2. For Southwest Airlines determine the following (Hint: Note 7 will be very useful here):

a. Operating lease payment (or expense) made during the 2017 fiscal year

b. Total undiscounted operating lease payments due in the future (ignore subleases, i.e. do not use the operating leases, net number)

c. Total undiscounted capital lease payments due in the future

d. Total capital lease liability at the end of 2017 (excluding the lease incentive obligation of $105 million)

e. Net capital lease asset at the end of 2017

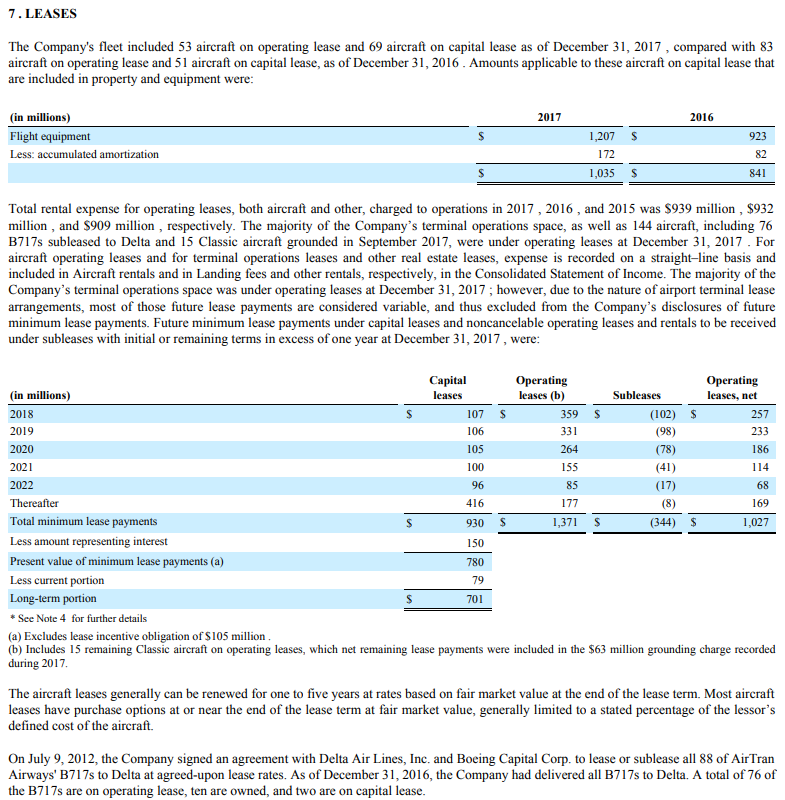

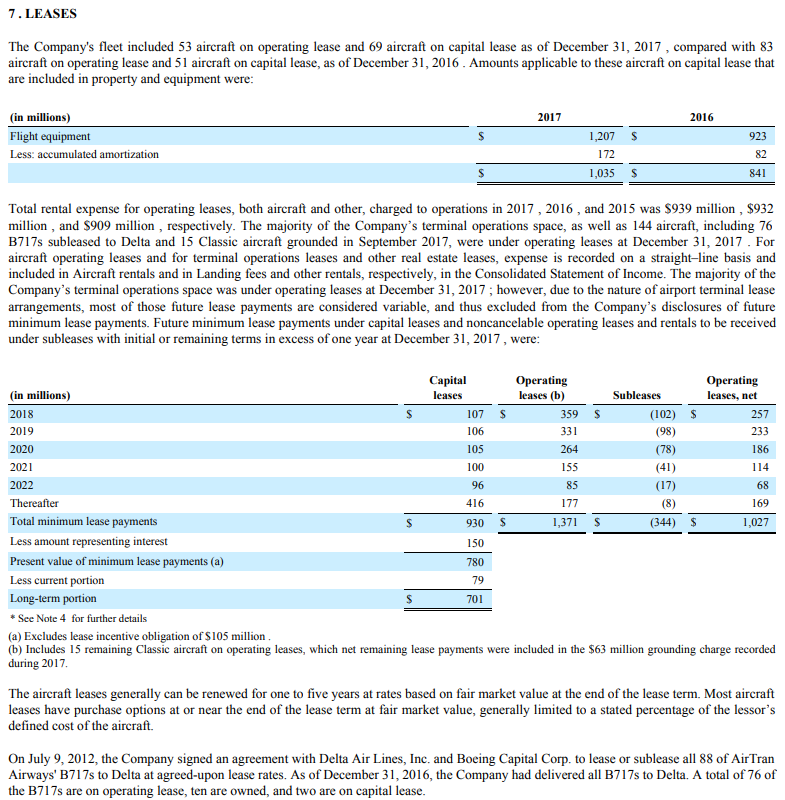

7. LEASES The Company's fleet included 53 aircraft on operating lease and 69 aircraft on capital lease as of December 31, 2017, compared with 83 aircraft on operating lease and 51 aircraft on capital lease, as of December 31, 2016. Amounts applicable to these aircraft on capital lease that are included in property and equipment were: 2017 2016 (in millions) Flight equipment Less: accumulated amortization $ 923 1,207 172 1,035 82 841 S Total rental expense for operating leases, both aircraft and other, charged to operations in 2017, 2016, and 2015 was $939 million, $932 million, and $909 million, respectively. The majority of the Company's terminal operations space, as well as 144 aircraft, including 76 B717s subleased to Delta and 15 Classic aircraft grounded in September 2017, were under operating leases at December 31, 2017. For aircraft operating leases and for terminal operations leases and other real estate leases, expense is recorded on a straight-line basis and included in Aircraft rentals and in Landing fees and other rentals, respectively, in the Consolidated Statement of Income. The majority of the Company's terminal operations space was under operating leases at December 31, 2017; however, due to the nature of airport terminal lease arrangements, most of those future lease payments are considered variable, and thus excluded from the Company's disclosures of future minimum lease payments. Future minimum lease payments under capital leases and noncancelable operating leases and rentals to be received under subleases with initial or remaining terms in excess of one year at December 31, 2017, were: 257 105 186 Capital Operating Operating (in millions) leases leases (b) Subleases leases, net 2018 107 $ 359 $ (102) $ 2019 106 331 (98) 233 2020 264 (78) 2021 100 155 (41) 114 2022 96 85 (17) 68 Thereafter 416 177 (8) 169 Total minimum lease payments 930 1,371 $ (344) $ 1,027 Less amount representing interest 150 Present value of minimum lease payments (a) 780 Less current portion 79 Long-term portion $ 701 * See Note 4 for further details (a) Excludes lease incentive obligation of $105 million. (b) Includes 15 remaining Classic aircraft on operating leases, which net remaining lease payments were included in the $63 million grounding charge recorded during 2017 The aircraft leases generally can be renewed for one to five years at rates based on fair market value at the end of the lease term. Most aircraft leases have purchase options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. On July 9, 2012, the Company signed an agreement with Delta Air Lines, Inc. and Boeing Capital Corp. to lease or sublease all 88 of Air Tran Airways' B717s to Delta at agreed-upon lease rates. As of December 31, 2016, the Company had delivered all B717s to Delta. A total of 76 of the B717s are on operating lease, ten are owned, and two are on capital lease. 