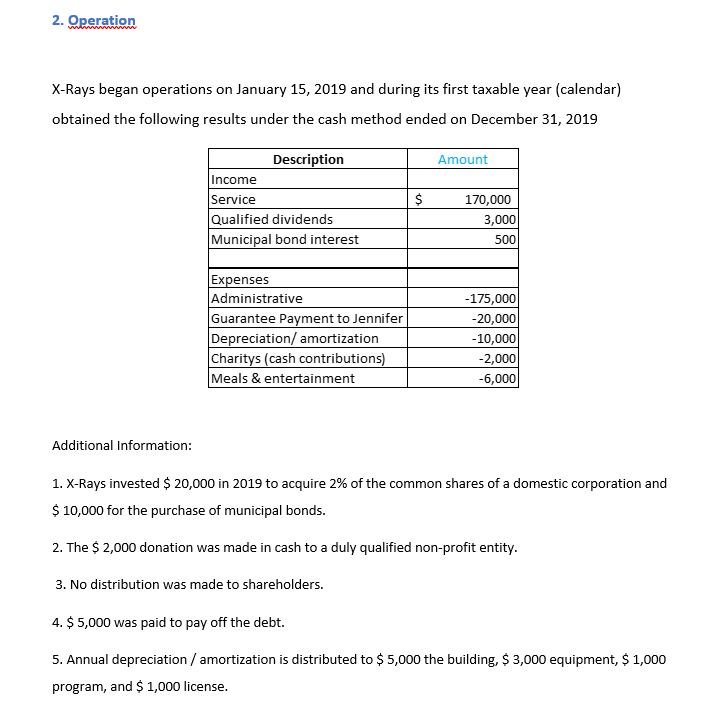

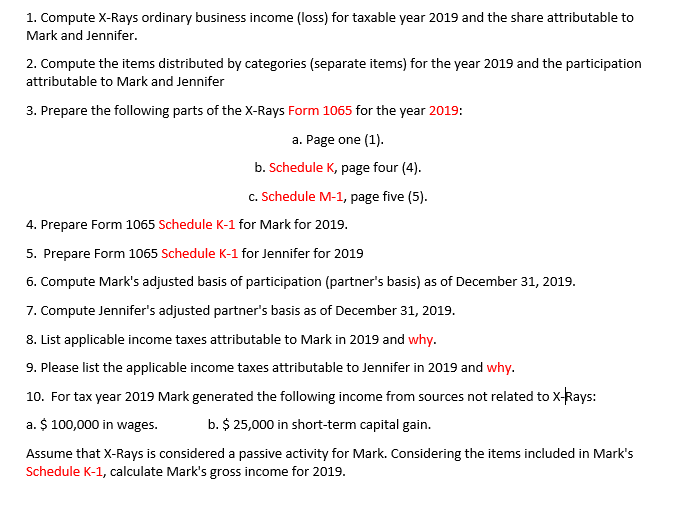

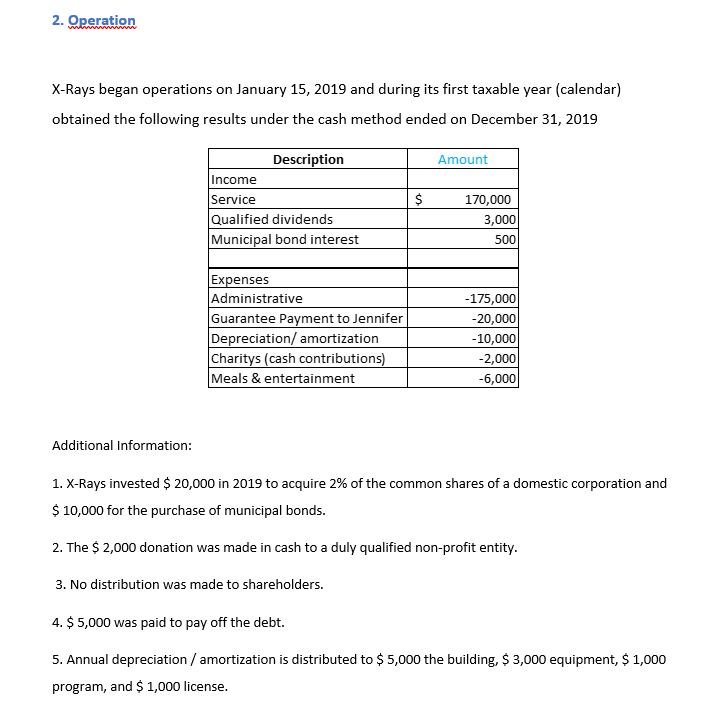

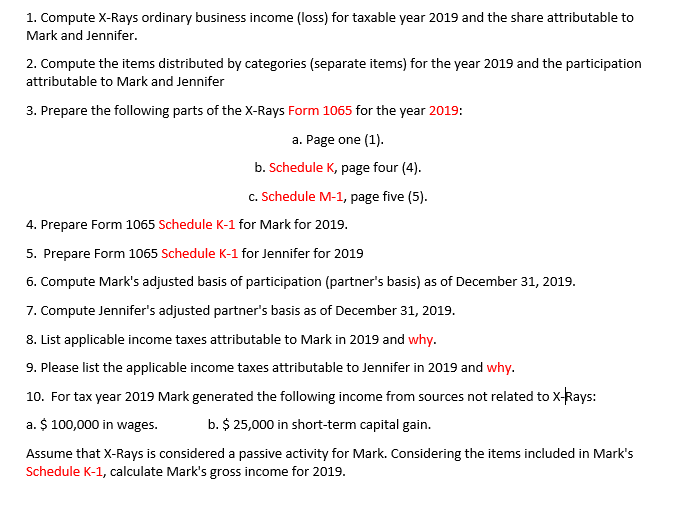

2. Operation X-Rays began operations on January 15, 2019 and during its first taxable year (calendar) obtained the following results under the cash method ended on December 31, 2019 Amount Description Income Service Qualified dividends Municipal bond interest $ 170,000 3,000 500 Expenses Administrative Guarantee Payment to Jennifer Depreciation/ amortization Charitys (cash contributions) Meals & entertainment -175,000 -20,000 -10,000 -2,000 -6,000 Additional Information: 1. X-Rays invested $ 20,000 in 2019 to acquire 2% of the common shares of a domestic corporation and $ 10,000 for the purchase of municipal bonds. 2. The $2,000 donation was made in cash to a duly qualified non-profit entity. 3. No distribution was made to shareholders. 4. $5,000 was paid to pay off the debt. 5. Annual depreciation / amortization is distributed to $5,000 the building, $ 3,000 equipment, $ 1,000 program, and $ 1,000 license. 1. Compute X-Rays ordinary business income (loss) for taxable year 2019 and the share attributable to Mark and Jennifer. 2. Compute the items distributed by categories (separate items) for the year 2019 and the participation attributable to Mark and Jennifer 3. Prepare the following parts of the X-Rays Form 1065 for the year 2019: a. Page one (1). b. Schedule K, page four (4). C. Schedule M-1, page five (5). 4. Prepare Form 1065 Schedule K-1 for Mark for 2019. 5. Prepare Form 1065 Schedule K-1 for Jennifer for 2019 6. Compute Mark's adjusted basis of participation (partner's basis) as of December 31, 2019. 7. Compute Jennifer's adjusted partner's basis as of December 31, 2019. 8. List applicable income taxes attributable to Mark in 2019 and why. 9. Please list the applicable income taxes attributable to Jennifer in 2019 and why. 10. For tax year 2019 Mark generated the following income from sources not related to X-Rays: a. $ 100,000 in wages. b. $ 25,000 in short-term capital gain. Assume that X-Rays is considered a passive activity for Mark. Considering the items included in Mark's Schedule K-1, calculate Mark's gross income for 2019. 