Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Calendar Anomalies ( 3 points total) a) Download the adjusted closing prices for S&P 500 monthly from 12/1927 to most recent. Compute monthly returns

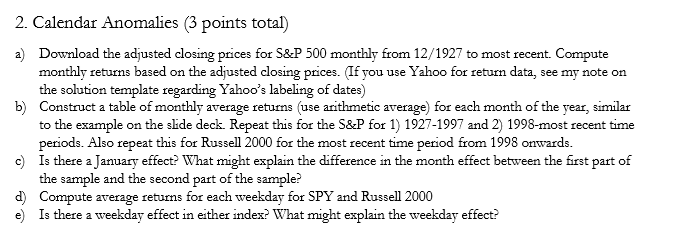

2. Calendar Anomalies ( 3 points total) a) Download the adjusted closing prices for S\&P 500 monthly from 12/1927 to most recent. Compute monthly returns based on the adjusted closing prices. (If you use Yahoo for return data, see my note on the solution template regarding Yahoo's labeling of dates) b) Construct a table of monthly average returns (use arithmetic average) for each month of the year, similar to the example on the slide deck. Repeat this for the S\&P for 1) 1927-1997 and 2) 1998-most recent time periods. Also repeat this for Russell 2000 for the most recent time period from 1998 onwards. c) Is there a January effect? What might explain the difference in the month effect between the first part of the sample and the second part of the sample? d) Compute average returns for each weekday for SPY and Russell 2000 e) Is there a weekday effect in either index? What might explain the weekday effect

2. Calendar Anomalies ( 3 points total) a) Download the adjusted closing prices for S\&P 500 monthly from 12/1927 to most recent. Compute monthly returns based on the adjusted closing prices. (If you use Yahoo for return data, see my note on the solution template regarding Yahoo's labeling of dates) b) Construct a table of monthly average returns (use arithmetic average) for each month of the year, similar to the example on the slide deck. Repeat this for the S\&P for 1) 1927-1997 and 2) 1998-most recent time periods. Also repeat this for Russell 2000 for the most recent time period from 1998 onwards. c) Is there a January effect? What might explain the difference in the month effect between the first part of the sample and the second part of the sample? d) Compute average returns for each weekday for SPY and Russell 2000 e) Is there a weekday effect in either index? What might explain the weekday effect Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started