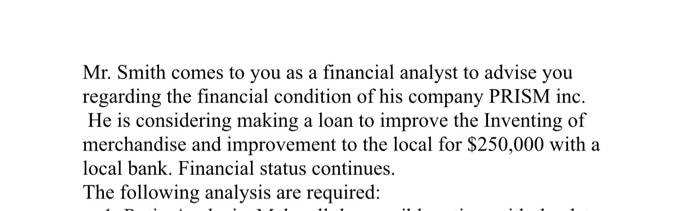

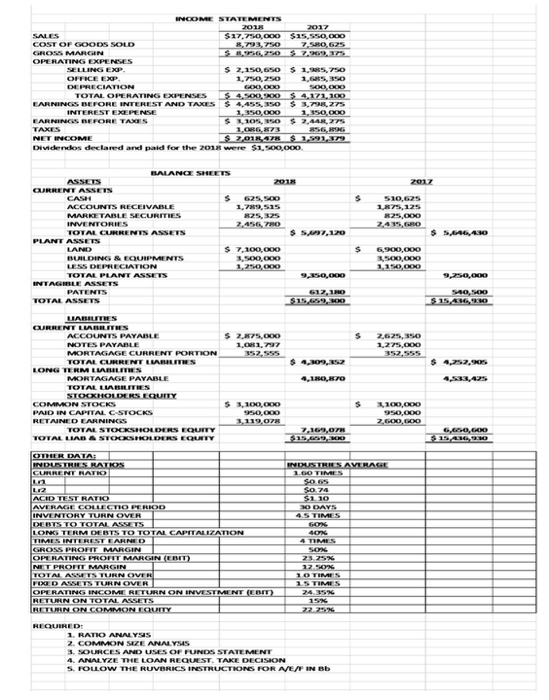

2. Common Size Analysis: Express the elements and accounts of the financial statements in percentage terms. Present the results for both years and for the statements for both the Income Statement and the Balance Sheet. Use at least four decimal places to convert them to%. Mr. Smith comes to you as a financial analyst to advise you regarding the financial condition of his company PRISM inc. He is considering making a loan to improve the Inventing of merchandise and improvement to the local for $250,000 with a local bank. Financial status continues. The following analysis are required: SALES COST OF CONOOS SOLD COV MARCIN $17.750,000 8. 750 $15.550.000 2,150,650 1,750,250 VELLING EP OFFRE EXP CHEFRECIATION TOTAL OPERATING EXPENSES EARNINGS BEFORE INTEREST AND TAJES INTEREST EXPENSE ARUS BEFORE TAXES S 4.500.000 $4,455,150 1.350.000 $ 1.995,750 1.RS, SO SOB,000 $4,171,100 $ 3, 275 1,350,000 $ 3.AAR 27 S0R S11 NET INCOME Dividendos declared and paid for the 2018 were $1,500,000 BALANCE SHEETS ASSETS CALE 625.500 1.79.as ACCOUNTS RECEIVABLE MARKETABLE SECURITIES INVENTORIES TOTAL CURRENTS ASSETS ASSES 1875,125 R . NO 7.41, 2,456, ZRO LAND COND $ 7,100.000 3.500.000 1,250,000 1,150,OCO 9, ,DO 9. R BULDING EQUIPMENTS LESS DEPRECIATION TOTAL PLANT ASSETS INTAGILE ASSETS PATENTS TOTAL ASSETS OKO 190, VED 612,1 $15,699,00 $ 2,675.000 1,081,737 2,62,50 1,275,00 4,292, KY LARRETES CURRENT LABRITES ACCOUNTS PAYABLE NOTES PAYABLE MORTAGAGE CURRENT PORTION TOTAL CURRENT FLATS TERM LIABILITRES MORTALIACE PAYABLE TOTAL LASHES STOCKHOLDERS EQUITY COMMON STOCKS PAID IN CAPITAL C-STOCKS RETAINED EARNINGS TOTAL STOCKHOLDERS EQUITY TOTAL LIAB ANTONOXIKOLDERS EQUIY 4,180,TO 4. $1,100,000 950.000 1.100, 950.00 2.GOD, GOD 7.16 . OTHER DATA INDUSTRIES RATKOS INDUSTRIES AVERAGE CONNENINAR ACID TEST RATIO AVERAGE CONECTOR INVENTORY TURN OVER DBTS TO TOTAL ASSETS LONTERM DEBTS TO TOTAL CAPITALIZATION TIMES INTEREST EARNED CROSS PROFIT MARGIN OPERATING PROFIT MARGINEBIT) NET PROFITMARGIN TOTAI AWTS TURNOVER FOED AWEUS TURNOVER OPERATING INCOME RETURN ON INVEST RETURN ON TOTAL ASSETS EUROCOMMONITORUL REQUIRED 1. RATKO ANALYSIS 2. COMMON ME ANALYSIS 1. SOURCES AND USES OF FUNES STATEMENT 4. ANALYZE THE LOAN REQUEST. TAKE DECISION S. FOLLOW THE RUBRICS INSTRUKTONGS FOR NEA IN Bb