Question

2. Pastel payroll has set aside codes that the payroll administrator can use. Complete the table in your answer book by correctly identifying the

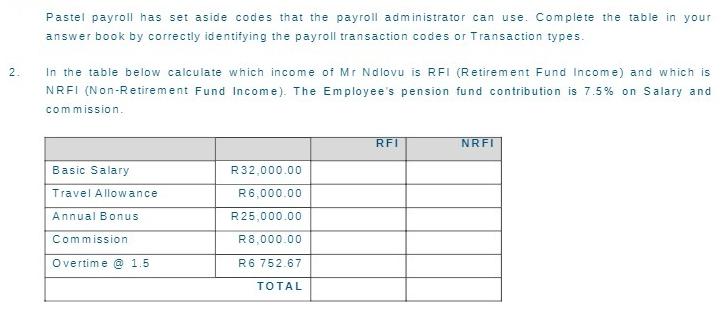

2. Pastel payroll has set aside codes that the payroll administrator can use. Complete the table in your answer book by correctly identifying the payroll transaction codes or Transaction types. In the table below calculate which income of Mr Ndlovu is RFI (Retirement Fund Income) and which is NRFI (Non-Retirement Fund Income). The Employee's pension fund contribution is 7.5% on Salary and commission. Basic Salary Travel Allowance Annual Bonus Commission Overtime @ 1.5 R32,000.00 R6,000.00 R25,000.00 R8,000.00 R6 752.67 TOTAL RFI NRFI

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

determine which income of Mr Ndlovu is Retirement Fund Income RFI and which is NonRetirement Fund ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing A Practical Approach

Authors: Robyn Moroney

1st Canadian Edition

978-1118472972, 1118472977, 978-1742165943

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App