Answered step by step

Verified Expert Solution

Question

1 Approved Answer

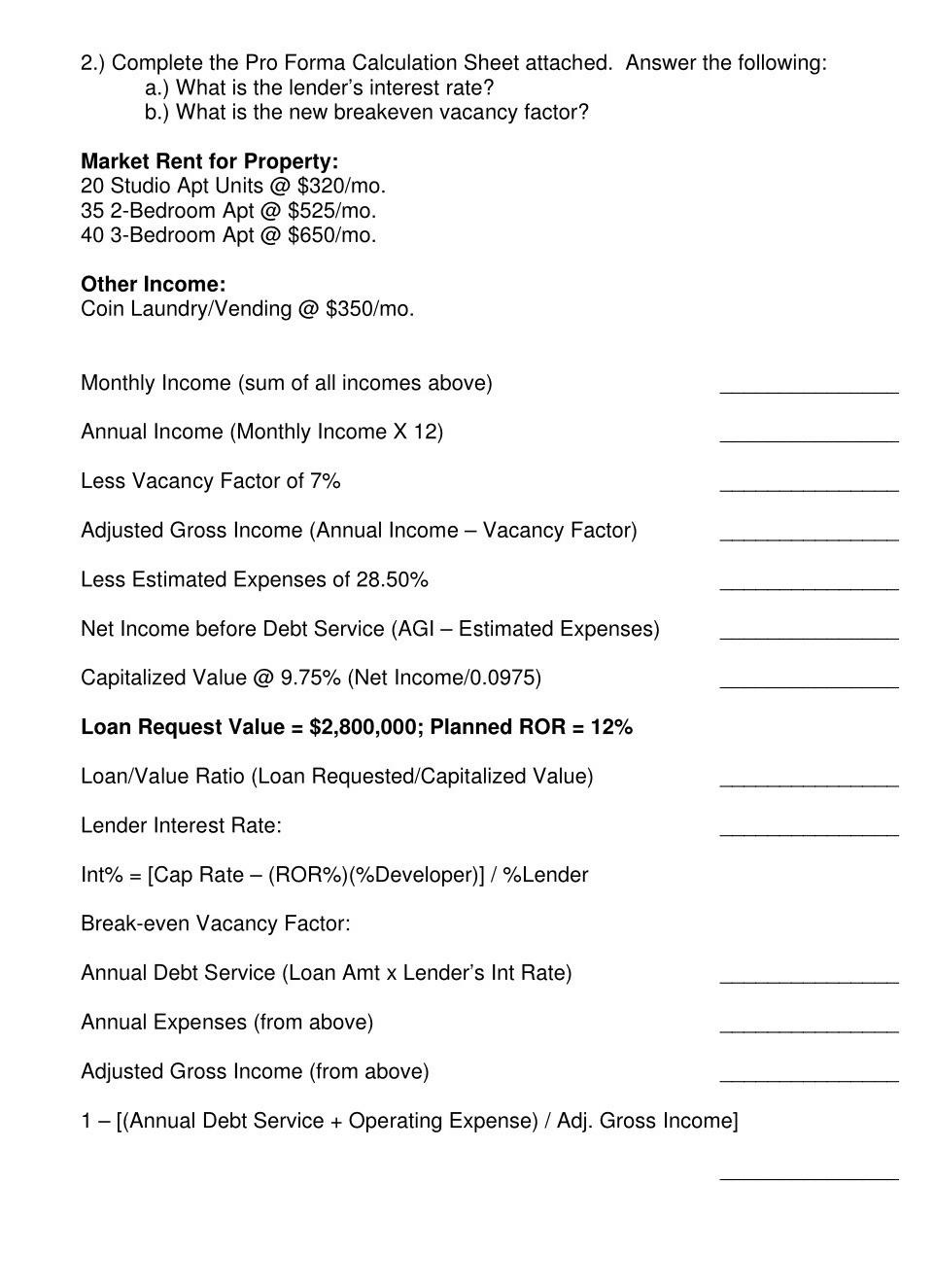

2.) Complete the Pro Forma Calculation Sheet attached. Answer the following: a.) What is the lender's interest rate? b.) What is the new breakeven

2.) Complete the Pro Forma Calculation Sheet attached. Answer the following: a.) What is the lender's interest rate? b.) What is the new breakeven vacancy factor? Market Rent for Property: 20 Studio Apt Units @ $320/mo. 35 2-Bedroom Apt @ $525/mo. 40 3-Bedroom Apt @ $650/mo. Other Income: Coin Laundry/Vending @ $350/mo. Monthly Income (sum of all incomes above) Annual Income (Monthly Income X 12) Less Vacancy Factor of 7% Adjusted Gross Income (Annual Income - Vacancy Factor) Less Estimated Expenses of 28.50% Net Income before Debt Service (AGI - Estimated Expenses) Capitalized Value @ 9.75% (Net Income/0.0975) Loan Request Value = $2,800,000; Planned ROR = 12% Loan/Value Ratio (Loan Requested/Capitalized Value) Lender Interest Rate: Int%[Cap Rate - (ROR%) (%Developer)] / %Lender Break-even Vacancy Factor: Annual Debt Service (Loan Amt x Lender's Int Rate) Annual Expenses (from above) Adjusted Gross Income (from above) 1-[(Annual Debt Service + Operating Expense) / Adj. Gross Income]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started