2. Operation X-Rays began operations on January 15, 2019 and during its first taxable year (calendar) obtained the following results under the cash method ended on December 31, 2019 Amount Description Income Service Qualified dividends Municipal bond interest $ 170,000 3,000 500 Expenses Administrative Guarantee Payment to Jennifer Depreciation/ amortization Charitys (cash contributions) Meals & entertainment -175,000 -20,000 -10,000 -2,000 -6,000 Additional Information: 1. X-Rays invested $ 20,000 in 2019 to acquire 2% of the common shares of a domestic corporation and $ 10,000 for the purchase of municipal bonds. 2. The $2,000 donation was made in cash to a duly qualified non-profit entity. 3. No distribution was made to shareholders. 4. $5,000 was paid to pay off the debt. 5. Annual depreciation / amortization is distributed to $5,000 the building, $ 3,000 equipment, $ 1,000 program, and $ 1,000 license. 1. Compute X-Rays ordinary business income (loss) for taxable year 2019 and the share attributable to Mark and Jennifer. 2. Compute the items distributed by categories (separate items) for the year 2019 and the participation attributable to Mark and Jennifer 3. Prepare the following parts of the X-Rays Form 1065 for the year 2019: a. Page one (1). b. Schedule K, page four (4). C. Schedule M-1, page five (5). 4. Prepare Form 1065 Schedule K-1 for Mark for 2019. 5. Prepare Form 1065 Schedule K-1 for Jennifer for 2019 6. Compute Mark's adjusted basis of participation (partner's basis) as of December 31, 2019. 7. Compute Jennifer's adjusted partner's basis as of December 31, 2019. 8. List applicable income taxes attributable to Mark in 2019 and why. 9. Please list the applicable income taxes attributable to Jennifer in 2019 and why. 10. For tax year 2019 Mark generated the following income from sources not related to X-Rays: a. $ 100,000 in wages. b. $ 25,000 in short-term capital gain. Assume that X-Rays is considered a passive activity for Mark. Considering the items included in Mark's Schedule K-1, calculate Mark's gross income for 2019