Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(2) E2-34 on page 2-41 of EMSZ (2015) 15 marks in total Part (a) is worth 7 marks. If necessary, you can look up Apple

(2) E2-34 on page 2-41 of EMSZ (2015) 15 marks in total

(2) E2-34 on page 2-41 of EMSZ (2015) 15 marks in total

Part (a) is worth 7 marks. If necessary, you can look up Apple Inc and Dell Inc on wikipedia.org

Part (b) is worth 8 marks

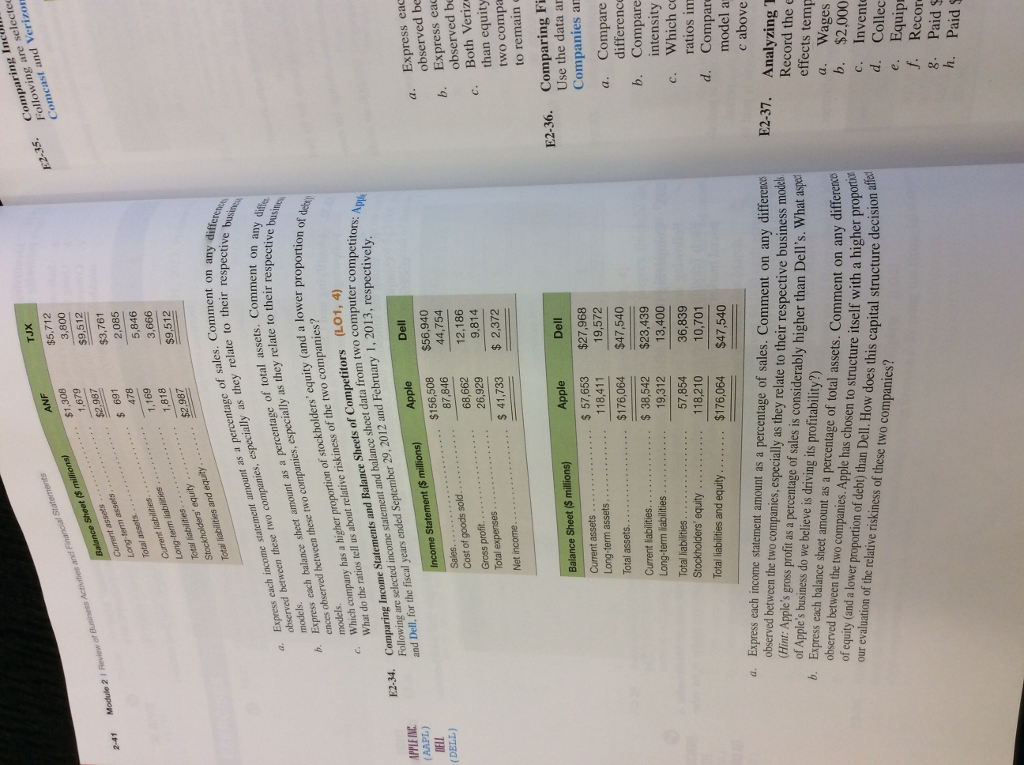

Following are selecte Comeast and Verizo 35. Comparing Ine $5,712 $9,512 987 2,085 1,818 Stockholders' equity of sales. Comment on any relate to their respective , especially as they observed between these two companies models on any diff ences observed between these two companies, especially as they relate to their models b.Express each halance sheet amount as a percentage of total assets. Comment of stockholders equity (and a low Comparing Income Statements and Balance Sheets of Competitors (L01, 4) Following are selected income statement and balance shcet data from two has a higher prop What do the ratios tell us about relative riskiness of the two companies? Ppl y 1, 2013, respectively nber 29, 2012 Dell a. Express eac observed b b. Express ea observed b c. Both Veriz than equity two compa IFLL $156,508 $56,940 87,846 68,662 12,186 26,929 Sales. Cost of goods sold.. .. 41,733 $2,372 to remain Comparing Fi Use the data an E2-36. Balance Sheet (S m $57,653 $27,968 19,572 $176,064 $47,540 38,542 $23,439 19,312 13,400 57,854 36,839 ....118,210 10,701 $176,064 $47,540 Companies a Long-term assets Total assets. Current labilities Long-term liabilities Total liabilities a. Compare differenc b. Compare intensity c. Which co ratios im d. Compar Total liabilities and equity a. Express each income statement amount as a percentage of sales. Comment on any di observed between the two companies, especially as they relate to their respective business m Hint: Apple's gross profit as a percentage of sales is considerably higher than Dell's. What ase. of Apple's business do we believe is driving its profitability?) fferenc E2-37. Analyzing1 b. Express each Record the balance sheet amount as a percentage of total assets. Comment on any di observed between the two companies. Apple has chosen to structure itself with a higher proj of equity (and a lower proportion of debt) than Dell.How does this capital structure decison our evaluation of the relative riskiness of these two companies? effects temp b. $2,000 c. Invent decision afleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started