Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. J&J Cash flow from investing activities 3. J&J Cash flow from financial activities 3 J&J change in Cash and Cash equivalent Obtain the statement

2. J&J Cash flow from investing activities 3. J&J Cash flow from financial activities 3 J&J change in Cash and Cash equivalent

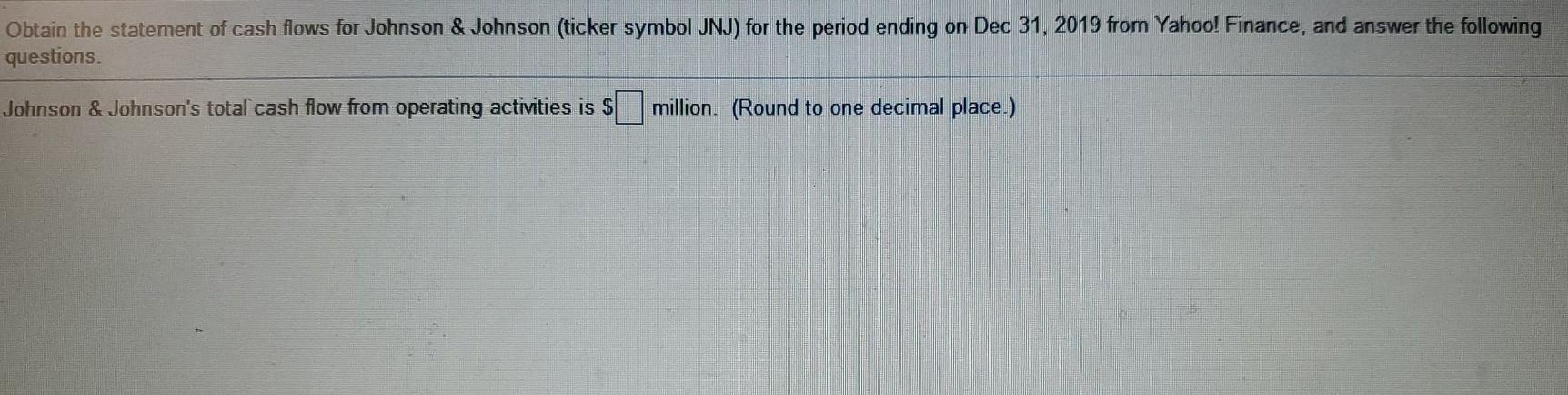

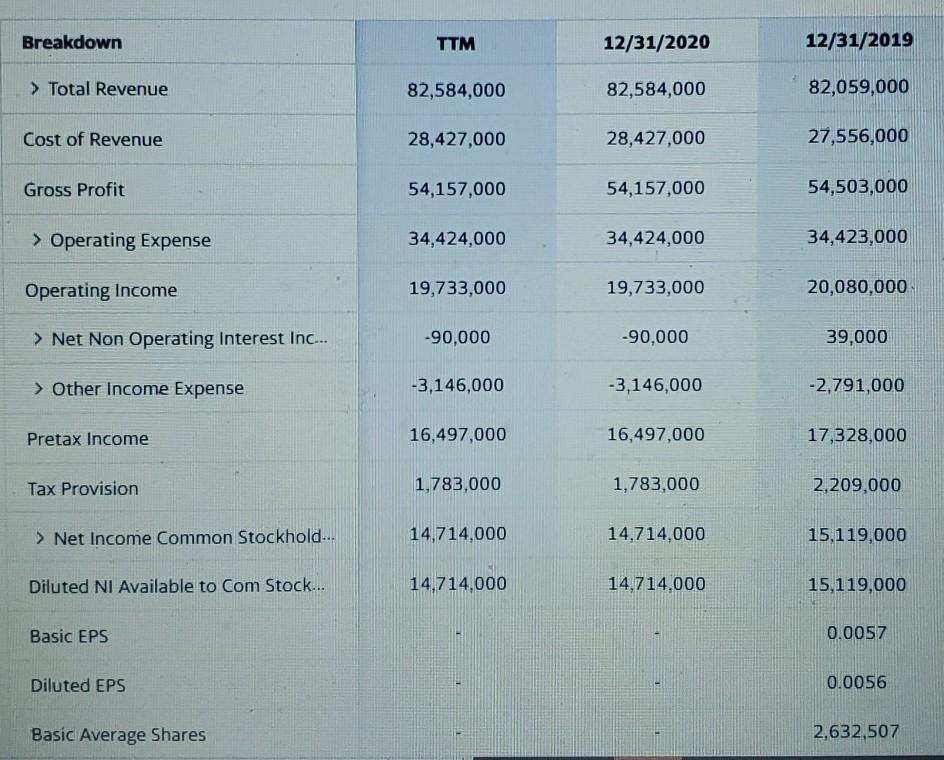

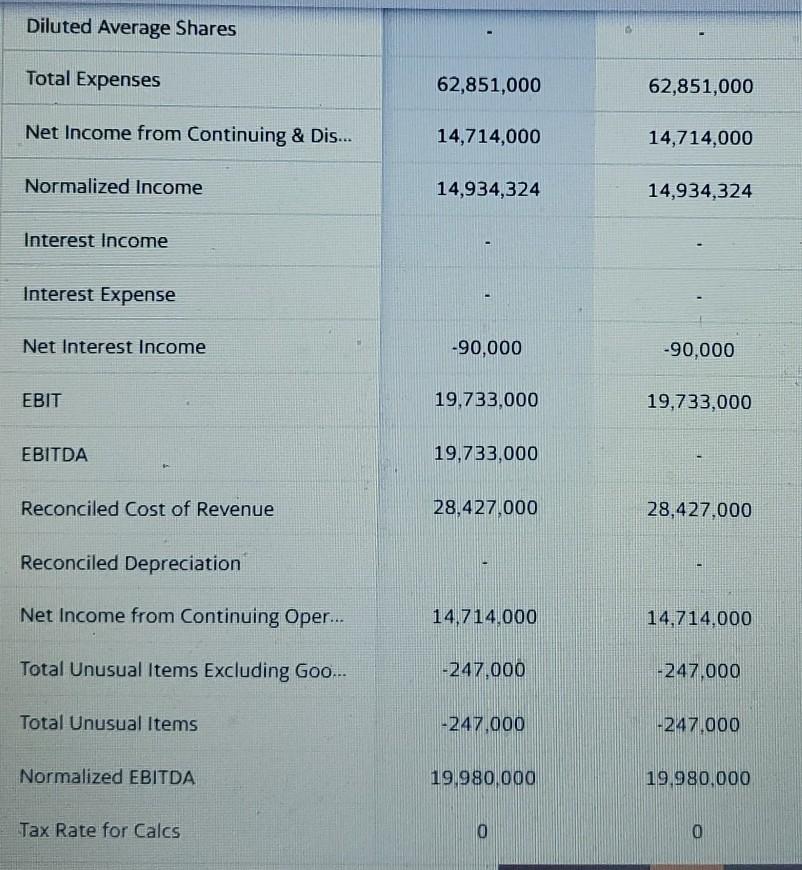

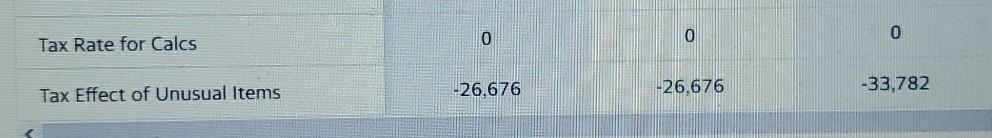

Obtain the statement of cash flows for Johnson & Johnson (ticker symbol JNJ) for the period ending on Dec 31, 2019 from Yahoo! Finance, and answer the following questions. Johnson & Johnson's total cash flow from operating activities is $ million. (Round to one decimal place.) Breakdown TTM 12/31/2020 12/31/2019 > Total Revenue 82,584,000 82,584,000 82,059,000 Cost of Revenue 28,427,000 28,427,000 27,556,000 Gross Profit 54,157,000 54,157,000 54,503,000 > Operating Expense 34,424,000 34,424,000 34,423,000 Operating Income 19,733,000 19,733,000 20,080,000 > Net Non Operating