Answered step by step

Verified Expert Solution

Question

1 Approved Answer

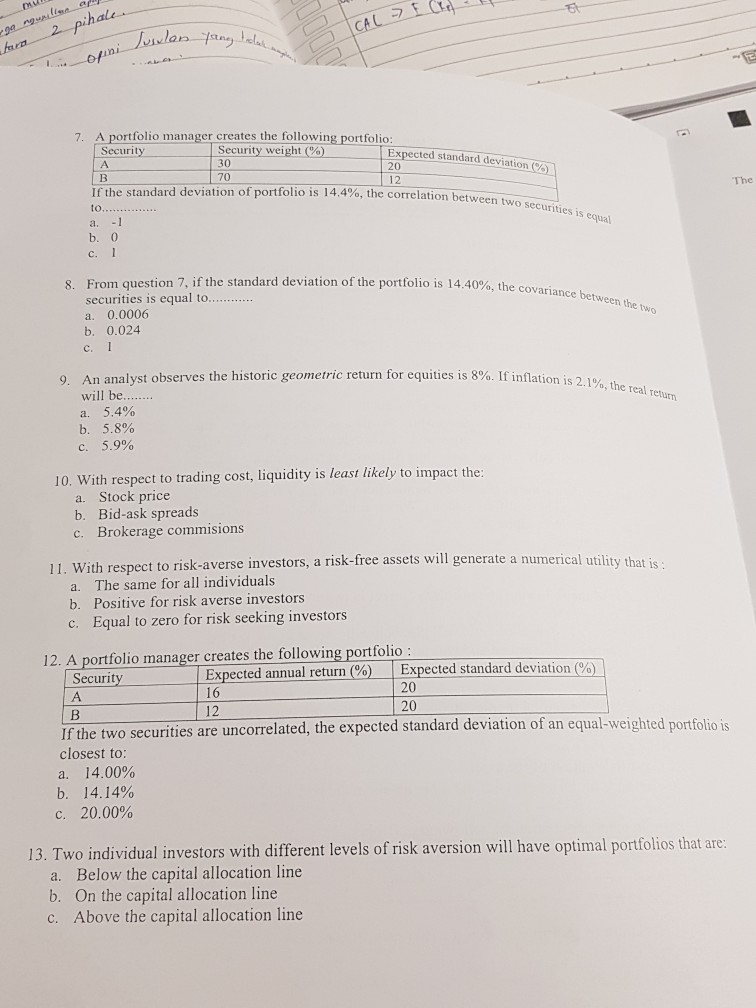

2 pihale. oni lan anea CAL F ga ngupiline A portfolio manager creates the following portfolio: Security weight (%) 30 7 Expected standard deviation (%)

2 pihale. oni lan anea CAL F ga ngupiline A portfolio manager creates the following portfolio: Security weight (%) 30 7 Expected standard deviation (%) 1 Security A 20 If the standard deviation of portfolio is 14.4% , the correlation between twO securities is equal 12 The to b. 0 1 C 8. From question 7, if the standard deviation of the portfolio is 14.40%, the covariance between the two securities is equal to... 0.0006 0.024 C 8%. If inflation is 2.1 %, the real retu 9. An analyst observes the historic geometric return for equities will be.... 5.4% 5.8% 5.9% C 10. With respect to trading cost, liquidity is least likely to impact the: a. Stock price b. Bid-ask spreads Brokerage commisions C 11. With respect to risk-averse investors, a risk-free assets will generate a numerical utility that is : The same for all individuals b. Positive for risk averse investors Equal to zero for risk seeking investors c. 12. A portfolio manager creates the following portfolio : Security Expected standard deviation (%) Expected annual return (%) 20 16 A 20 12 If the two securities are uncorrelated, the expected standard deviation of an equal-weighted portfolio is closest to: a. 14.00% b. 14.14% 20.00% C 13. Two individual investors with different levels of risk aversion will have optimal portfolios that are: allocation line Below the b. On the capital allocation line c. Above the capital allocation line

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started