Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. continued 3 The net present value (NPV) method estimates how much a potential project will contribute to -Select- , and it is the best

2.

continued

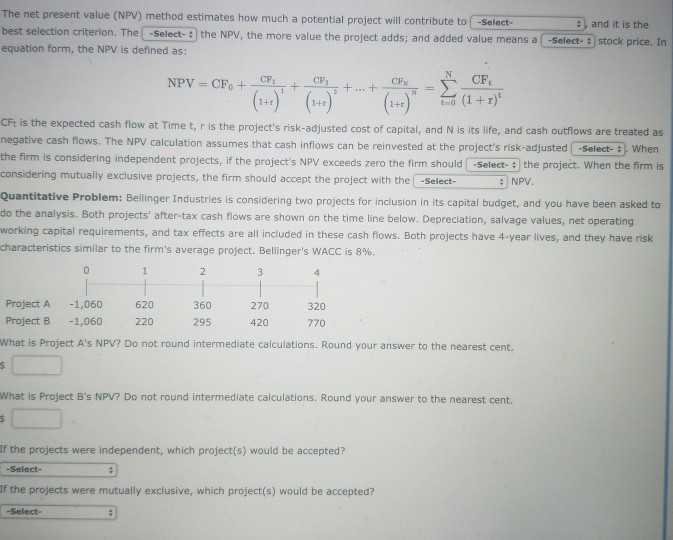

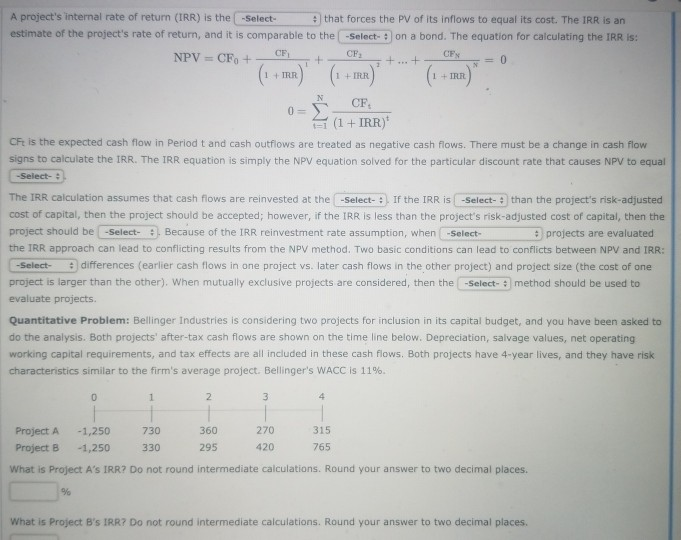

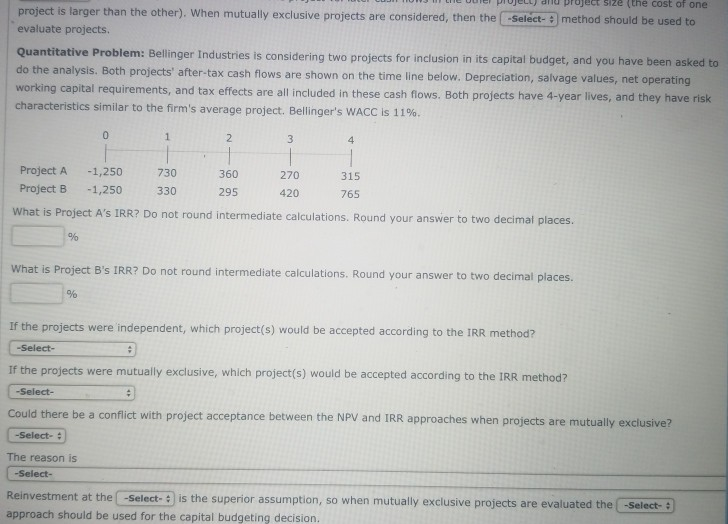

3

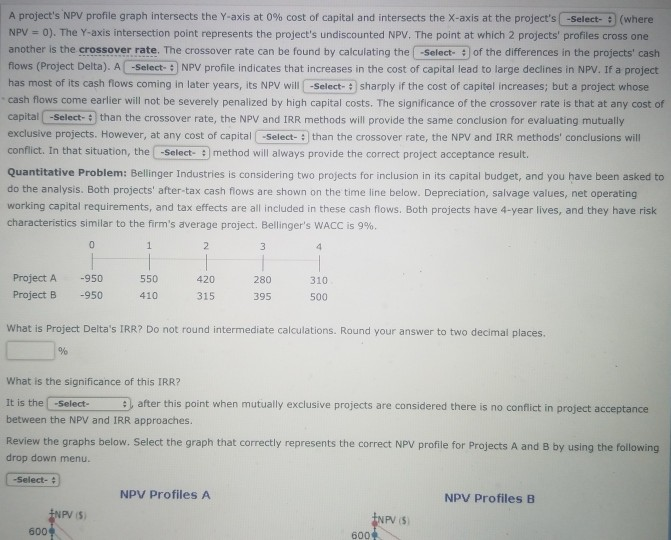

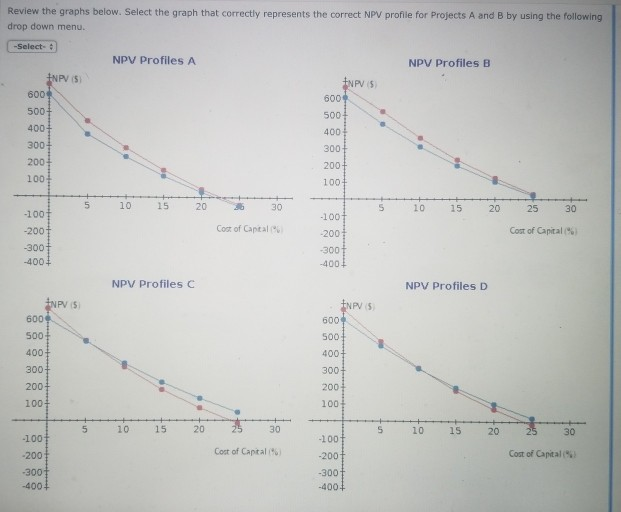

The net present value (NPV) method estimates how much a potential project will contribute to -Select- , and it is the best selection criterion. The Select the NPV, the more value the project adds; and added value means a -Select- stock price. In equation form, the NPV is defined as: NPV = CF + CPA + CP2 + + CPx_s CF CFt is the expected cash flow at Timet, r is the project's risk-adjusted cost of capital, and N is its life, and cash outflows are treated as negative cash flows. The NPV calculation assumes that cash inflows can be reinvested at the project's risk-adjusted -Select- :. When the firm is considering independent projects, if the project's NPV exceeds zero the firm should Select the project. When the firm is considering mutually exclusive projects, the firm should accept the project with the -Select- NPV. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 8%. 0 34 Project A -1,060 620 360 270 320 Project B -1,060 220 295 420 770 What is Project A's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. What is Project B's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. f the projects were independent, which project(s) would be accepted? -Select- f the projects were mutually exclusive, which project(s) would be accepted? -Select- A project's internal rate of return (IRR) is the Select that forces the PV of its inflows to equal its cost. The IRR is an estimate of the project's rate of return, and it is comparable to the -Select- : on a bond. The equation for calculating the IRR IS: NPV = CF, + CF CP: 0 (1 + m2) (1 + rrr) (1 + inn)" CF, 0- 1 (1 + IRR)' CF is the expected cash flow in Period t and cash outflows are treated as negative cash flows. There must be a change in cash flow signs to calculate the IRR. The IRR equation is simply the NPV equation solved for the particular discount rate that causes NPV to equal -Select- The IRR calculation assumes that cash flows are reinvested at the -Select- : If the IRR is -Select- than the project's risk-adjusted cost of capital, then the project should be accepted; however, if the IRR is less than the project's risk-adjusted cost of capital, then the project should be -Select- . Because of the IRR reinvestment rate assumption, when -Select projects are evaluated the TRR approach can lead to conflicting results from the NPV method. Two basic conditions can lead to conflicts between NPV and IRR: -Select- differences (earlier cash flows in one project vs. later cash flows in the other project) and project size (the cost of one project is larger than the other). When mutually exclusive projects are considered, then the Select method should be used to evaluate projects Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 11% Project A -1,250 730 360 270 315 Project B 1,250 330 295 420 765 What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. project is larger than the other). When mutually exclusive projects are considered, then the -Select-method should be used to evaluate projects. