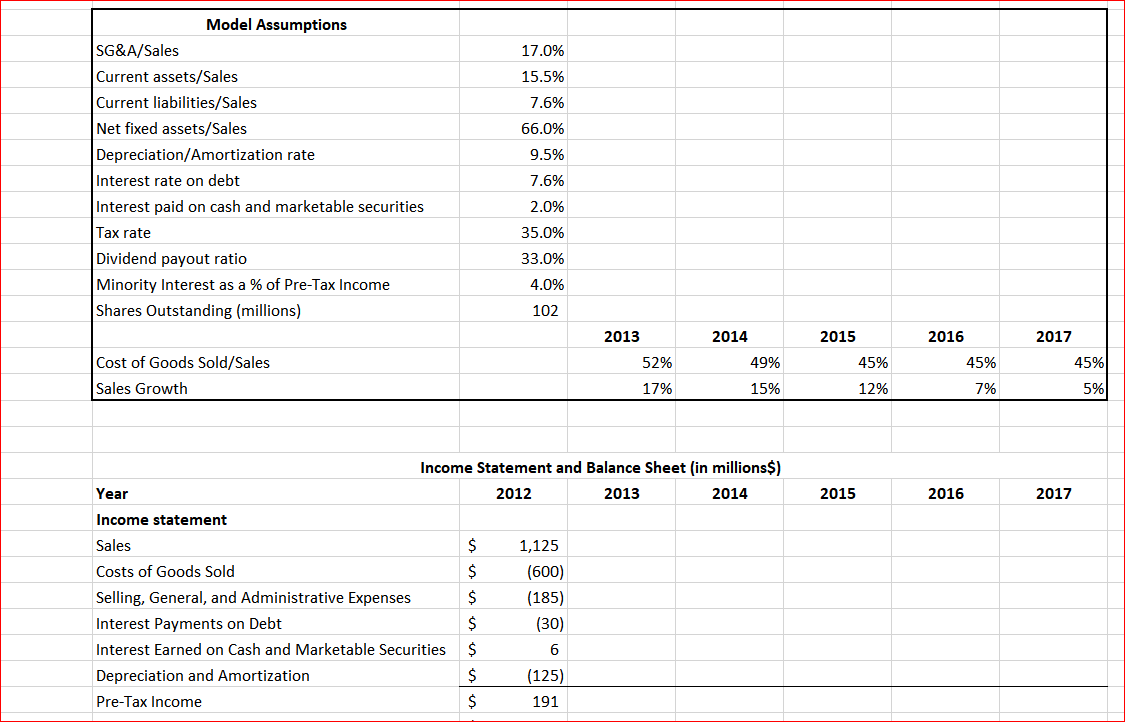

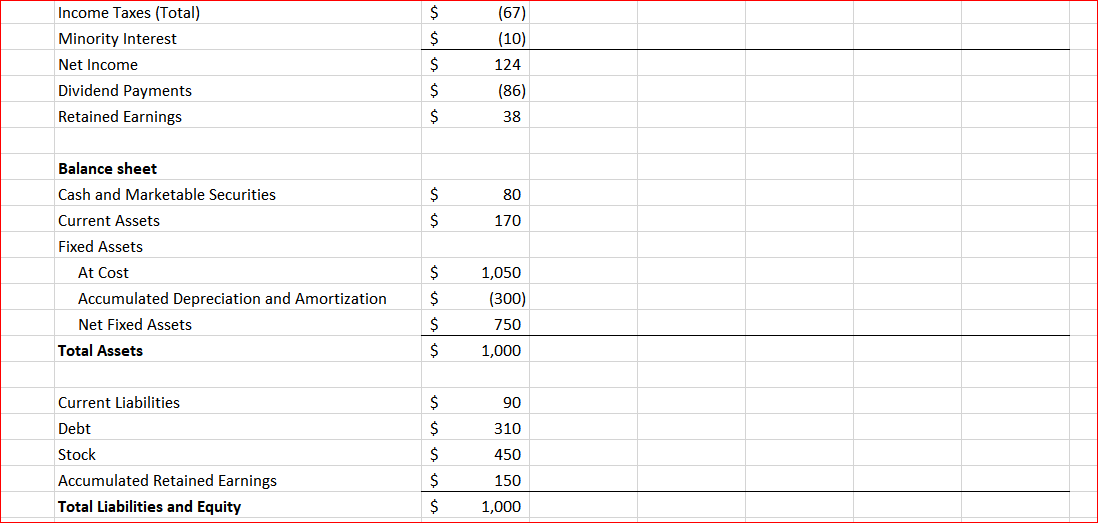

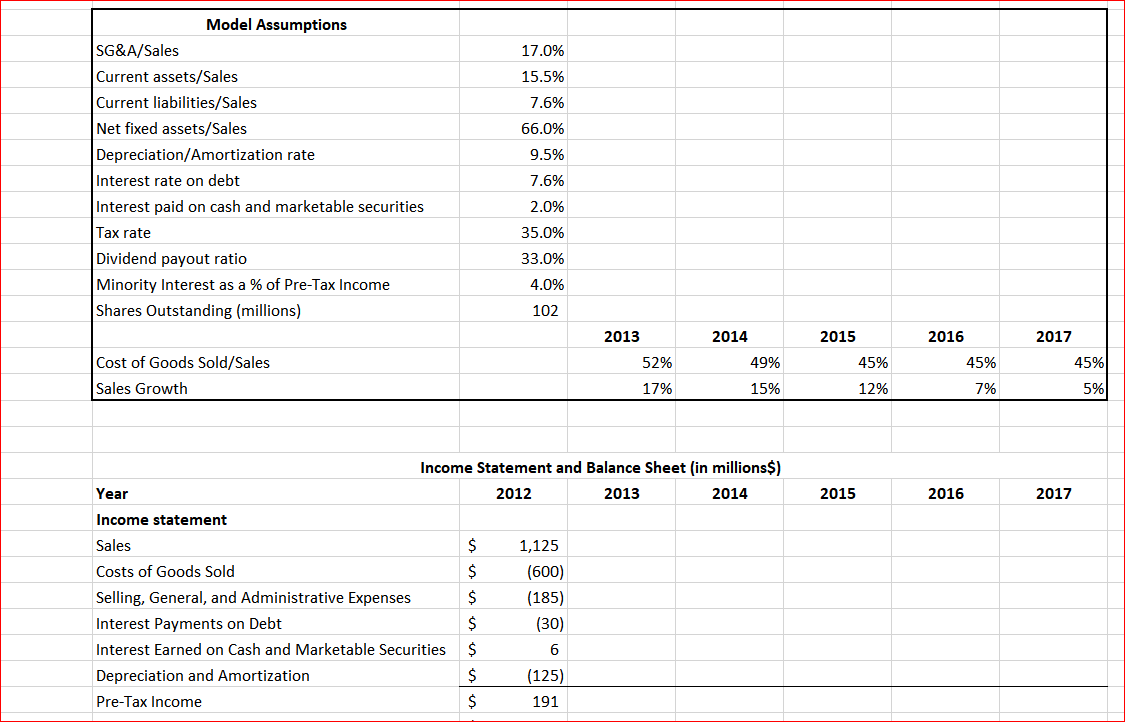

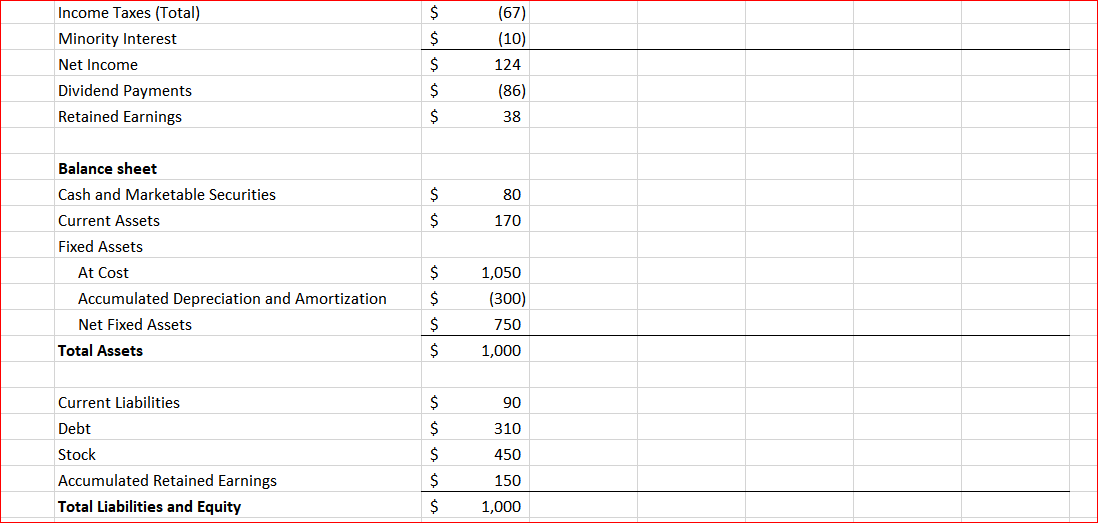

2) Finish the financial statements below. Remember, assets should equal liabilities plus equities each year! Hint: You are going to want to subtract minority interest from pretax income in order to get net income. Minority interest is the share of the profit belonging to minorty shareholders (see an accounting text for more). B) Complete the Earnings-to-Free-Cash-Flow Table below. B) Use the cost of financing information given to find the firm's WACC. 4) Assuming a long-run growth rate of free-cash flow of 4%, what is this firm's enterprise value today? 