Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. During the year, Ken sold a warehouse property for $180,000 (land - $15,000, building - $165,000). Brickbase used the building to store construction'

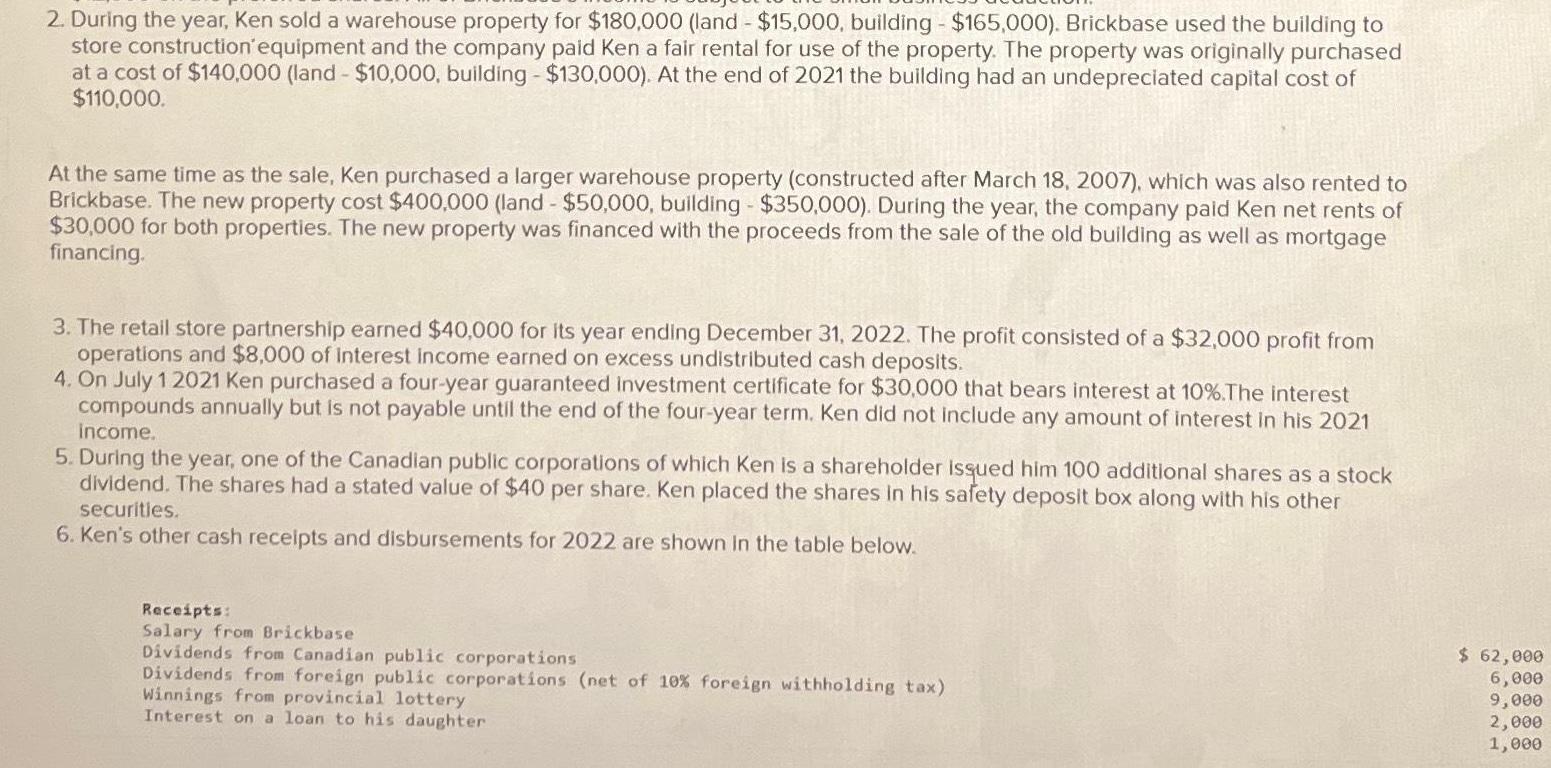

2. During the year, Ken sold a warehouse property for $180,000 (land - $15,000, building - $165,000). Brickbase used the building to store construction' equipment and the company paid Ken a fair rental for use of the property. The property was originally purchased at a cost of $140,000 (land - $10,000, building $130,000). At the end of 2021 the building had an undepreciated capital cost of $110,000. At the same time as the sale, Ken purchased a larger warehouse property (constructed after March 18, 2007), which was also rented to Brickbase. The new property cost $400,000 (land - $50,000, building $350,000). During the year, the company paid Ken net rents of $30,000 for both properties. The new property was financed with the proceeds from the sale of the old building as well as mortgage financing. 3. The retail store partnership earned $40,000 for its year ending December 31, 2022. The profit consisted of a $32,000 profit from operations and $8,000 of Interest income earned on excess undistributed cash deposits. 4. On July 1 2021 Ken purchased a four-year guaranteed investment certificate for $30,000 that bears interest at 10%. The interest compounds annually but is not payable until the end of the four-year term. Ken did not include any amount of interest in his 2021 income. 5. During the year, one of the Canadian public corporations of which Ken is a shareholder issued him 100 additional shares as a stock dividend. The shares had a stated value of $40 per share. Ken placed the shares in his safety deposit box along with his other securities. 6. Ken's other cash receipts and disbursements for 2022 are shown in the table below. Receipts: Salary from Brickbase Dividends from Canadian public corporations Dividends from foreign public corporations (net of 10% foreign withholding tax) Winnings from provincial lottery Interest on a loan to his daughter $ 62,000 6,000 9,000 2,000 1,000

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Given the detailed information on Kens financial transactions and income we need to compute his net and taxable income for 2022 along with his net federal tax savings if he lowers his taxable income b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started