Answered step by step

Verified Expert Solution

Question

1 Approved Answer

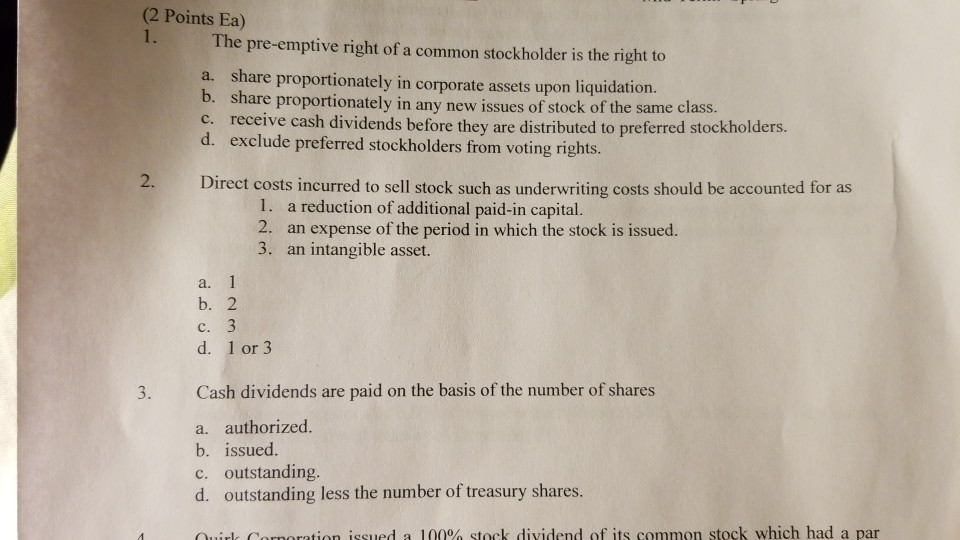

(2 Points Ea) The pre-emptive right of a common stockholder is the right to a. share proportionately in corporate assets upon liquidation. b. share proportionately

(2 Points Ea) The pre-emptive right of a common stockholder is the right to a. share proportionately in corporate assets upon liquidation. b. share proportionately in any new issues of stock of the same class. c. receive cash dividends before they are distributed to preferred stockholders. d. exclude preferred stockholders from voting rights. Direct costs incurred to sell stock such as underwriting costs should be accounted for as 1. a reduction of additional paid-in capital. 2. an expense of the period in which the stock is issued. 3. an intangible asset. a. b. 1 2 d. 1 or 3 Cash dividends are paid on the basis of the number of shares a. authorized b. issued. c. outstanding. d. outstanding less the number of treasury shares. Muirk Carnoration issued a 100% stock dividend of its common stock which had a par

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started