Interest Inc... -90,000 -90,000 39,000 > Other Income Expense -3,146,000 -3,146,000 -2,791,000 Pretax Income 16,497,000 16,497,000 17,328,000 Tax Provision 1,783.000 1,783,000 2,209,000 > Net Income Common Stockhold... 14,714,000 14,714,000 15,119,000 Diluted NI Available to Com Stock... 14,714,000 14,714,000 15,119,000 Basic EPS 0.0057 Diluted EPS 0.0056 Basic Average Shares 2,632,507 Diluted Average Shares Total Expenses 62,851,000 62,851,000 Net Income from Continuing & Dis... 14,714,000 14,714,000 Normalized Income 14,934,324 14,934,324 Interest Income Interest Expense Net Interest Income -90,000 -90,000 EBIT 19,733,000 19,733,000 EBITDA 19,733,000 Reconciled Cost of Revenue 28,427,000 28,427,000 Reconciled Depreciation Net Income from Continuing Oper... 14,714,000 14,714.000 Total Unusual Items Excluding Goo... -247.000 -247,000 Total Unusual Items -247.000 -247.000 Normalized EBITDA 19.980,000 19.980,000 Tax Rate for Calcs 0 0 0 0 0 Tax Rate for Calcs -26,676 Tax Effect of Unusual Items -26,676 -33,782Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started