7. LEASES The Company's fleet included 53 aircraft on operating lease and 69 aircraft on capital lease as of December 31, 2017, compared with 83 aircraft on operating lease and 51 aircraft on capital lease, as of December 31, 2016. Amounts applicable to these aircraft on capital lease that are included in property and equipment were: 2017 2016 (in millions) Flight equipment Less: accumulated amortization $ 923 1,207 172 1,035 82 841 S Total rental expense for operating leases, both aircraft and other, charged to operations in 2017, 2016, and 2015 was $939 million, $932 million, and $909 million, respectively. The majority of the Company's terminal operations space, as well as 144 aircraft, including 76 B717s subleased to Delta and 15 Classic aircraft grounded in September 2017, were under operating leases at December 31, 2017. For aircraft operating leases and for terminal operations leases and other real estate leases, expense is recorded on a straight-line basis and included in Aircraft rentals and in Landing fees and other rentals, respectively, in the Consolidated Statement of Income. The majority of the Company's terminal operations space was under operating leases at December 31, 2017; however, due to the nature of airport terminal lease arrangements, most of those future lease payments are considered variable, and thus excluded from the Company's disclosures of future minimum lease payments. Future minimum lease payments under capital leases and noncancelable operating leases and rentals to be received under subleases with initial or remaining terms in excess of one year at December 31, 2017, were: 257 105 186 Capital Operating Operating (in millions) leases leases (b) Subleases leases, net 2018 107 $ 359 $ (102) $ 2019 106 331 (98) 233 2020 264 (78) 2021 100 155 (41) 114 2022 96 85 (17) 68 Thereafter 416 177 (8) 169 Total minimum lease payments 930 1,371 $ (344) $ 1,027 Less amount representing interest 150 Present value of minimum lease payments (a) 780 Less current portion 79 Long-term portion $ 701 * See Note 4 for further details (a) Excludes lease incentive obligation of $105 million. (b) Includes 15 remaining Classic aircraft on operating leases, which net remaining lease payments were included in the $63 million grounding charge recorded during 2017 The aircraft leases generally can be renewed for one to five years at rates based on fair market value at the end of the lease term. Most aircraft leases have purchase options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. On July 9, 2012, the Company signed an agreement with Delta Air Lines, Inc. and Boeing Capital Corp. to lease or sublease all 88 of Air Tran Airways' B717s to Delta at agreed-upon lease rates. As of December 31, 2016, the Company had delivered all B717s to Delta. A total of 76 of the B717s are on operating lease, ten are owned, and two are on capital lease