5) We are going to use the enterprise value (EV) of the firm that you just calculated to value just the equity piece. Take a look at Section 7.9 of the text for how to do this. You are going to need to add something to the EV and subtract something. These items go in cells K66 and K67, with the corresponding values in L66 and L67. Put your answer for the equity value of the firm in cell L68. Note that this is the total equity value of the firm, not the per share price. Put your estimate for the per share price in 067. 17.0% 15.5% 7.6% 66.0% Model Assumptions SG&A/Sales Current assets/Sales Current liabilities/Sales Net fixed assets/Sales Depreciation/Amortization rate Interest rate on debt Interest paid on cash and marketable securities Tax rate Dividend payout ratio Minority Interest as a % of Pre-Tax Income Shares Outstanding (millions) 9.5% 7.6% 2.0% 35.0% 33.0% 4.0% 102 2013 2014 2015 2016 45% 52% 49% 45% Cost of Goods Sold/Sales Sales Growth 2017 45%) 5% 17% 15% 12% 7% Income Statement and Balance Sheet (in millionss) 2012 2013 2014 Year 2015 2016 2017 Income statement $ $ $ Sales Costs of Goods Sold Selling, General, and Administrative Expenses Interest Payments on Debt Interest Earned on Cash and Marketable Securities Depreciation and Amortization Pre-Tax Income 1,125 (600) (185) (30) 6 (125) $ $ $ $ 191 $ $ Income Taxes (Total) Minority Interest Net Income Dividend Payments Retained Earnings (67) (10) 124 $ $ (86) 38 $ Balance sheet Cash and Marketable Securities $ 80 Current Assets $ 170 Fixed Assets At Cost Accumulated Depreciation and Amortization Net Fixed Assets Total Assets $ $ 1,050 (300) 750 1,000 $ $ Current Liabilities $ 90 $ 310 $ 450 Debt Stock Accumulated Retained Earnings Total Liabilities and Equity 150 $ $ 1,000