Answered step by step

Verified Expert Solution

Question

1 Approved Answer

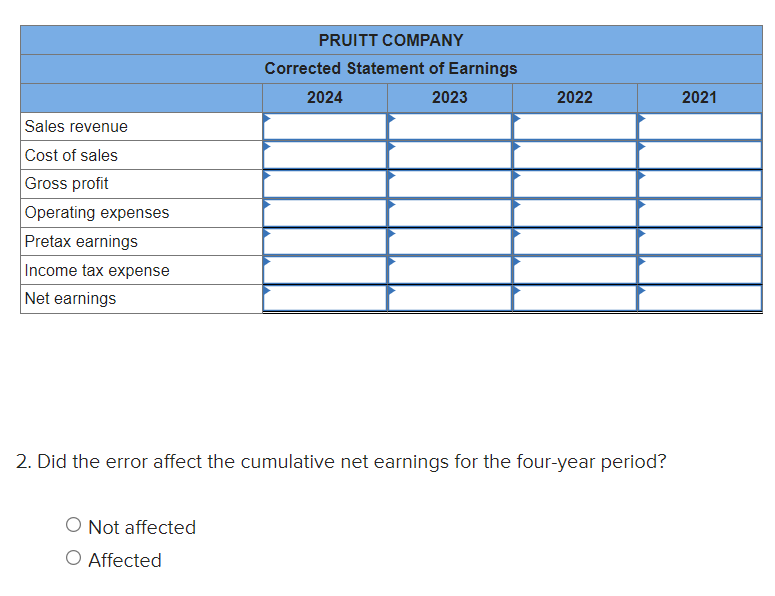

2. Did the error affect the cumulative net earnings for the four-year period? Not affected Affected Neverstop Corporation sells item A as part of its

