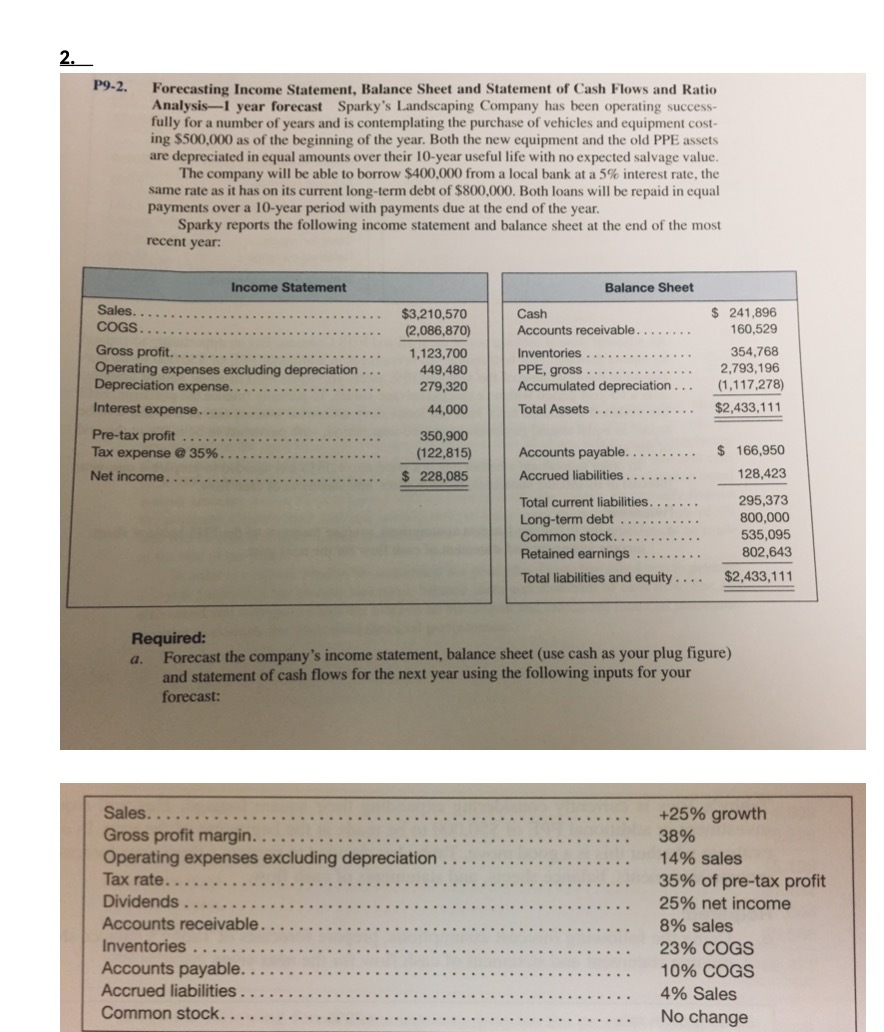

2. P9-2. Forecasting Income Statement, Balance Sheet and Statement of Cash Flows and Ratio Analysis-1 year forecast Sparky's Landscaping Company has been operating success- fully for a number of years and is contemplating the purchase of vehicles and equipment cost- ing $500,000 as of the beginning of the year. Both the new equipment and the old PPE assets are depreciated in equal amounts over their 10-year useful life with no expected salvage value. The company will be able to borrow $400,000 from a local bank at a 5% interest rate, the same rate as it has on its current long-term debt of $800,000. Both loans will be repaid in equal payments over a 10-year period with payments due at the end of the year. Sparky reports the following income statement and balance sheet at the end of the most recent year: Income Statement Balance Sheet Sales. . . . .. . $3,210,570 Cash $ 241,896 COGS. ... (2,086,870) Accounts receivable. . . . . . . . 160,529 Gross profit. .. . . . . . . . . . . . 1,123,700 Inventories . . 354,768 Operating expenses excluding depreciation . 449,480 PPE, gross . . . . . . . . . . . . .. 2,793,196 Depreciation expense. . . . .. 279,320 Accumulated depreciation . .. (1,117,278) Interest expense.. ... . 44,000 $2,433,111 . . . Total Assets . . . . . Pre-tax profit . . . ... 350,900 Tax expense @ 35%. 5 166,950 . . . (122,815) Accounts payable. . . . . . . Net income. $ 228,085 Accrued liabilities . 128,423 Total current liabilities. . . 295,373 Long-term debt . . .. . 800,000 Common stock. . . .. 535,095 Retained earnings 802,643 Total liabilities and equity . . .. $2,433,111 Required: a. Forecast the company's income statement, balance sheet (use cash as your plug figure) and statement of cash flows for the next year using the following inputs for your forecast: Sales. . . .. . . . . . . . . . . . . .. . . ... . +25% growth Gross profit margin. . .... . . .. . 38% Operating expenses excluding depreciation . 14% sales Tax rate . . . . 35% of pre-tax profit Dividends . .. . . . 25% net income Accounts receivable. 8% sales Inventories . . . 23% COGS Accounts payable. . . 10% COGS Accrued liabilities .. 4% Sales Common stock. ... No change