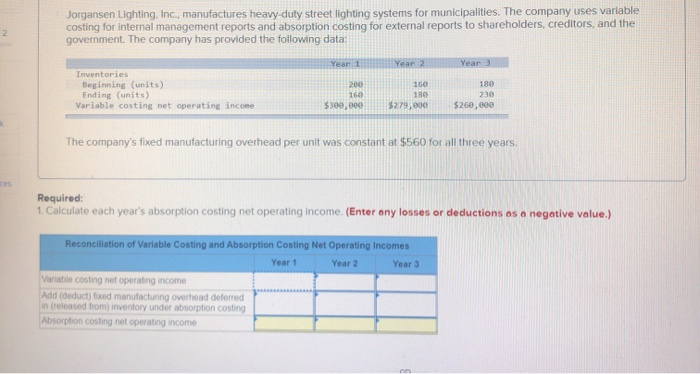

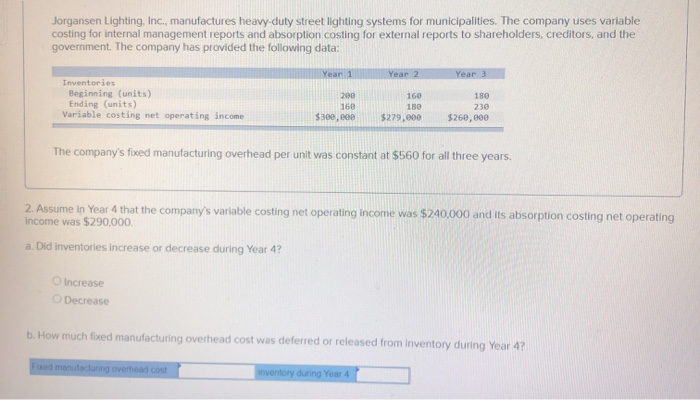

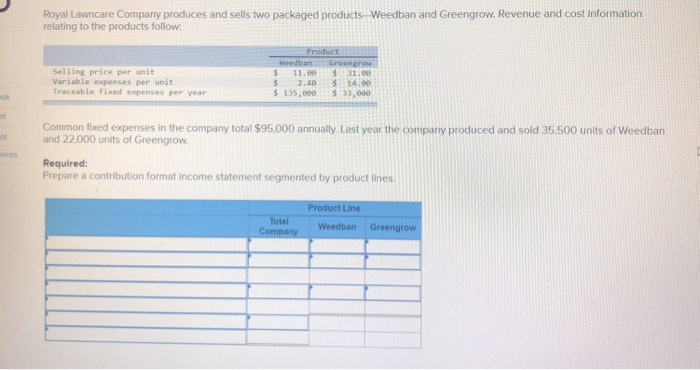

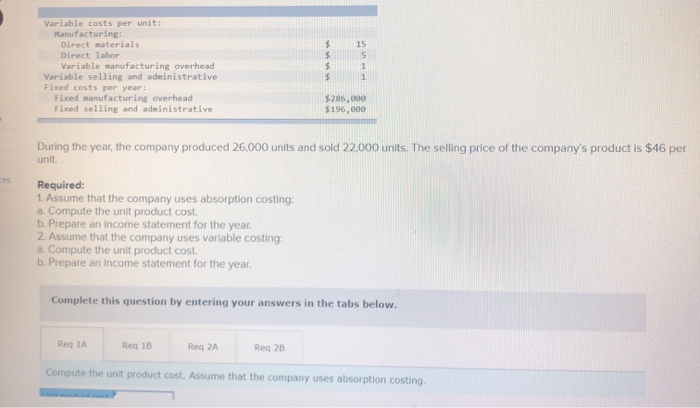

2 Jorgansen Lighting, Inc., manufactures heavy duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the govemment. The company has provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) Ending (units) Variable costing net operating income 200 160 $300,000 160 180 $279,800 180 230 $260,000 The company's fixed manufacturing overhead per unit was constant at $560 for all three years. Required: 1. Calculate each year's absorption costing net operating income (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Year 3 Variable costing net operating income Add (deduct) foxed manufacturing overhead deferred in released from) inventory under absorption costing Absorption costing net operating income Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year Inventories Beginning (units) Ending (units) Variable costing net operating income 200 160 $300,000 160 180 $279,900 180 230 $260,000 The company's fixed manufacturing overhead per unit was constant at $560 for all three years. 2. Assume in Year 4 that the company's variable costing net operating income was $240,000 and its absorption costing net operating Income was $290,000 a. Did Inventories increase or decrease during Year 4? Increase Decrease b. How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4? inventory during Year 4 Royal Lawncare Company produces and sells two packaged products Weedban and Greengrow. Revenue and cost information relating to the products follow Product Weedban Groenew 11.00 $31.00 $ 2.40 $ 14.ee $ 135,000 $ 33,000 Selling price per unit Variable expenses per unit Traceable fixed expenses per year $ Common fixed expenses in the company total $95,000 annually. Last year the company produced and sold 35 500 units of Weedban and 22.000 units of Greengrow. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Company Weedban Greengrow Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative $ $ $ $ 15 5 1 1 $286,000 $196,000 During the year, the company produced 26,000 units and sold 22.000 units. The selling price of the company's product is $46 per unit Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year, Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 2A Reg 28 Compute the unit product cost. Assume that the company uses absorption costing