Answered step by step

Verified Expert Solution

Question

1 Approved Answer

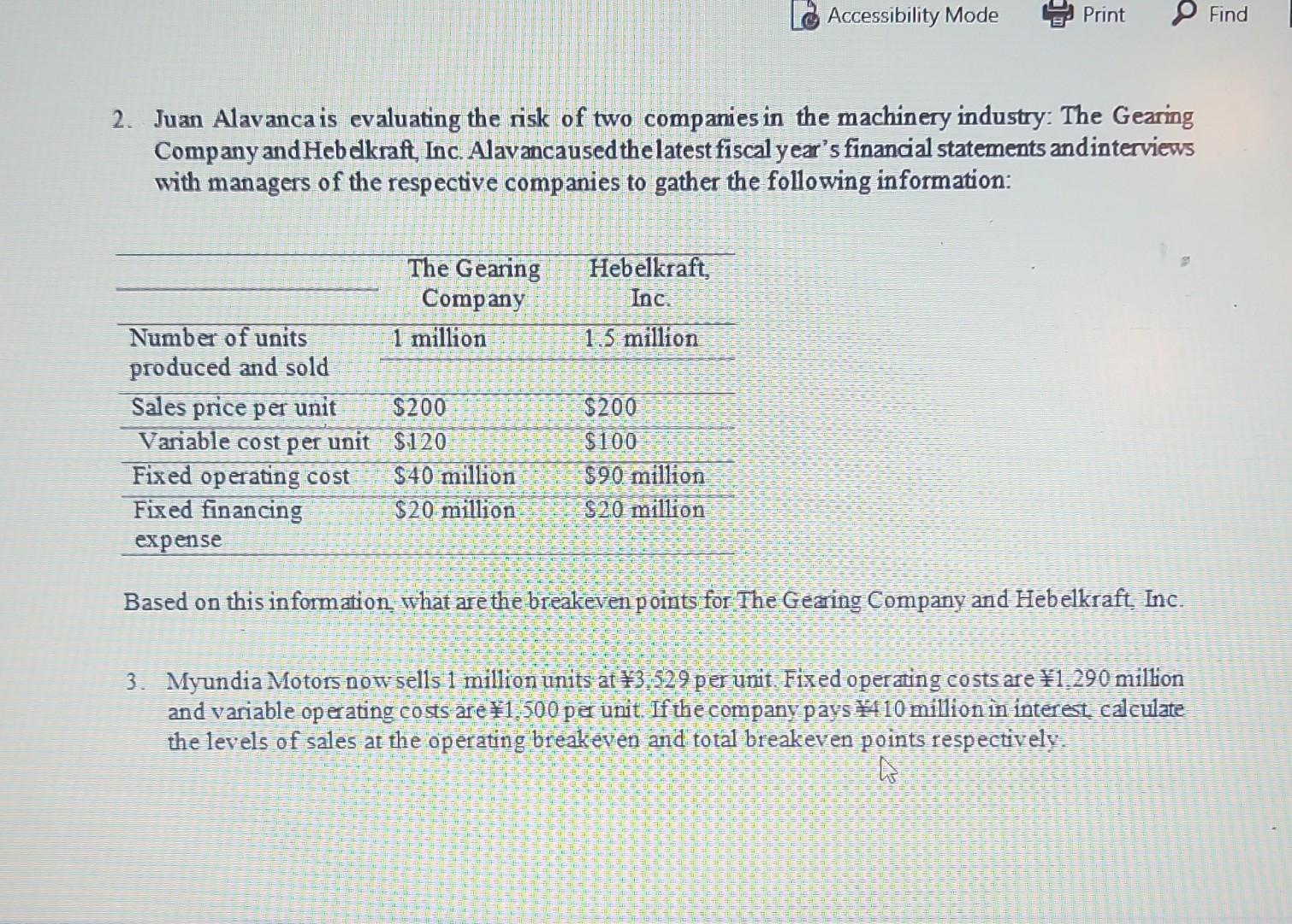

2. Juan Alavanca is evaluating the risk of two companies in the machinery industry: The Gearing Company and Heb dkraft, Inc. Alavancaused the latest fiscal

