Which of the following properties, all owned by Claudia, would likely enable her to claim a deduction for home loan interest? (1) A property

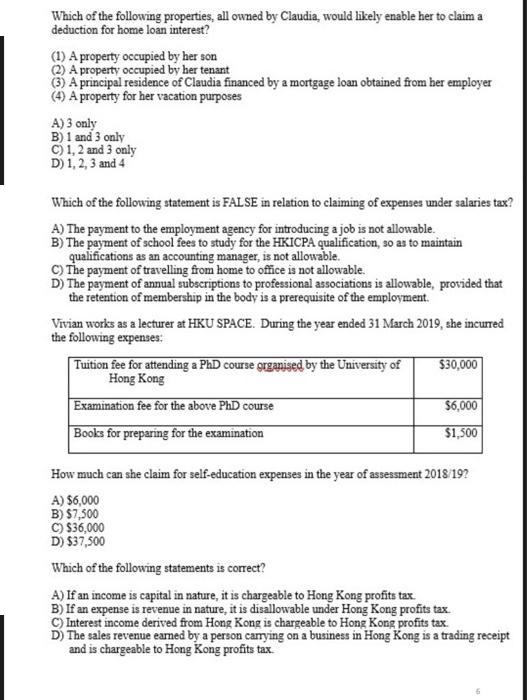

Which of the following properties, all owned by Claudia, would likely enable her to claim a deduction for home loan interest? (1) A property occupied by her son (2) A property occupied by her tenant (3) A principal residence of Claudia financed by a mortgage loan obtained from her employer (4) A property for her vacation purposes A) 3 only B) 1 and 3 only C) 1, 2 and 3 only D) 1, 2, 3 and 4 Which of the following statement is FALSE in relation to claiming of expenses under salaries tax? A) The payment to the employment agency for introducing a job is not allowable. B) The payment of school fees to study for the HKICPA qualification, so as to maintain qualifications as an accounting manager, is not allowable. C) The payment of travelling from home to office is not allowable. D) The payment of annual subscriptions to professional associations is allowable, provided that the retention of membership in the body is a prerequisite of the employment. Vivian works as a lecturer at HKU SPACE. During the year ended 31 March 2019, she incurred the following expenses: Tuition fee for attending a PhD course organised by the University of Hong Kong Examination fee for the above PhD course Books for preparing for the examination $30,000 $6,000 $1,500 How much can she claim for self-education expenses in the year of assessment 2018/19? A) $6,000 B) $7,500 C) $36,000 D) $37,500 Which of the following statements is correct? A) If an income is capital in nature, it is chargeable to Hong Kong profits tax B) If an expense is revenue in nature, it is disallowable under Hong Kong profits tax. C) Interest income derived from Hong Kong is chargeable to Hong Kong profits tax. D) The sales revenue earned by a person carrying on a business in Hong Kong is a trading receipt and is chargeable to Hong Kong profits tax.

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 C 1 2 and 3 only Since the deduction for home loan interest is based on the premise that the taxpa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started