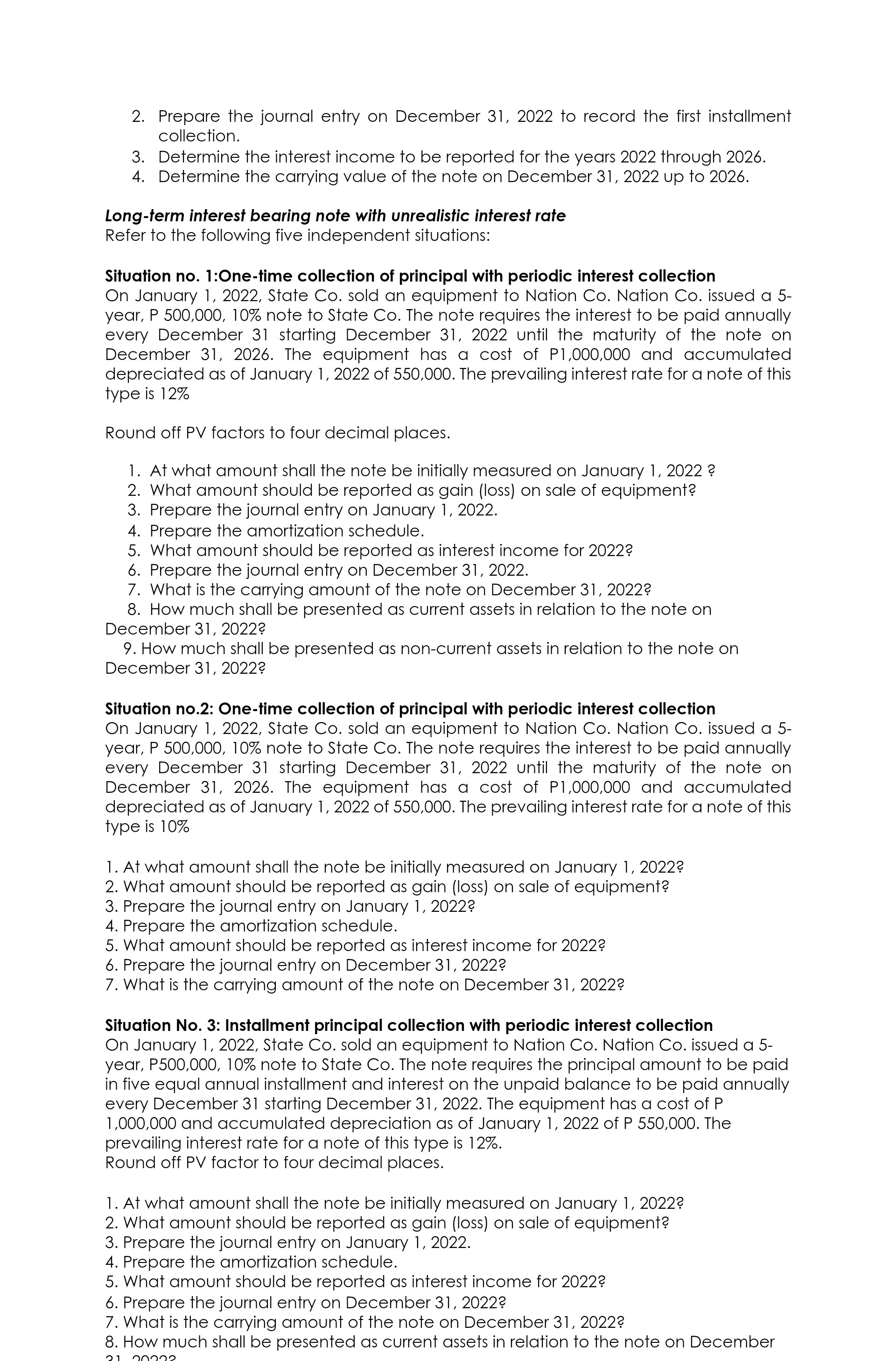

2. Prepare the journal entry on December 31, 2022 to record the first installment collection. 3. Determine the interest income to be reported for the years 2022 through 2026. 4. Determine the carrying value of the note on December 31, 2022 up to 2026. Long-term interest bearing note with unrealistic interest rate Refer to the following five independent situations: Situation no. 1:0ne-time collection of principal with periodic interest collection On January 1, 2022, State Co. sold an equipment to Nation Co. Nation Co. issued a 5 year, P 500,000, 10% note to State Co. The note requires the interest to be paid annually every December 31 starting December 31, 2022 until the maturity of the note on December 31, 2026. The equipment has a cost of P1,000,000 and accumulated depreciated as of January 1, 2022 of 550,000. The prevailing interest rate fora note of this type is 12% Round off PV factors to four decimal places. 1. At what amount shall the note be initially measured on January 1, 2022 ? 2. What amount should be reported as gain (loss) on sale of equipment? 3. Prepare the journal entry on January 1, 2022. 4. Prepare the amortization schedule. 5. What amount should be reported as interest income for 2022? 6. Prepare the journal entry on December 31, 2022. 7. What is the carrying amount of the note on December 31,2022? 8. How much shall be presented as current assets in relation to the note on December 31, 2022? 9. How much shall be presented as noncurrent assets in relation to the note on December 31, 2022? Situation no.2: One-time collection of principal with periodic interest collection On January 1, 2022, State Co. sold an equipment to Nation Co. Nation Co. issued a 5 year, P 500,000, 10% note to State Co. The note requires the interest to be paid annually every December 31 starting December 31, 2022 until the maturity of the note on December 31, 2026. The equipment has a cost of P1,000,000 and accumulated depreciated as of January 1,2022 of 550,000. The prevailing interest rate fora note of this type is 10% .At what amount shall the note be initially measured on January 1, 2022? . What amount should be reported as gain (loss) on sale of equipment? . Prepare the journal entry on January 1, 2022? . Prepare the amortization schedule. . What amount should be reported as interest income for 2022? . Prepare the journal entry on December 31, 2022? . What is the carrying amount of the note on December 31. 2022? \\loxtn-hwk)' Situation No. 3: Installment principal collection with periodic interest collection On January 1, 2022, State Co. sold an equipment to Nation Co. Nation Co. issued a 5 year, P500000, 10% note to State Co. The note requires the principal amount to be paid in five equal annual installment and interest on the unpaid balance to be paid annually every December 31 starting December 31, 2022. The equipment has a cost of P 1,000,000 and accumulated depreciation as of January 1, 2022 of P 550,000. The prevailing interest rate for a note of this type is 12%. Round off PV factor to tour decimal places. 1.At what amount shall the note be initially measured on January 1, 2022? 2. What amount should be reported as gain (loss) on sale of equipment? 3. Prepare the journal entry on January 1, 2022. 4. Prepare the amortization schedule. 5. What amount should be reported as interest income for 2022? 6. Prepare the journal entry on December 31, 2022? 7. What is the carrying amount of the note on December 31. 2022? 8 '2 . How much shall be presented as current assets in relation to the note on December 1 GAO\")