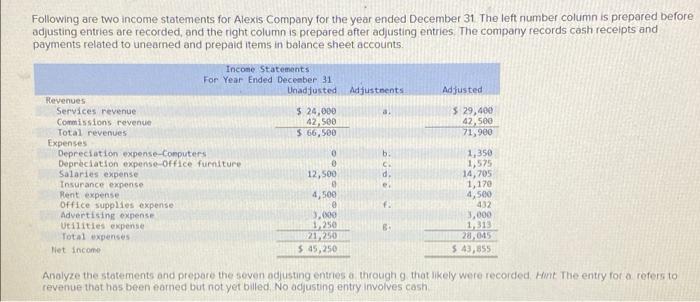

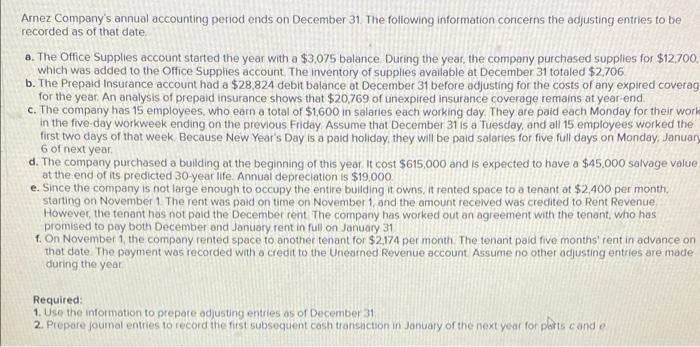

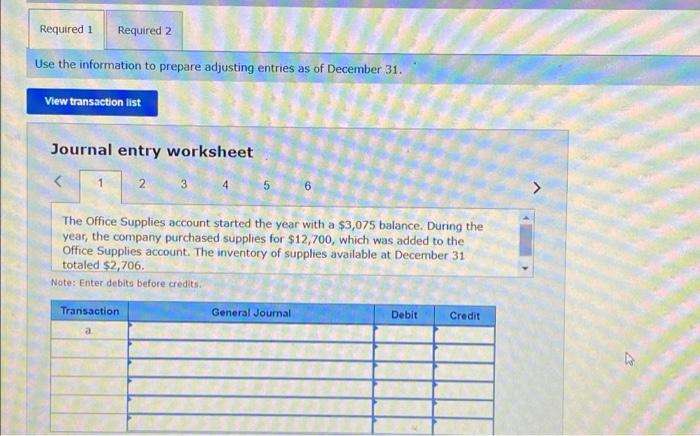

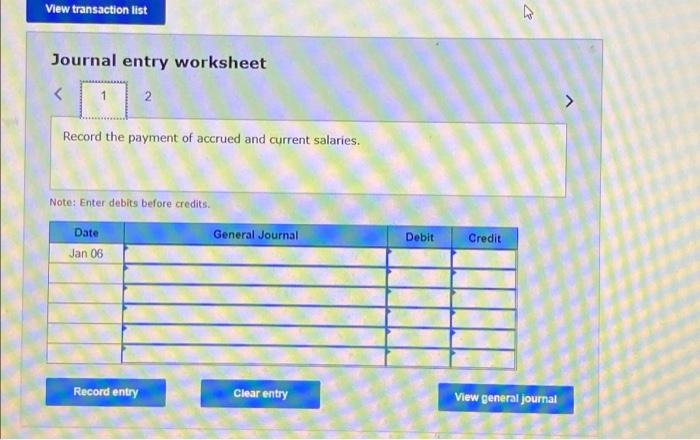

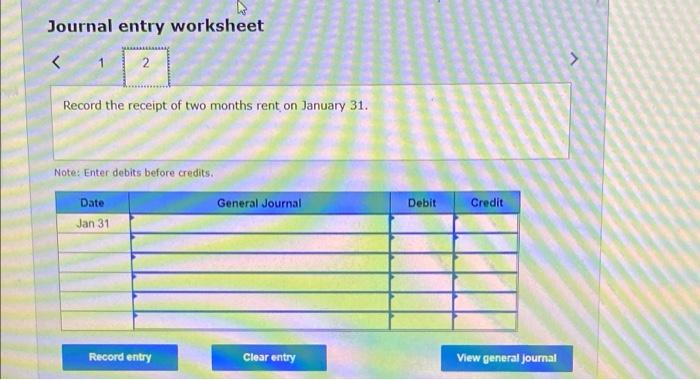

Following are two income statements for Alexis Company for the year ended December 31 The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Adjusted $ 29,400 42,500 71,900 Income Statements For Year Ended December 31 Unadjusted Adjustnents Revenues Services revenue $ 24,000 Commissions revenue 42,500 Total revenues $ 66,500 Expenses Depreciation expense-Computers b Depreciation expense Office furniture 0 Salaries expense 12,500 Insurance expense e Rent expense 4,500 Office Supplies expense Advertising expense 3.000 Utilities expense 1/250 B Total expenses 21,250 Het income 5.45,250 1,350 1,575 14,705 1,170 4,500 432 3,000 1,313 20,015 5 43,855 Analyze the statements and prepare the seven adjusting entries a through that likely were recorded Hit The entry for a refers to revenue that has been earned but not yet billed. No adjusting entry involves cash Answer is not complete. No Event General Journal Credit Debit 29,400 1 a Accounts receivable Services revenue 24,000 2 b Depreciation expense-Computers 0 X 3 Accumulated depreciation Office furniture $ 0 4 d 14,705 Salaries expense Salaries payable 12,500 5 1,170 Insurance expense Prepaid insurance E S 6 Utilities expense Office supplies 1,313 432 7 9 Utilities expense Utilities payable 1,313 olo 1.250 Arnez Company's annual accounting period ends on December 31. The foliowing information concerns the adjusting entries to be recorded as of that date. a. The Office Supplies account started the year with a $3,075 balance During the year, the company purchased supplies for $12,700, which was added to the Office Supplies account. The inventory of supplies available at December 31 totaled $2,706 b. The Prepaid Insurance account had a $28,824 debit balance at December 31 before adjusting for the costs of any expired coverag for the year. An analysis of prepaid