Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) Calculate the balance of each of the following accounts as of December 31, 2021: - common shares - preferred shares - contributed surplus -

2) Calculate the balance of each of the following accounts as of December 31, 2021:

- common shares

- preferred shares

- contributed surplus

- retained earnings

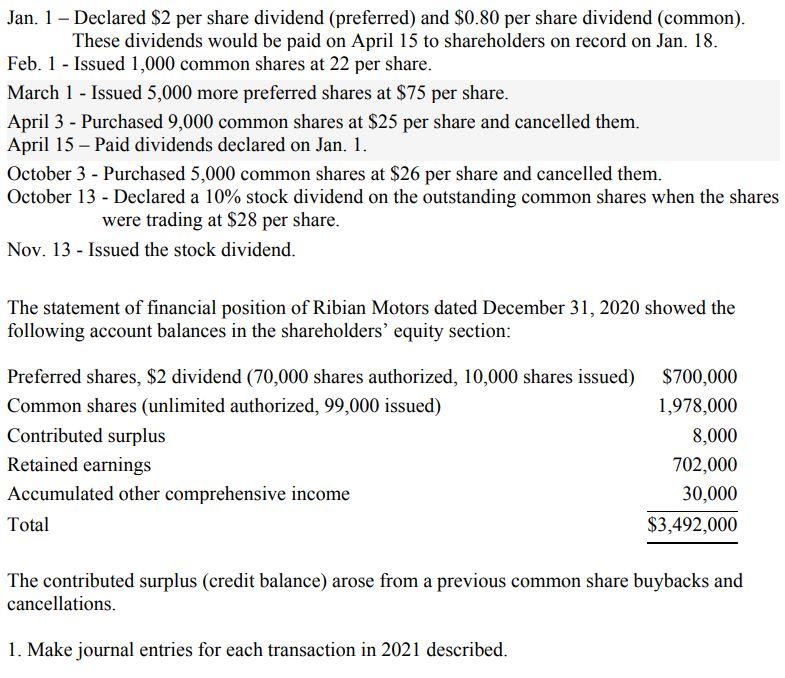

Jan. 1 - Declared $2 per share dividend (preferred) and $0.80 per share dividend (common). These dividends would be paid on April 15 to shareholders on record on Jan. 18. Feb. 1 - Issued 1,000 common shares at 22 per share. March 1 - Issued 5,000 more preferred shares at $75 per share. April 3 - Purchased 9,000 common shares at $25 per share and cancelled them. April 15 - Paid dividends declared on Jan. 1. October 3 - Purchased 5,000 common shares at $26 per share and cancelled them. October 13 - Declared a 10% stock dividend on the outstanding common shares when the shares were trading at $28 per share. Nov. 13 - Issued the stock dividend. The statement of financial position of Ribian Motors dated December 31, 2020 showed the following account balances in the shareholders' equity section: Preferred shares, $2 dividend (70,000 shares authorized, 10,000 shares issued) $700,000 Common shares (unlimited authorized, 99,000 issued) 1,978,000 Contributed surplus 8,000 Retained earnings 702,000 Accumulated other comprehensive income 30,000 Total $3,492,000 The contributed surplus (credit balance) arose from a previous common share buybacks and cancellations. 1. Make journal entries for each transaction in 2021 describedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started