rating and 20% leverage in B), how would your response change if there were costs of financial distress? Assume that direct costs of bankruptcy amount to 10% of the unlevered firm whereas indirect costs are 15%, and that default probability is 0.3% for BB rated firms%? What should you do? Explain numerically (5 marks) D)During President Pinera's last mandate the bankruptcy law was reformed, bringing it closer to the standards of developed economies. What could have changed as a result? Would your response in C) change? Explain numerically even if this requires some assumptions. (10 marks)