insurance shows that $20,769 of unexpired insurance coverage remains at year-end c. The company has 15 employees, who earn a total of $1,600 in salaries each working day. They are paid each Monday for their work in the five-day workweek ending on the previous Friday Assume that December 31 is a Tuesday, and all 15 employees worked the first two days of that week. Because New Year's Day is a paid holiday, they will be paid salaries for five full days on Monday, January 6 of next year d. The company purchased a building at the beginning of this year It cost $615,000 and is expected to have a $45,000 salvage value at the end of its predicted 30-year life. Annual depreciation is $19,000 e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $2,400 per month starting on November 1. The rent was paid on time on November 1, and the amount received was credited to Rent Revenue However, the tenant has not paid the December rent. The company has worked out on agreement with the tenant, who has promised to pay both December and January rent in full on January 31 f. On November 1, the company rented space to another tenant for $2.174 per month The tenant paid five months' rent in advance on that date. The payment was recorded with a credit to the Unearned Revenue account Assume no other adjusting entries are made during the year Required: 1. Use the information to prepare adjusting entries as of December 31 2. Prepare journal entries to record the fist subsequent cash transaction in January of the next year for platts cand Required 1 Required 2 Use the information to prepare adjusting entries as of December 31. View transaction list Journal entry worksheet 2 3 5 6 The Office Supplies account started the year with a $3,075 balance. During the year, the company purchased supplies for $12,700, which was added to the Office Supplies account. The inventory of supplies available at December 31 totaled $2,706. Note: Enter debits before credits Transaction General Journal Debit Credit . View transaction list Journal entry worksheet