2) Calculate NPV for the worst-case scenario

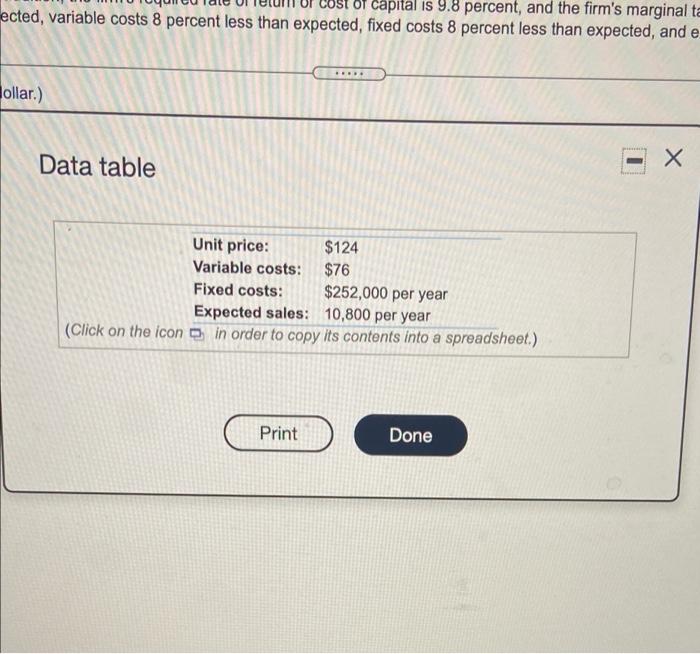

Related to Checkpoint 13.5) (Scenario analysis) Family Security is considering ting tiny GPS traces that can be inserted the sole of a chilesho, which would the low for the tracking that the there was to abducted. The states that might be off by 6 percent (bove or below) .scoated with this new product are shown here ces produine, you are recorded in your and would be to row how wil you will fare if your states on her listed above are 8 percent higher or percent lower than expected. Assume that is new product rewire in inalty of 104 million, who working at 10 years, being depreciated down to sing straight-line depreciation. In addition, the figured value ofrem cost demanats i 34 en CNPV decat scontohatisha high statistica per bovended, we percorrected food coeren en anderecedented NIV under the worst scenario The DV or the be will be bound to the new detar) of capital is 9.8 percent, and the firm's marginal ta ected, variable costs 8 percent less than expected, fixed costs 8 percent less than expected, and e ... ollar.) Data table Unit price: $124 Variable costs: $76 Fixed costs: $252,000 per year Expected sales: 10,800 per year (Click on the icon in order to copy its contents into a spreadsheet.) Print Done Related to Checkpoint 13.5) (Scenario analysis) Family Security is considering ting tiny GPS traces that can be inserted the sole of a chilesho, which would the low for the tracking that the there was to abducted. The states that might be off by 6 percent (bove or below) .scoated with this new product are shown here ces produine, you are recorded in your and would be to row how wil you will fare if your states on her listed above are 8 percent higher or percent lower than expected. Assume that is new product rewire in inalty of 104 million, who working at 10 years, being depreciated down to sing straight-line depreciation. In addition, the figured value ofrem cost demanats i 34 en CNPV decat scontohatisha high statistica per bovended, we percorrected food coeren en anderecedented NIV under the worst scenario The DV or the be will be bound to the new detar) of capital is 9.8 percent, and the firm's marginal ta ected, variable costs 8 percent less than expected, fixed costs 8 percent less than expected, and e ... ollar.) Data table Unit price: $124 Variable costs: $76 Fixed costs: $252,000 per year Expected sales: 10,800 per year (Click on the icon in order to copy its contents into a spreadsheet.) Print Done