Answered step by step

Verified Expert Solution

Question

1 Approved Answer

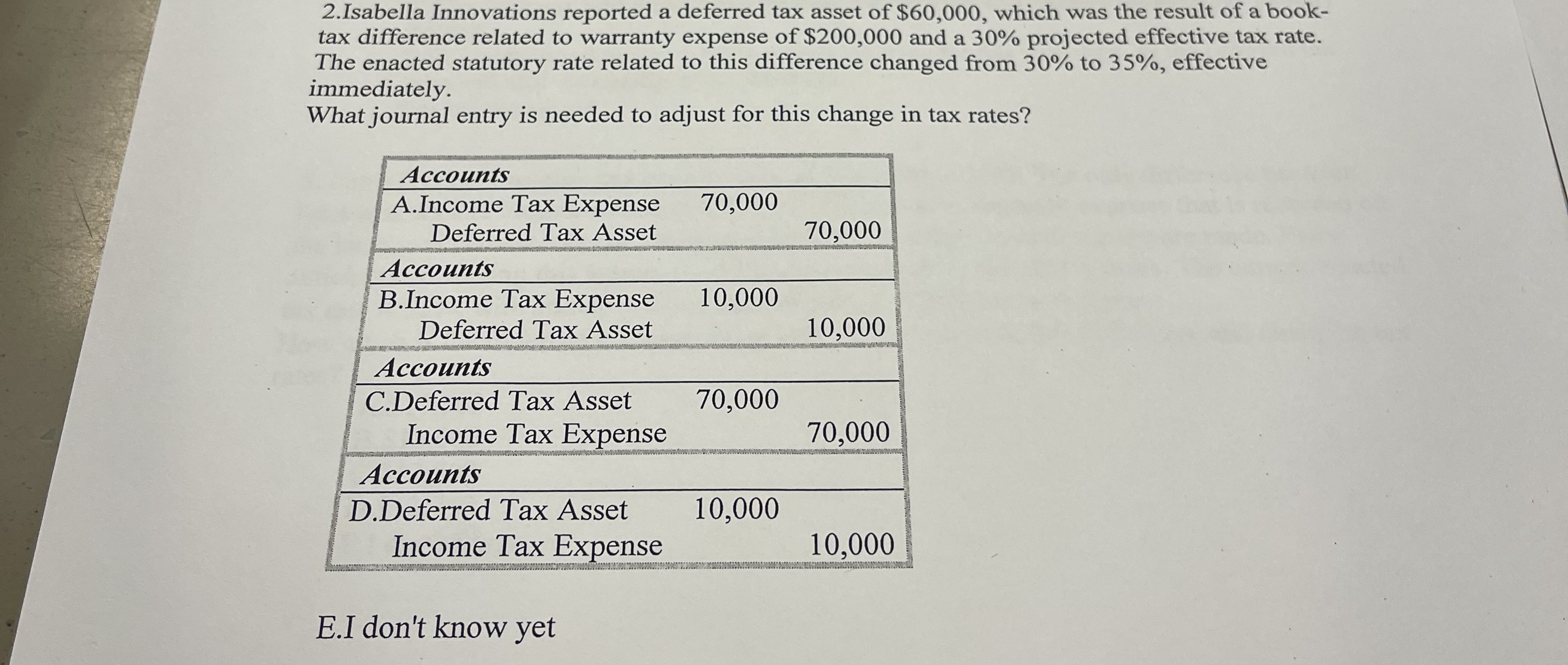

2 . Isabella Innovations reported a deferred tax asset of $ 6 0 , 0 0 0 , which was the result of a booktax

Isabella Innovations reported a deferred tax asset of $ which was the result of a booktax difference related to warranty expense of $ and a projected effective tax rate. The enacted statutory rate related to this difference changed from to effective immediately.

What journal entry is needed to adjust for this change in tax rates?

tabletableAccountsAIncome Tax ExpenseDeferred Tax AssetAccountstableBIncome Tax ExpenseDeferred Tax AssetAccountstableCDeferred Tax AssetIncome Tax ExpenseAccountstableDDeferred Tax AssetIncome Tax Expense

EI don't know yet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started