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 11%. 2 3 Project A -1,250 730 360 270 315 Project B -1,250 295 420 What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. 330 765 What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? -Select- If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? -Select- Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? -Select- The reason is -Select- Reinvestment at the -Select- is the superior assumption, so when mutually exclusive projects are evaluated the -Select- approach should be used for the capital budgeting decision. A project's NPV profile graph intersects the Y-axis at 0% cost of capital and intersects the X-axis at the project's -Select- (where NPV = 0). The Y-axis intersection point represents the project's undiscounted NPV. The point at which 2 projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the -Select- of the differences in the projects' cash flows (Project Delta). A -Select- NPV profile indicates that increases in the cost of capital lead to large declines in NPV. If a project has most of its cash flows coming in later years, its NPV will -Select- sharply if the cost of capital increases; but a project whose cash flows come earlier will not be severely penalized by high capital costs. The significance of the crossover rate is that at any cost of capital -Select- than the crossover rate, the NPV and IRR methods will provide the same conclusion for evaluating mutually exclusive projects. However, at any cost of capital -Select- than the crossover rate, the NPV and IRR methods' conclusions will conflict. In that situation, the -Select- method will always provide the correct project acceptance result. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%. 0 2 Project A Project B -950 -950 550 410 420 315 280 395 310 500 What is Project Delta's IRR? Do not round intermediate calculations. Round your answer to two decimal places. What is the significance of this IRR? It is the -Select after this point when mutually exclusive projects are considered there is no conflict in project acceptance between the NPV and IRR approaches. Review the graphs below. Select the graph that correctly represents the correct NPV profile for Projects A and B by using the following drop down menu. -Select- NPV Profiles A NPV Profiles B NPV 5 INPV (5) 600 6000 Review the graphs below. Select the graph that correctly represents the correct NPV profile for Projects A and B by using the following drop down menu. -Select- NPV Profiles A NPV Profiles B INPV INPV 5 600 600 500+ 500+ 4001 400 3001 3001 2001 200+ 100+ 1007 5 10 15 20 25 30 5 10 15 20 25 30 -1001 -1007 -2007 Cost of Captal -2007 Cost of Capital -3007 -3007 -4001 -4001 NPV Profiles C NPV Profiles D NPV 5 NPV 5 600 500 500+ 4001 300+ 2007 1001 5 10 15 20 30 -1001 -1001 -2007 Cost of Capital -2007 Cost of Capital -3001 -3001 -4001 -4001 5001 400+ 1001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started