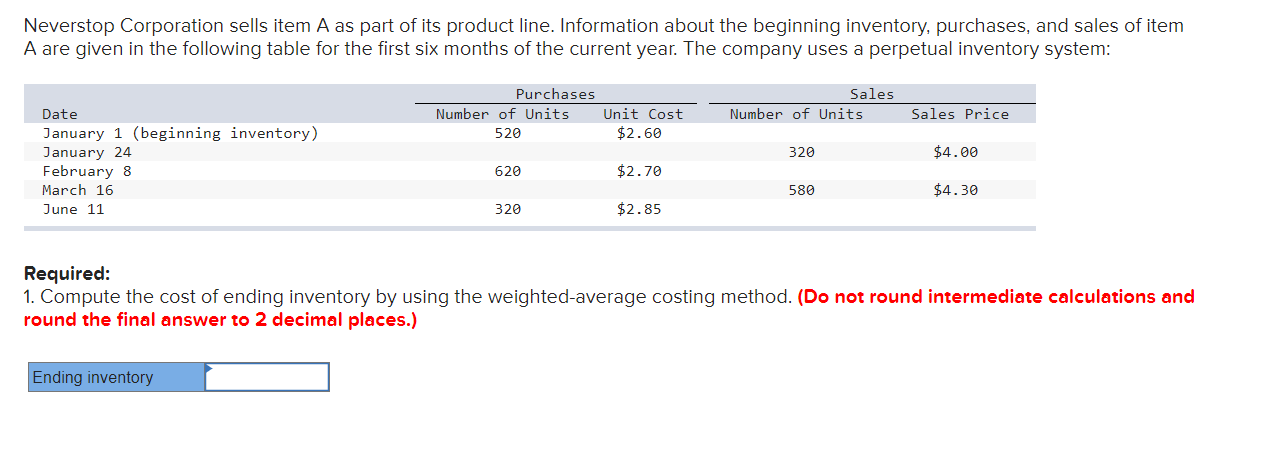

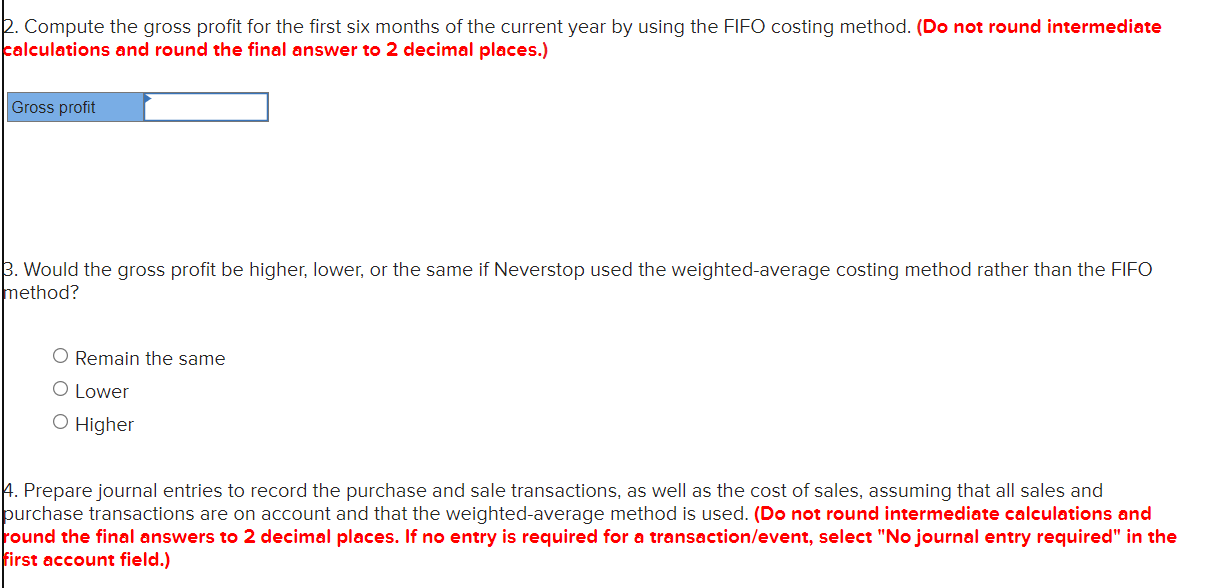

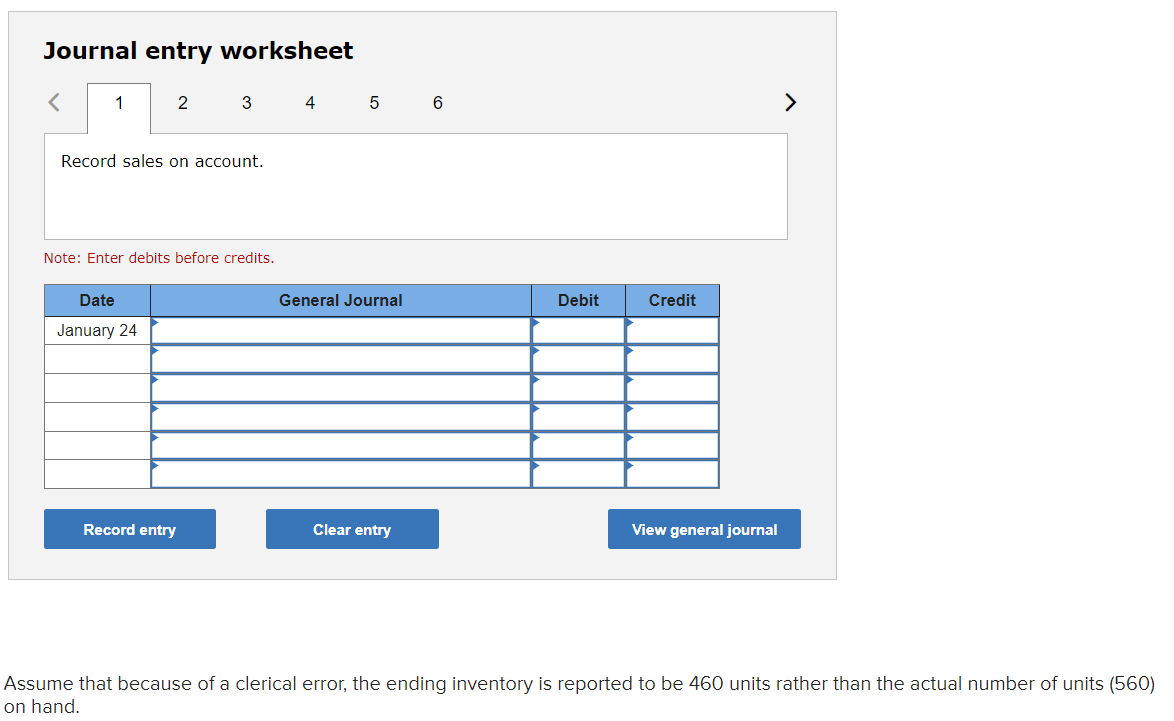

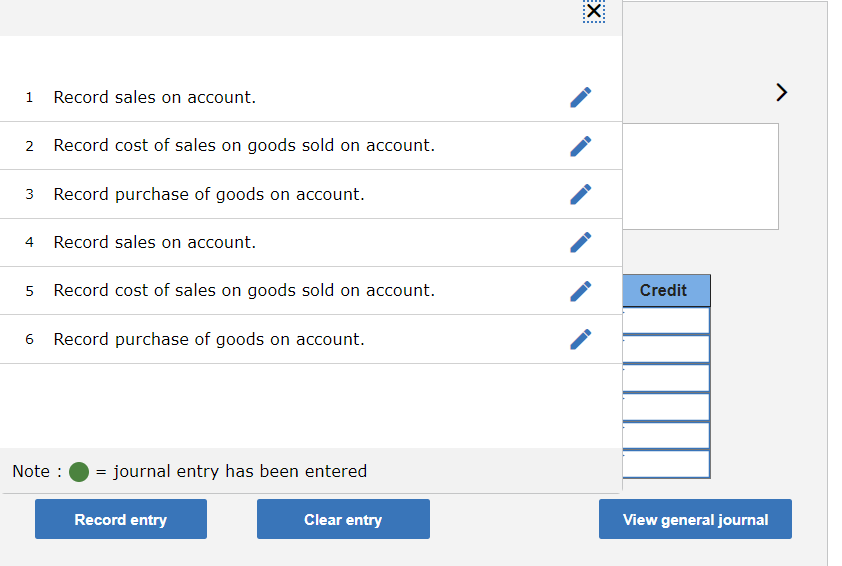

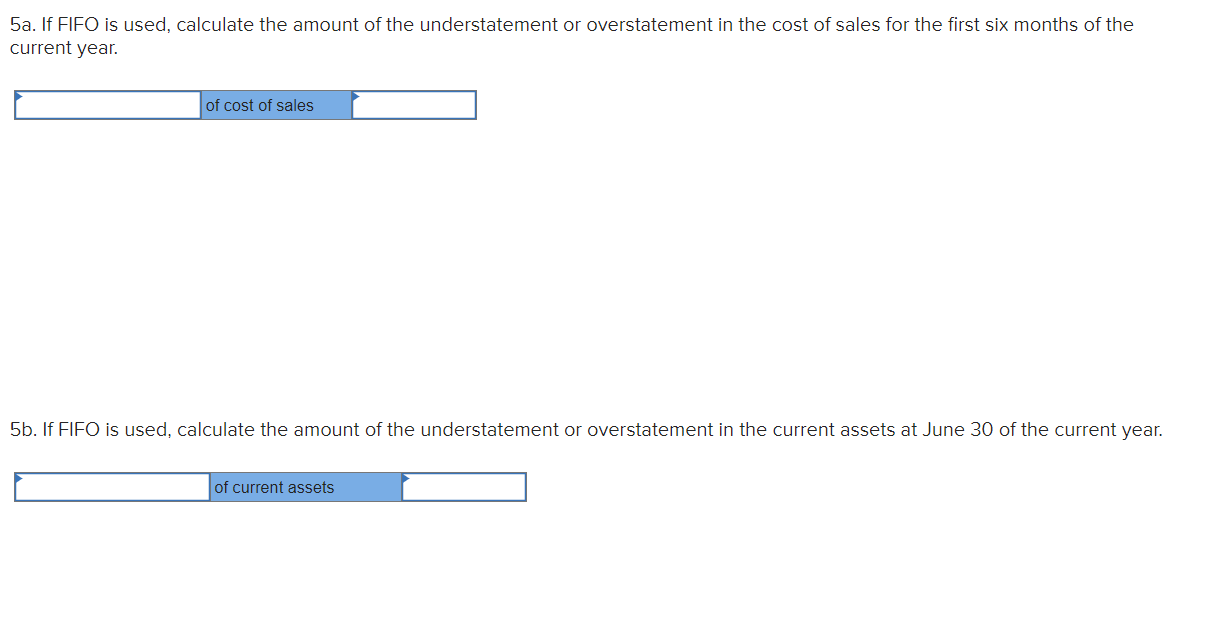

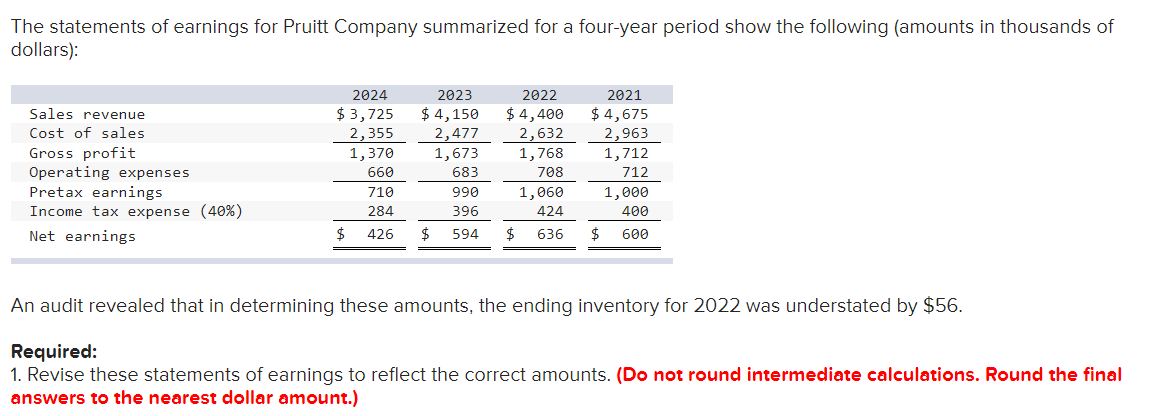

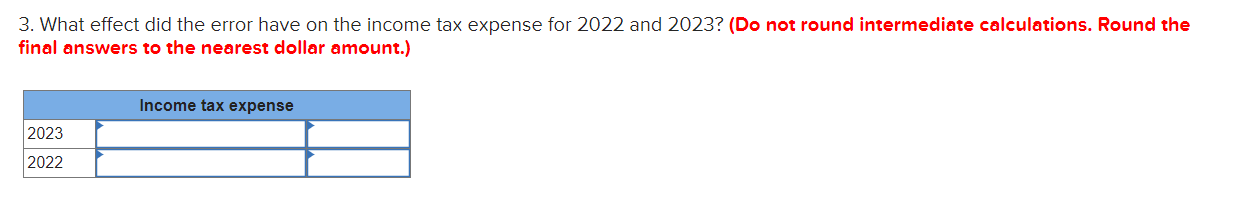

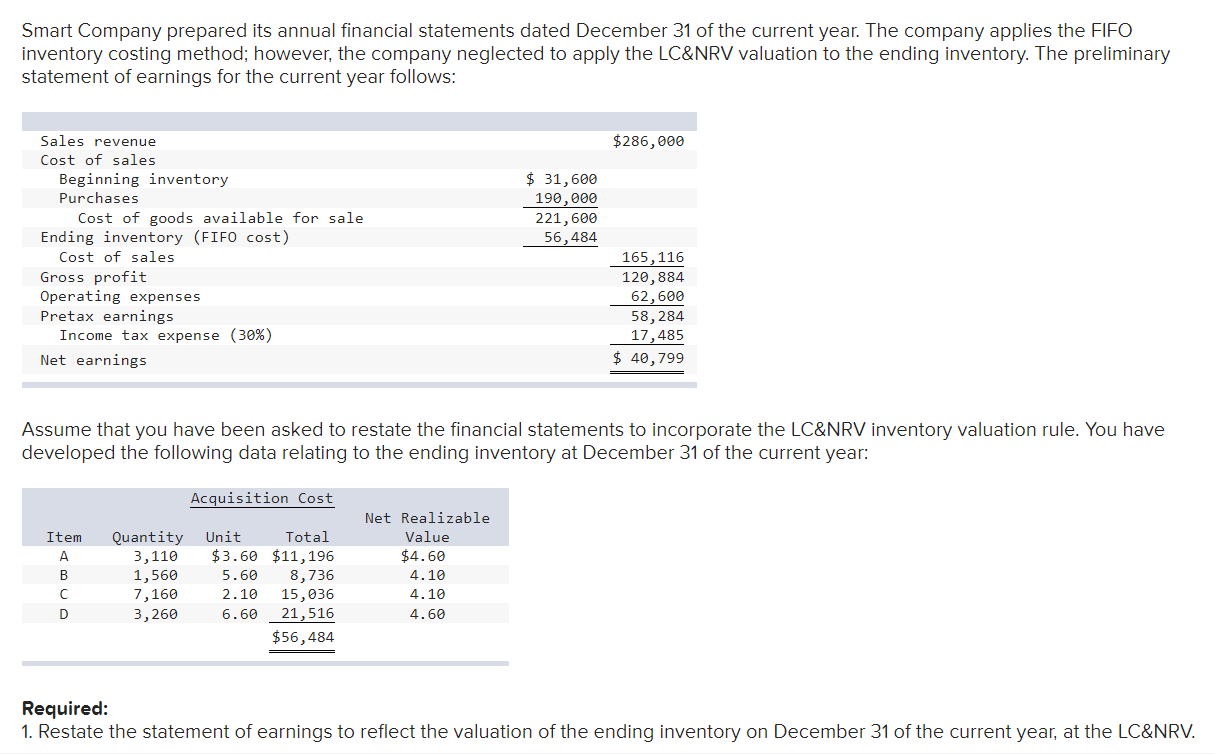

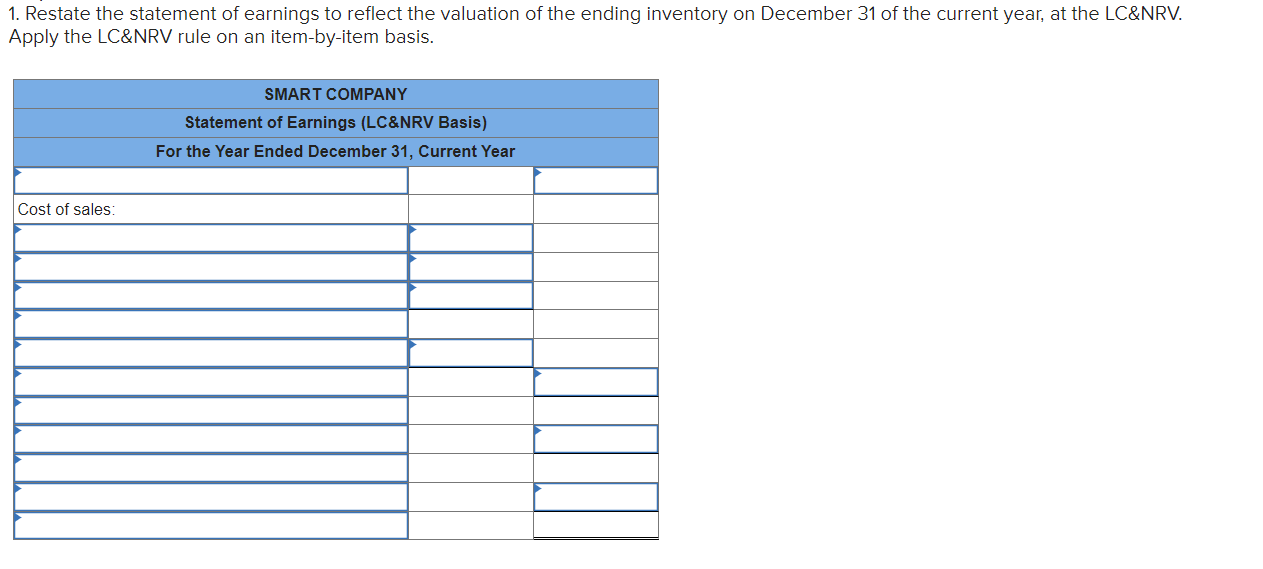

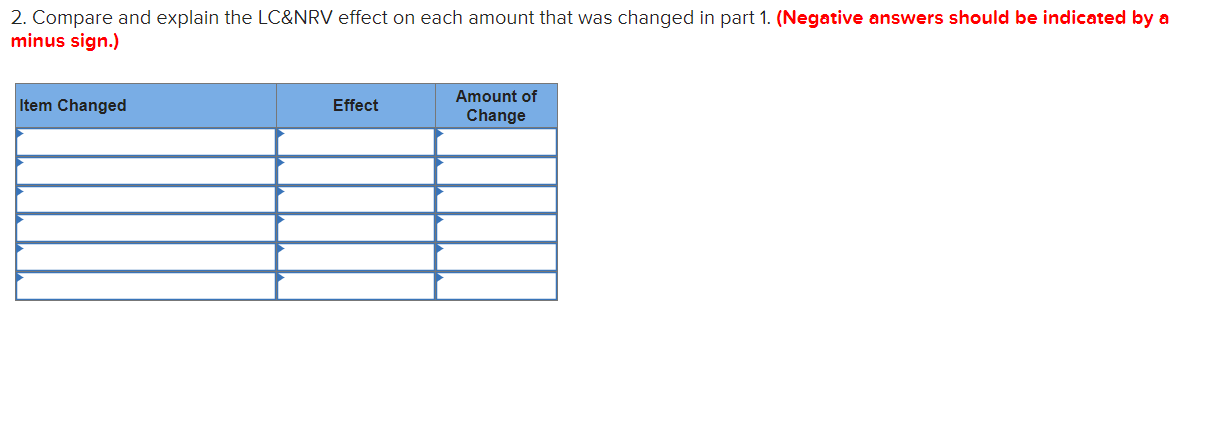

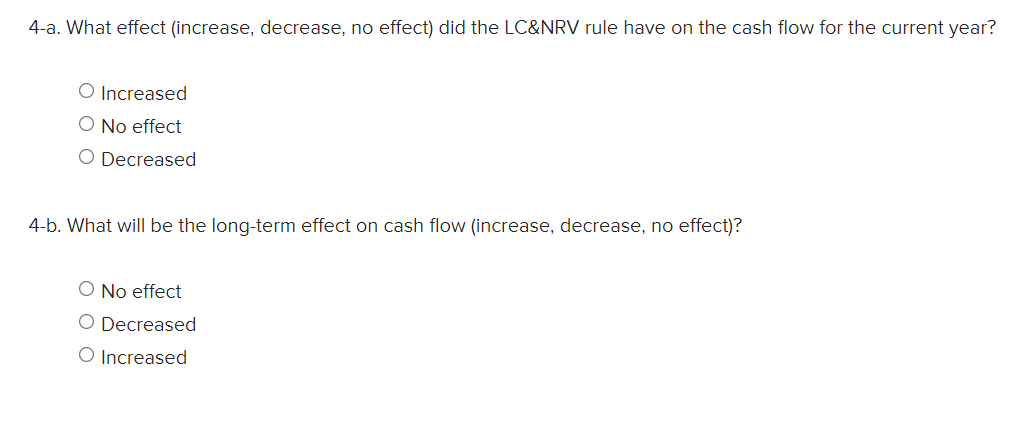

2. Did the error affect the cumulative net earnings for the four-year period? Not affected Affected Neverstop Corporation sells item A as part of its product line. Information about the beginning inventory, purchases, and