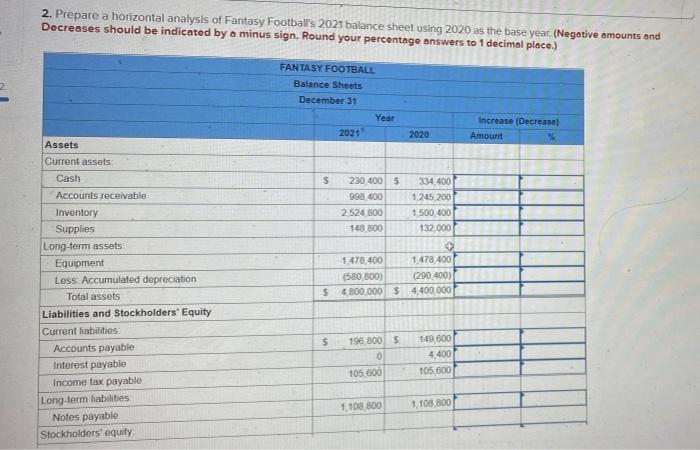

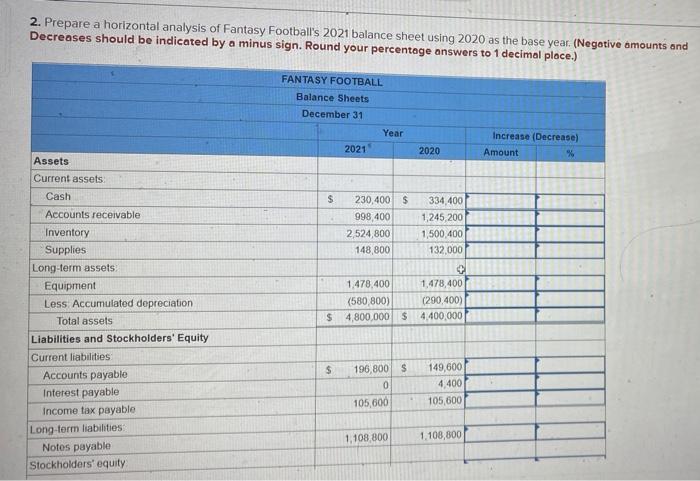

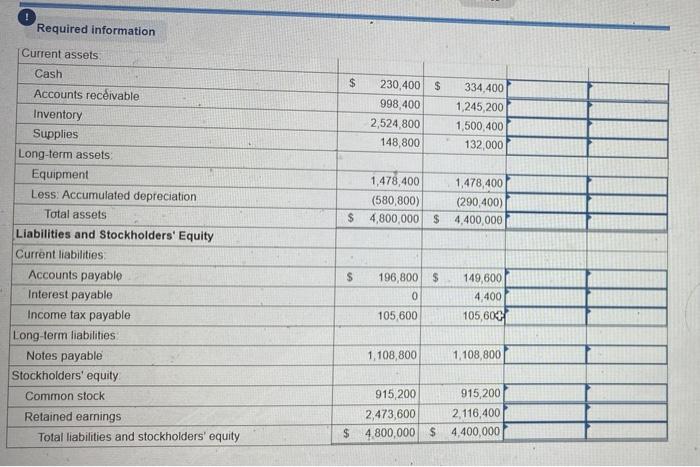

2. Prepare a horizontal analysis of Fantasy Football's 2021 balance sheet using 2020 as the base year, (Negative amounts and Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) 2 FANTASY FOOTBALL Balance Sheets December 31 Year 2021 Increase (Decrease) Amount 2020 $ 230.000 $ 998000 2524 800 148.800 334.400 1.245.2001 1 500 400 132.000 Assets Current assets Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Income tax payable Long-term liabilities Notes payablo Stockholders' equity + 1.478.400 1.478.400 1580 800) (290.400) 4 800,000 $4,400.000 $ 5 196 800 $ 0 105.600 149.600 4,400 105.600 1.108 800 1.108 800 2. Prepare a horizontal analysis of Fantasy Football's 2021 balance sheet using 2020 as the base year. (Negative amounts and Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) FANTASY FOOTBALL Balance Sheets December 31 Year 2021 Increase (Decrease) Amount % 2020 Assets Current assets Cash $ 230,400 $ 998 400 2,524,800 148,800 334,400 1,245,200 1,500,400 132,000 1,478,400 1,478,400 (580, 800) (290,400) $ 4,800,000 $4.400,000 Accounts receivable Inventory Supplies Long-term assets Equipment Less Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Income tax payable Long-term liabilities Notos payable Stockholders' equity $ 196,800 $ 0 105,000 149,600 4,400 105,600 1,108 800 1,108,800 Required information Current assets $ 230,400 $ 998,400 2,524,800 148,800 334,400 1,245,200 1,500,400 132,000 1,478,400 1.478.400 (580,800) (290,400) $ 4,800,000 $4,400,000 Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders' equity Common stock Retained earnings Total liabilities and stockholders' equity $ 196,800 $ 0 105 600 149,600 4.400 105,6007 1,108,800 1,108,800 915,200 915,200 2,473,600 2. 116,400 $ 4.800,000 $4.400,000