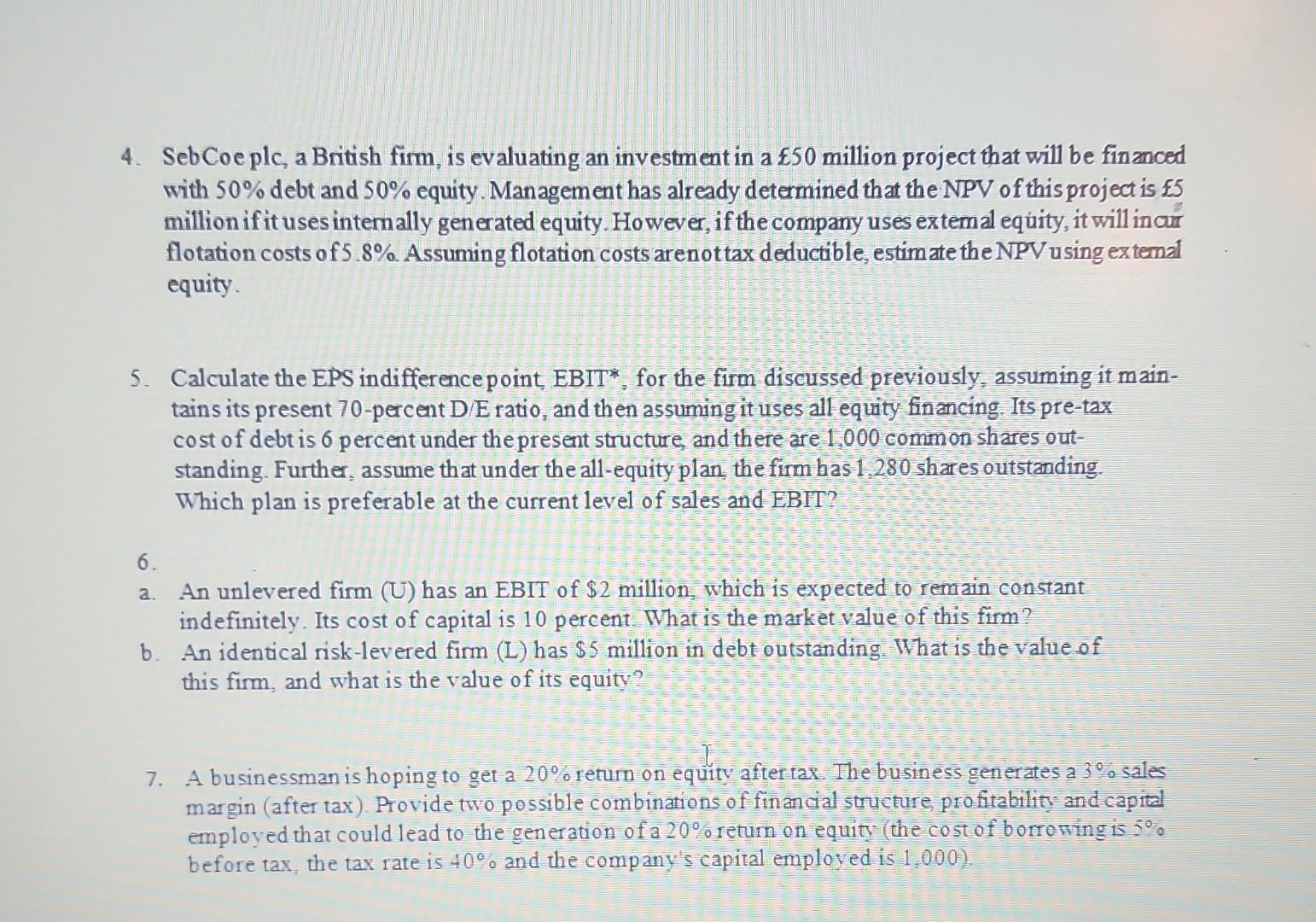

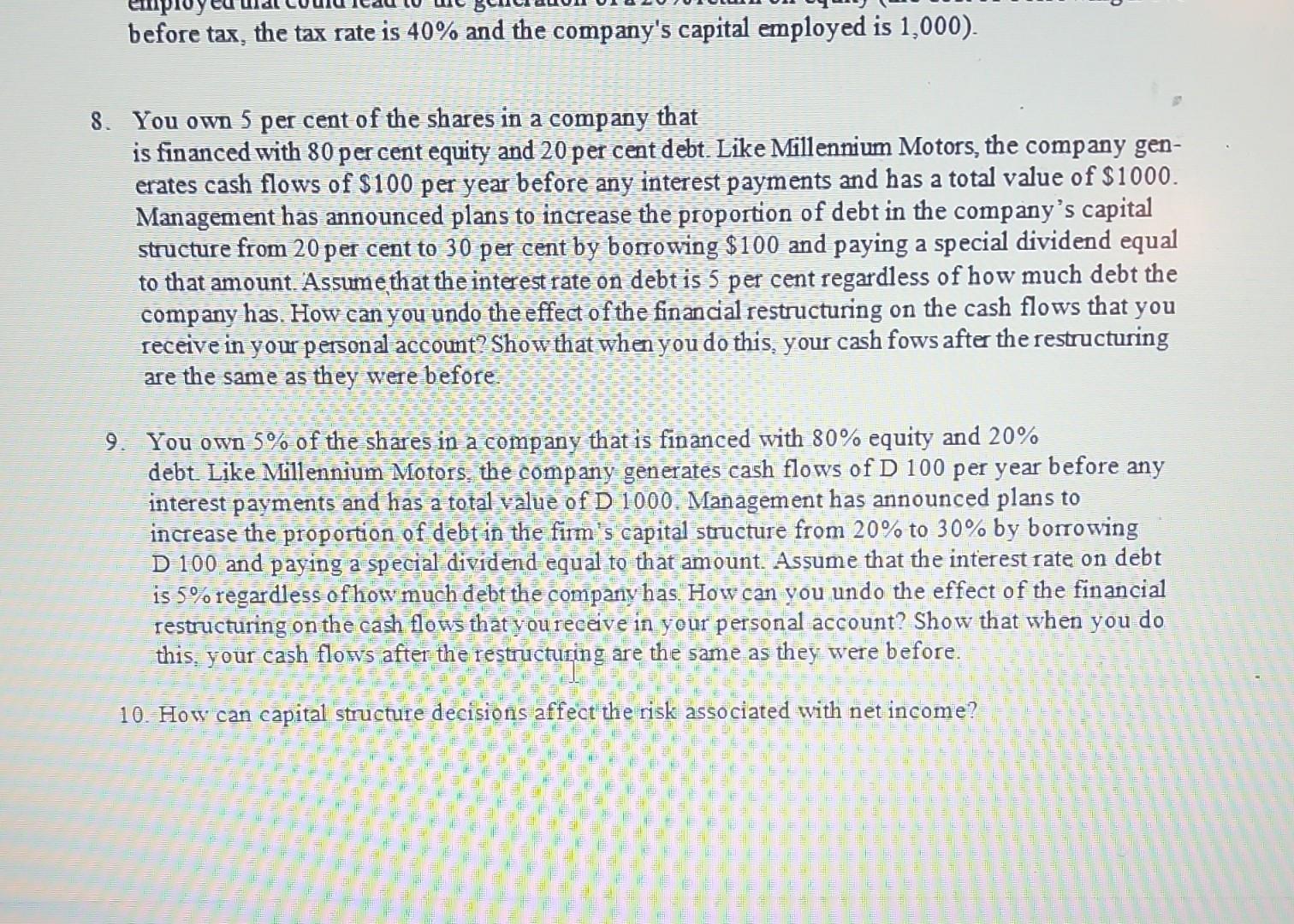

2. Juan Alavanca is evaluating the risk of two companies in the machinery industry: The Gearing Company and Heb dkraft, Inc. Alavancaused the latest fiscal year's financial statements andinterviews with managers of the respective companies to gather the following information: Based on this information what are the breakeven ponts for The Gearing Company and Hebelkraft Inc. 3. Myundia Motors now sells 1 million units at 3,529 per unit Fixed operating costs are 1,290 million and variable operating costs are x1,500 per unit. If the company pays 4410 million in interest calculate the levels of sales at the operating breakeven and total breakeven points respectively. 4. SebCoe plc, a British firm, is evaluating an investment in a 50 million project that will be financed with 50% debt and 50% equity. Management has already determined that the NPV of this project is 55 million if it uses internally generated equity. However, if the company uses extemal equity, it will incur flotation costs of 5.8%. Assuming flotation costs arenot tax deductible, estim ate the NPV using ex temal equity. 5. Calculate the EPS indifference point, EBIT*, for the firm discussed previously, assuming it maintains its present 70 -percent D/E ratio, and then assuming it uses all equity financing. Its pre-tax cost of debt is 6 percent under the present structure, and there are 1,000 common shares outstanding. Further, assume that under the all-equity plan, the firm has 1,280 shares outstanding. Which plan is preferable at the current level of sales and EBIT? 6. a. An unlevered firm (U) has an EBIT of \$2 million, which is expected to remain constant indefinitely. Its cost of capital is 10 percent. What is the market value of this firm? b. An identical risk-levered firm (L) has $5 million in debt outstanding, What is the value of this firm, and what is the value of its equity? 