sales of item A are given in the following table for the first six months of the current year. The company uses a perpetual inventory system: Required: 1. Compute the cost of ending inventory by using the weighted-average costing method. (Do not round intermediate calculations and round the final answer to 2 decimal places.) Journal entry worksheet Note: Enter debits before credits. Assume that because of a clerical error, the ending inventory is reported to be 460 units rather than the actual number of units (560) on hand. 2. Compare and explain the LC\&NRV effect on each amount that was changed in part 1. (Negative answers should be indicated by a minus sign.) 4-a. What effect (increase, decrease, no effect) did the LC\&NRV rule have on the cash flow for the current year? Increased No effect Decreased 4-b. What will be the long-term effect on cash flow (increase, decrease, no effect)? No effect Decreased Increased Smart Company prepared its annual financial statements dated December 31 of the current year. The company applies the FIFO inventory costing method; however, the company neglected to apply the LC\&NRV valuation to the ending inventory. The preliminary statement of earnings for the current year follows: Assume that you have been asked to restate the financial statements to incorporate the LC\&NRV inventory valuation rule. You have developed the following data relating to the ending inventory at December 31 of the current year: Required: 1. Restate the statement of earnings to reflect the valuation of the ending inventory on December 31 of the current year, at the LC\&NRV. 1. Restate the statement of earnings to reflect the valuation of the ending inventory on December 31 of the current year, at the LC\&NRV. Apply the LC\&NRV rule on an item-by-item basis. 3. What effect did the error have on the income tax expense for 2022 and 2023 ? (Do not round intermediate calculations. Round the final answers to the nearest dollar amount.) 5a. If FIFO is used, calculate the amount of the understatement or overstatement in the cost of sales for the first six months of the current year. 5b. If FIFO is used, calculate the amount of the understatement or overstatement in the current assets at June 30 of the current year. 2. Compute the gross profit for the first six months of the current year by using the FIFO costing method. (Do not round intermediate :alculations and round the final answer to 2 decimal places.) Would the gross profit be higher, lower, or the same if Neverstop used the weighted-average costing method rather than the FIFO method? Remain the same Lower Higher H. Prepare journal entries to record the purchase and sale transactions, as well as the cost of sales, assuming that all sales and ourchase transactions are on account and that the weighted-average method is used. (Do not round intermediate calculations and ound the final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the irst account field.) The statements of earnings for Pruitt Company summarized for a four-year period show the following (amounts in thousands of dollars): An audit revealed that in determining these amounts, the ending inventory for 2022 was understated by $56. Required: 1. Revise these statements of earnings to reflect the correct amounts. (Do not round intermediate calculations. Round the final answers to the nearest dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started