Question

2. Consider a one-period model with 2 states and 3 assets: a bank account and two stocks. Assume that the bond sells for $1 at

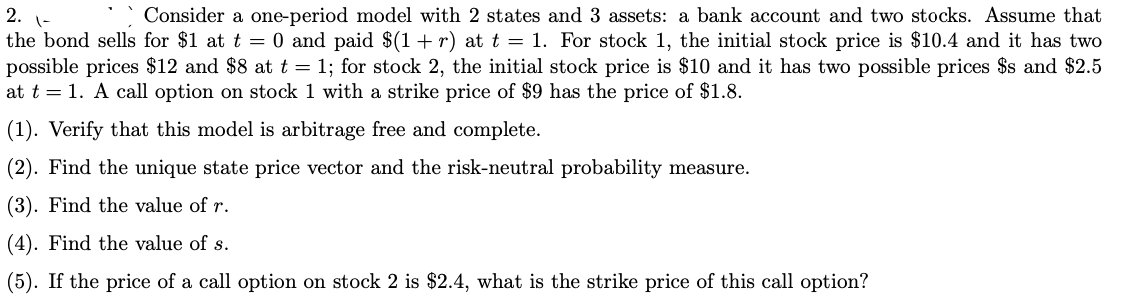

2. Consider a one-period model with 2 states and 3 assets: a bank account and two stocks. Assume that the bond sells for $1 at t = 0 and paid $(1+r) at t = 1. For stock 1, the initial stock price is $10.4 and it has two possible prices $12 and $8 at t = 1; for stock 2, the initial stock price is $10 and it has two possible prices $s and $2.5 at t = 1. A call option on stock 1 with a strike price of $9 has the price of $1.8.

(a). Verify that this model is arbitrage free and complete. (b). Find the unique state price vector and the risk-neutral probability measure. (c). Find the value of r. (d). Find the value of s. (e). If the price of a call option on stock 2 is $2.4, what is the strike price of this call option?

Please answer ASAP with full solutions and explanations!!

2. 1 Consider a one-period model with 2 states and 3 assets: a bank account and two stocks. Assume that the bond sells for $1 at t=0 and paid $(1+r) at t=1. For stock 1 , the initial stock price is $10.4 and it has two possible prices $12 and $8 at t=1; for stock 2 , the initial stock price is $10 and it has two possible prices $ s and $2.5 at t=1. A call option on stock 1 with a strike price of $9 has the price of $1.8. (1). Verify that this model is arbitrage free and complete. (2). Find the unique state price vector and the risk-neutral probability measure. (3). Find the value of r. (4). Find the value of s. (5). If the price of a call option on stock 2 is $2.4, what is the strike price of this call option? 2. 1 Consider a one-period model with 2 states and 3 assets: a bank account and two stocks. Assume that the bond sells for $1 at t=0 and paid $(1+r) at t=1. For stock 1 , the initial stock price is $10.4 and it has two possible prices $12 and $8 at t=1; for stock 2 , the initial stock price is $10 and it has two possible prices $ s and $2.5 at t=1. A call option on stock 1 with a strike price of $9 has the price of $1.8. (1). Verify that this model is arbitrage free and complete. (2). Find the unique state price vector and the risk-neutral probability measure. (3). Find the value of r. (4). Find the value of s. (5). If the price of a call option on stock 2 is $2.4, what is the strike price of this call optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started