7. A businessman is hoping to get a 20% return on equity after tax The business generates a 3% sales margin (after tax). Provide two possible combinations of financial structure profitability and capital employed that could lead to the generation of a 20% return on equity (the cost of borroming is 5% before tax, the tax rate is 40% and the company's capital employed is 1,000 ). before tax, the tax rate is 40% and the company's capital employed is 1,000 ). 8. You own 5 per cent of the shares in a company that is financed with 80 per cent equity and 20 per cent debt. Like Millennium Motors, the company generates cash flows of $100 per year before any interest payments and has a total value of $1000. Management has announced plans to increase the proportion of debt in the company's capital structure from 20 per cent to 30 per cent by borrowing $100 and paying a special dividend equal to that amount. Assume that the interest rate on debt is 5 per cent regardless of how much debt the company has. How can you undo the effect of the financial restructuring on the cash flows that you receive in your personal account? Show that when you do this, your cash fows after the restructuring are the same as they were before. 9. You own 5% of the shares in a company that is financed with 80% equity and 20% debt Like Millennium Motors the company generates cash flows of D100 per year before any interest payments and has a total value of D 1000. Management has announced plans to increase the proportion of debt in the firm's capital structure from 20% to 30% by borrowing D 100 and paying a special dividend equal to that amount. Assume that the interest rate on debt is 5% regardless of how much debt the company has. How can you undo the effect of the financial restructuring on the cash flows that you receive in your personal account? Show that when you do this, your cash flows after the restructuring are the same as they were before

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started