Answered step by step

Verified Expert Solution

Question

1 Approved Answer

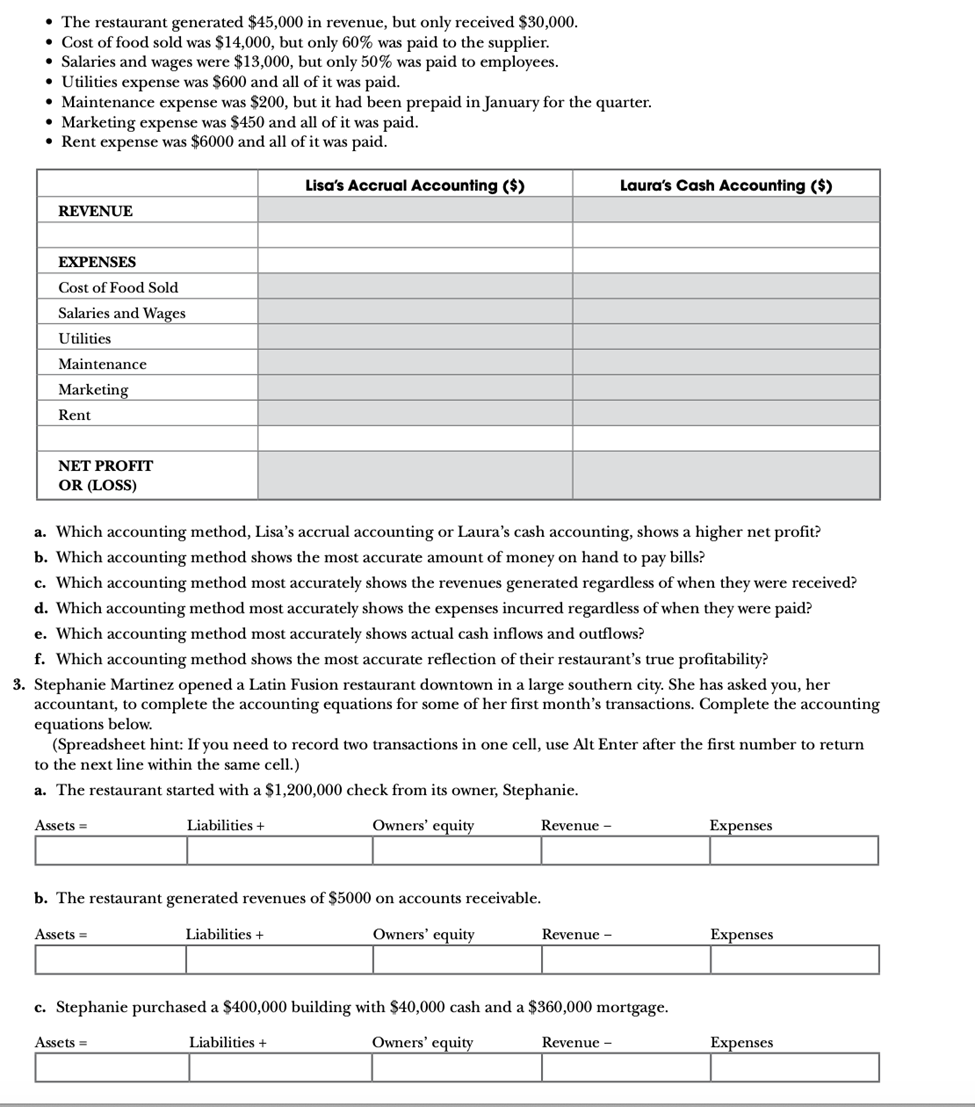

2. Lisa and Laura are twins who own a seafood restaurant in a coastal town. Lisa likes to report her income statement using accrual

