Answered step by step

Verified Expert Solution

Question

1 Approved Answer

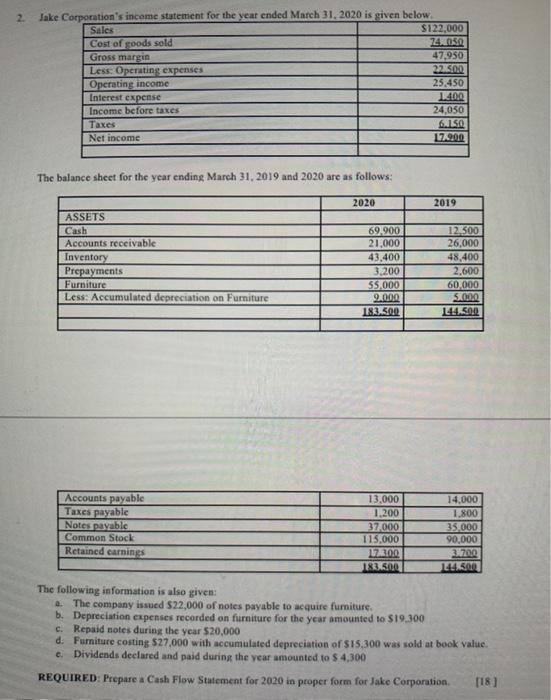

2. Jake Corporation's income statement for the year ended March 31, 2020 is given below. Sales Cost of goods sold Gross margin Less: Operating

2. Jake Corporation's income statement for the year ended March 31, 2020 is given below. Sales Cost of goods sold Gross margin Less: Operating expenses Operating income Interest expense Income before taxes Taxes Net income The balance sheet for the year ending March 31, 2019 and 2020 are as follows: $122,000 74.050 47,950 22.500 25,450 1.400 24,050 6.150 17.900 2020 2019 ASSETS Cash 69,900 12.500 Accounts receivable 21,000 26,000 Inventory 43,400 48,400 Prepayments 3.200 2,600 Furniture 55,000 60,000 Less: Accumulated depreciation on Furniture 9.000 5.000 183.500 144.500 Accounts payable Taxes payable Notes payable Common Stock Retained earnings The following information is also given: 13,000 14,000 1,200 37,000 1,800 35,000 115,000 90,000 17.300 3.700 183.500 144.500 a. The company issued $22,000 of notes payable to acquire furniture. b. Depreciation expenses recorded on furniture for the year amounted to $19,300 c. Repaid notes during the year $20,000 d. Furniture costing $27,000 with accumulated depreciation of $15,300 was sold at book value. e. Dividends declared and paid during the year amounted to $ 4,300 REQUIRED: Prepare a Cash Flow Statement for 2020 in proper form for Jake Corporation. [18]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the Cash Flow Statement for Jake Corporation for the year 2020 we will follow the indirec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started