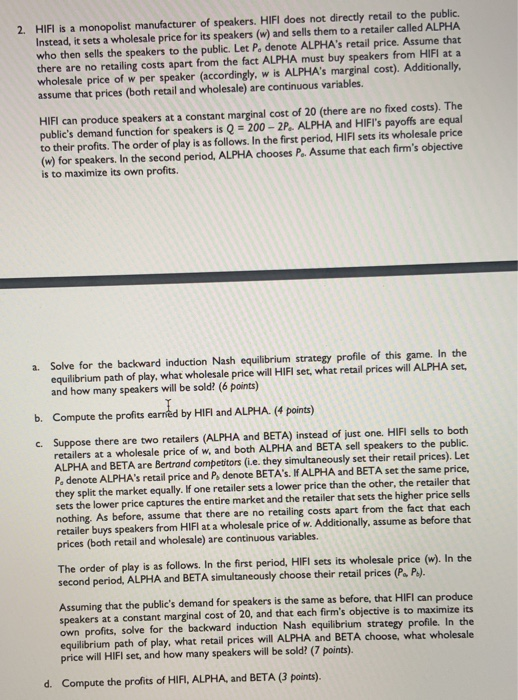

2. HIFI is a monopolist manufacturer of speakers. HIFI does not directly retail to the public. Instead, it sets a wholesale price for its speakers (w) and sells them to a retailer called ALPHA who then sells the speakers to the public. Let P. denote ALPHA's retail price. Assume that there are no retailing costs apart from the fact ALPHA must buy speakers from HIFI at a wholesale price of w per speaker (accordingly, w is ALPHA's marginal cost). Additionally, assume that prices (both retail and wholesale) are continuous variables. HIFI can produce speakers at a constant marginal cost of 20 (there are no fixed costs). The public's demand function for speakers is = 200 - 2P. ALPHA and HIFI's payoffs are equal to their profits. The order of play is as follows. In the first period, HIFI sets its wholesale price (w) for speakers. In the second period, ALPHA chooses P. Assume that each firm's objective is to maximize its own profits. a Solve for the backward induction Nash equilibrium strategy profile of this game. In the equilibrium path of play, what wholesale price will HIFI set, what retail prices will ALPHA set, and how many speakers will be sold? (6 points) b. Compute the profits earned by HIFI and ALPHA. (4 points) c. Suppose there are two retailers (ALPHA and BETA) instead of just one. HIFI sells to both retailers at a wholesale price of w, and both ALPHA and BETA sell speakers to the public. ALPHA and BETA are Bertrand competitors (.e. they simultaneously set their retail prices). Let P. denote ALPHA's retail price and P, denote BETA'S. I ALPHA and BETA set the same price, they split the market equally. If one retailer sets a lower price than the other, the retailer that sets the lower price captures the entire market and the retailer that sets the higher price sells nothing. As before, assume that there are no retailing costs apart from the fact that each retailer buys speakers from HIFI at a wholesale price of w. Additionally, assume as before that prices (both retail and wholesale) are continuous variables. The order of play is as follows. In the first period, HIFI sets its wholesale price (w). In the second period, ALPHA and BETA simultaneously choose their retail prices (PP). Assuming that the public's demand for speakers is the same as before, that HIFI can produce speakers at a constant marginal cost of 20, and that each firm's objective is to maximize its own profits, solve for the backward induction Nash equilibrium strategy profile. In the equilibrium path of play, what retail prices will ALPHA and BETA choose, what wholesale price will HIFI set, and how many speakers will be sold? (7 points) d. Compute the profits of HIFI, ALPHA, and BETA (3 points) 2. HIFI is a monopolist manufacturer of speakers. HIFI does not directly retail to the public. Instead, it sets a wholesale price for its speakers (w) and sells them to a retailer called ALPHA who then sells the speakers to the public. Let P. denote ALPHA's retail price. Assume that there are no retailing costs apart from the fact ALPHA must buy speakers from HIFI at a wholesale price of w per speaker (accordingly, w is ALPHA's marginal cost). Additionally, assume that prices (both retail and wholesale) are continuous variables. HIFI can produce speakers at a constant marginal cost of 20 (there are no fixed costs). The public's demand function for speakers is = 200 - 2P. ALPHA and HIFI's payoffs are equal to their profits. The order of play is as follows. In the first period, HIFI sets its wholesale price (w) for speakers. In the second period, ALPHA chooses P. Assume that each firm's objective is to maximize its own profits. a Solve for the backward induction Nash equilibrium strategy profile of this game. In the equilibrium path of play, what wholesale price will HIFI set, what retail prices will ALPHA set, and how many speakers will be sold? (6 points) b. Compute the profits earned by HIFI and ALPHA. (4 points) c. Suppose there are two retailers (ALPHA and BETA) instead of just one. HIFI sells to both retailers at a wholesale price of w, and both ALPHA and BETA sell speakers to the public. ALPHA and BETA are Bertrand competitors (.e. they simultaneously set their retail prices). Let P. denote ALPHA's retail price and P, denote BETA'S. I ALPHA and BETA set the same price, they split the market equally. If one retailer sets a lower price than the other, the retailer that sets the lower price captures the entire market and the retailer that sets the higher price sells nothing. As before, assume that there are no retailing costs apart from the fact that each retailer buys speakers from HIFI at a wholesale price of w. Additionally, assume as before that prices (both retail and wholesale) are continuous variables. The order of play is as follows. In the first period, HIFI sets its wholesale price (w). In the second period, ALPHA and BETA simultaneously choose their retail prices (PP). Assuming that the public's demand for speakers is the same as before, that HIFI can produce speakers at a constant marginal cost of 20, and that each firm's objective is to maximize its own profits, solve for the backward induction Nash equilibrium strategy profile. In the equilibrium path of play, what retail prices will ALPHA and BETA choose, what wholesale price will HIFI set, and how many speakers will be sold? (7 points) d. Compute the profits of HIFI, ALPHA, and BETA (3 points)