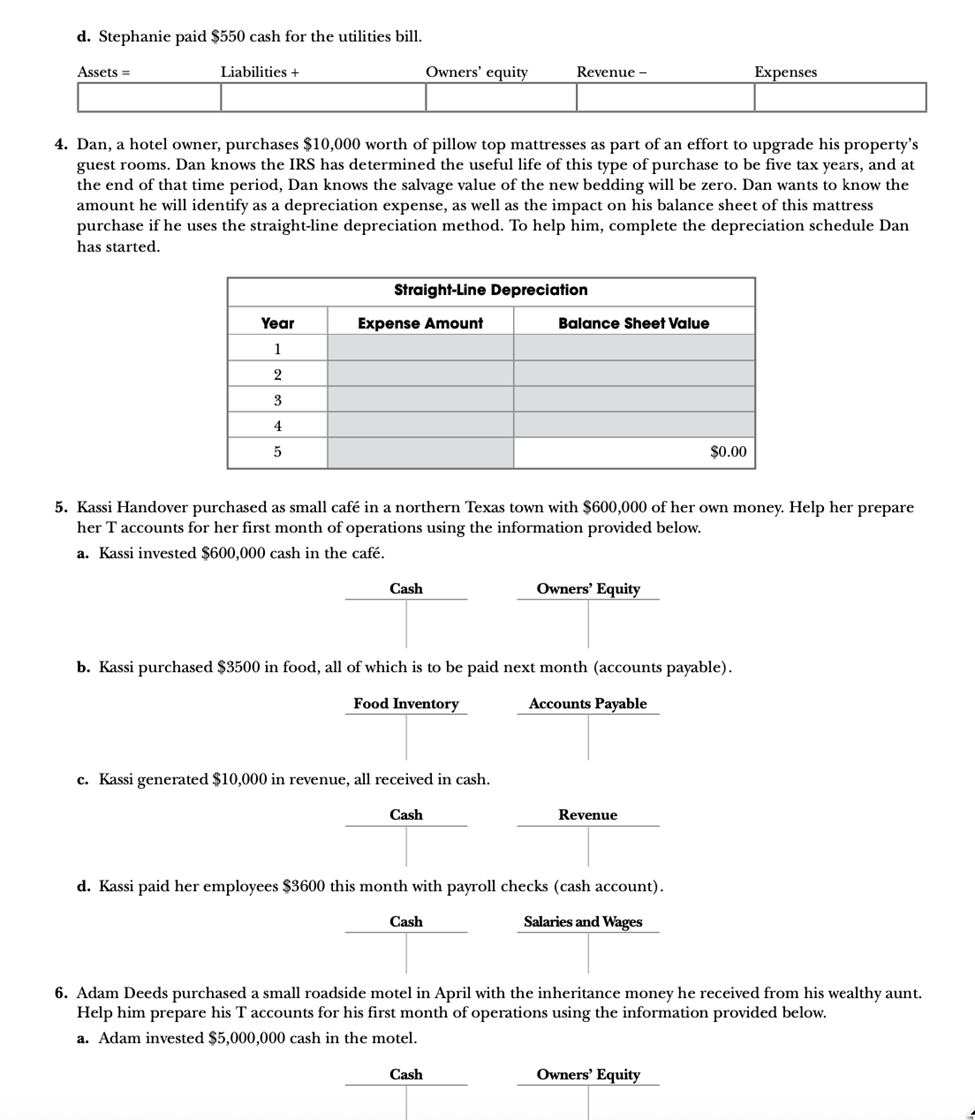

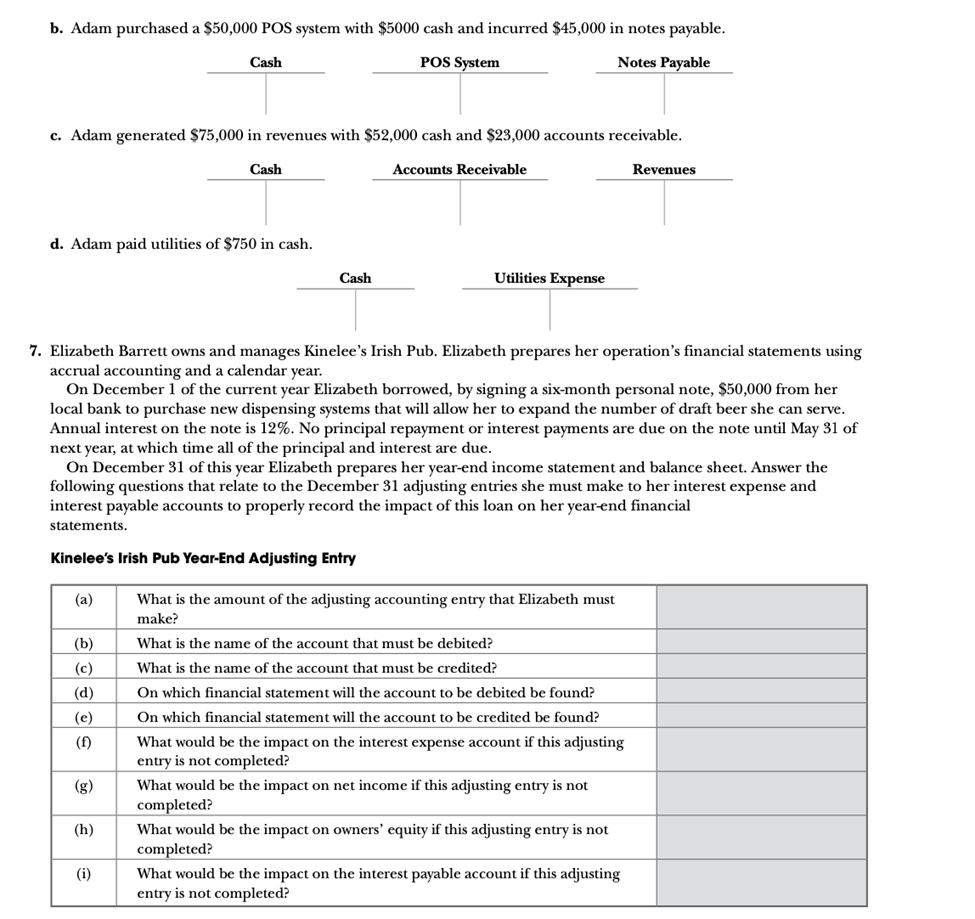

2. Lisa and Laura are twins who own a seafood restaurant in a coastal town. Lisa likes to report her income statement using accrual accounting, and Laura likes to report her income statement using cash accounting. Given the following information, complete the spreadsheet below for March using both accrual accounting for Lisa and cash account- ing for Laura. The restaurant generated $45,000 in revenue, but only received $30,000. Cost of food sold was $14,000, but only 60% was paid to the supplier. Salaries and wages were $13,000, but only 50% was paid to employees. Utilities expense was $600 and all of it was paid. Maintenance expense was $200, but it had been prepaid in January for the quarter. Marketing expense was $450 and all of it was paid. Rent expense was $6000 and all of it was paid. REVENUE EXPENSES Cost of Food Sold Salaries and Wages Utilities Maintenance Marketing Rent Lisa's Accrual Accounting ($) Laura's Cash Accounting ($) NET PROFIT OR (LOSS) a. Which accounting method, Lisa's accrual accounting or Laura's cash accounting, shows a higher net profit? b. Which accounting method shows the most accurate amount of money on hand to pay bills? c. Which accounting method most accurately shows the revenues generated regardless of when they were received? d. Which accounting method most accurately shows the expenses incurred regardless of when they were paid? e. Which accounting method most accurately shows actual cash inflows and outflows? f. Which accounting method shows the most accurate reflection of their restaurant's true profitability? 3. Stephanie Martinez opened a Latin Fusion restaurant downtown in a large southern city. She has asked you, her accountant, to complete the accounting equations for some of her first month's transactions. Complete the accounting equations below. (Spreadsheet hint: If you need to record two transactions in one cell, use Alt Enter after the first number to return to the next line within the same cell.) a. The restaurant started with a $1,200,000 check from its owner, Stephanie. Assets = Liabilities + Owners' equity b. The restaurant generated revenues of $5000 on accounts receivable. Assets = Liabilities + Owners' equity Revenue - Expenses Revenue - Expenses c. Stephanie purchased a $400,000 building with $40,000 cash and a $360,000 mortgage. Assets = Liabilities + Owners' equity Revenue - Expenses d. Stephanie paid $550 cash for the utilities bill. Assets = Liabilities + Owners' equity Revenue - Expenses 4. Dan, a hotel owner, purchases $10,000 worth of pillow top mattresses as part of an effort to upgrade his property's guest rooms. Dan knows the IRS has determined the useful life of this type of purchase to be five tax years, and at the end of that time period, Dan knows the salvage value of the new bedding will be zero. Dan wants to know the amount he will identify as a depreciation expense, as well as the impact on his balance sheet of this mattress purchase if he uses the straight-line depreciation method. To help him, complete the depreciation schedule Dan has started. Straight-Line Depreciation Year Expense Amount Balance Sheet Value 1 2 3 4 5 $0.00 5. Kassi Handover purchased as small caf in a northern Texas town with $600,000 of her own money. Help her prepare her T accounts for her first month of operations using the information provided below. a. Kassi invested $600,000 cash in the caf. Cash Owners' Equity b. Kassi purchased $3500 in food, all of which is to be paid next month (accounts payable). Food Inventory c. Kassi generated $10,000 in revenue, all received in cash. Cash Accounts Payable Revenue d. Kassi paid her employees $3600 this month with payroll checks (cash account). Cash Salaries and Wages 6. Adam Deeds purchased a small roadside motel in April with the inheritance money he received from his wealthy aunt. Help him prepare his T accounts for his first month of operations using the information provided below. a. Adam invested $5,000,000 cash in the motel. Cash Owners' Equity b. Adam purchased a $50,000 POS system with $5000 cash and incurred $45,000 in notes payable. Cash POS System Notes Payable c. Adam generated $75,000 in revenues with $52,000 cash and $23,000 accounts receivable. Cash d. Adam paid utilities of $750 in cash. Cash Accounts Receivable Utilities Expense Revenues 7. Elizabeth Barrett owns and manages Kinelee's Irish Pub. Elizabeth prepares her operation's financial statements using accrual accounting and a calendar year. On December 1 of the current year Elizabeth borrowed, by signing a six-month personal note, $50,000 from her local bank to purchase new dispensing systems that will allow her to expand the number of draft beer she can serve. Annual interest on the note is 12%. No principal repayment or interest payments are due on the note until May 31 of next year, at which time all of the principal and interest are due. On December 31 of this year Elizabeth prepares her year-end income statement and balance sheet. Answer the following questions that relate to the December 31 adjusting entries she must make to her interest expense and interest payable accounts to properly record the impact of this loan on her year-end financial statements. Kinelee's Irish Pub Year-End Adjusting Entry (a) What is the amount of the adjusting accounting entry that Elizabeth must make? (b) What is the name of the account that must be debited? (c) What is the name of the account that must be credited? (d) On which financial statement will the account to be debited be found? (e) On which financial statement will the account to be credited be found? (f) What would be the impact on the interest expense account if this adjusting entry is not completed? (g) What would be the impact on net income if this adjusting entry is not completed? (h) What would be the impact on owners' equity if this adjusting entry is not completed? (i) What would be the impact on the interest payable account if this adjusting entry is not completed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions about Kinelees Irish Pub yearend adjusting entry a What is the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started