Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 PROBLEM 25.9A ROI, Residual Income, and Performance Evaluation Marfar Industries produces metal stamping equipment. The company expanded vertically several years ago by acquiring Bent

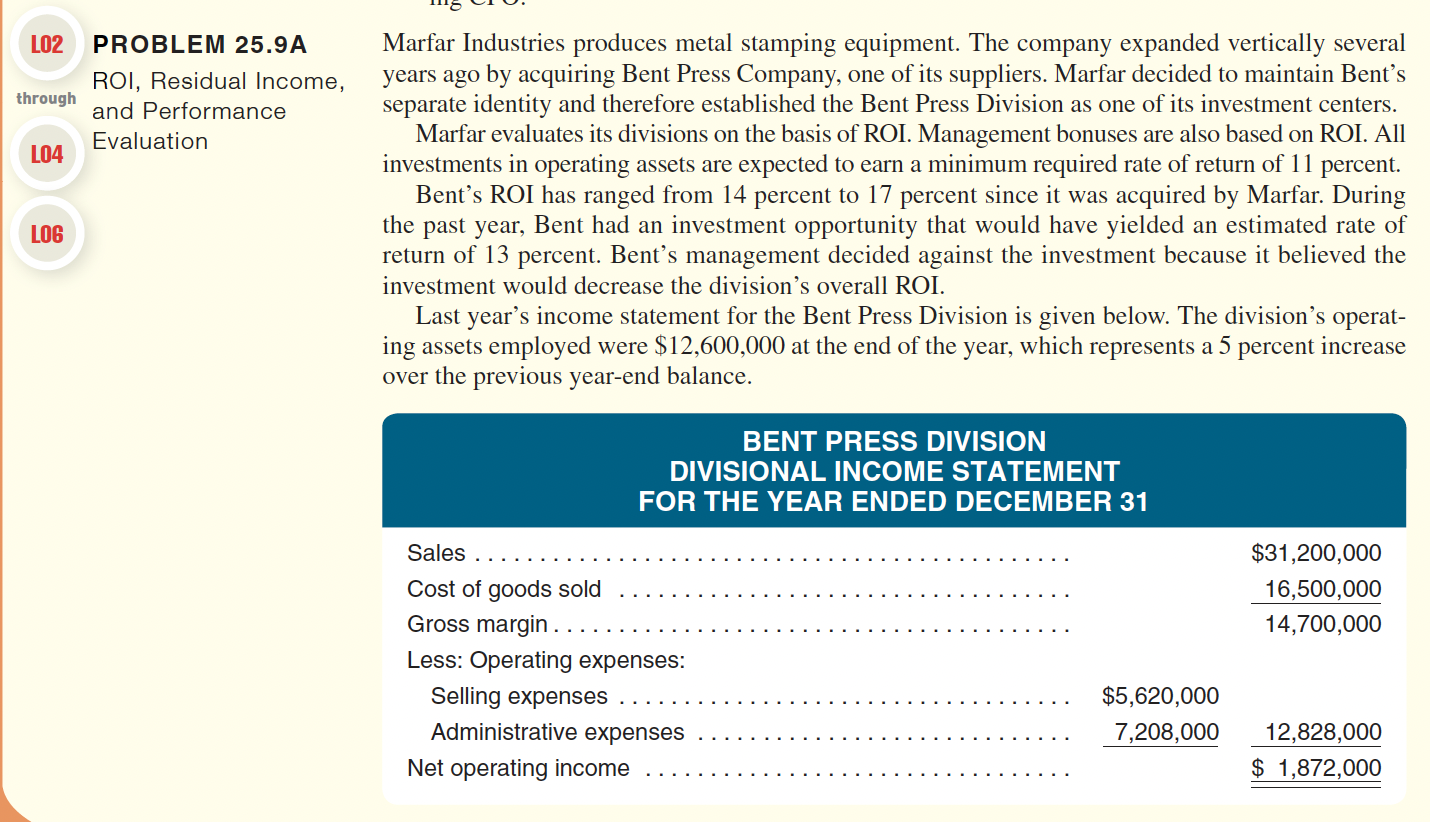

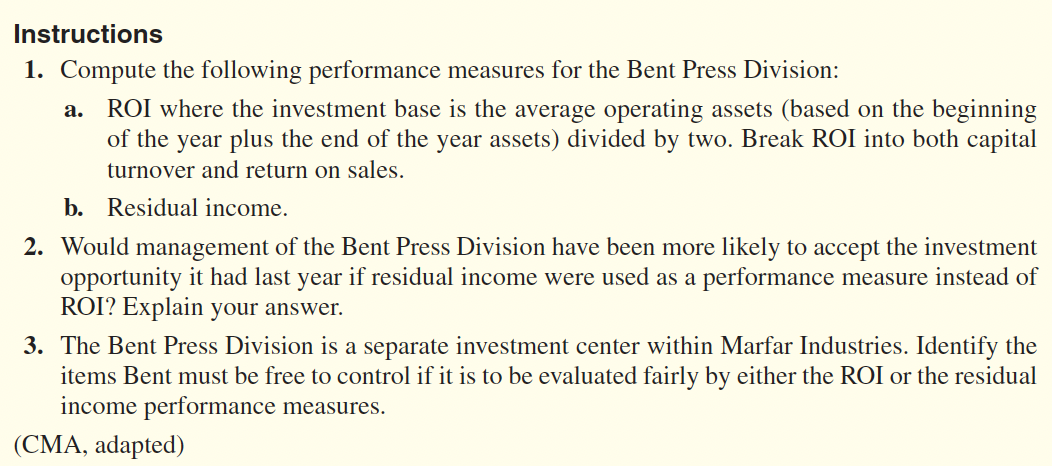

2 PROBLEM 25.9A ROI, Residual Income, and Performance Evaluation Marfar Industries produces metal stamping equipment. The company expanded vertically several years ago by acquiring Bent Press Company, one of its suppliers. Marfar decided to maintain Bent's separate identity and therefore established the Bent Press Division as one of its investment centers. Marfar evaluates its divisions on the basis of ROI. Management bonuses are also based on ROI. All investments in operating assets are expected to earn a minimum required rate of return of 11 percent. Bent's ROI has ranged from 14 percent to 17 percent since it was acquired by Marfar. During the past year, Bent had an investment opportunity that would have yielded an estimated rate of return of 13 percent. Bent's management decided against the investment because it believed the investment would decrease the division's overall ROI. Last year's income statement for the Bent Press Division is given below. The division's operating assets employed were $12,600,000 at the end of the year, which represents a 5 percent increase over the previous year-end balance. Instructions 1. Compute the following performance measures for the Bent Press Division: a. ROI where the investment base is the average operating assets (based on the beginning of the year plus the end of the year assets) divided by two. Break ROI into both capital turnover and return on sales. b. Residual income. 2. Would management of the Bent Press Division have been more likely to accept the investment opportunity it had last year if residual income were used as a performance measure instead of ROI? Explain your answer. 3. The Bent Press Division is a separate investment center within Marfar Industries. Identify the items Bent must be free to control if it is to be evaluated fairly by either the ROI or the residual income performance measures

2 PROBLEM 25.9A ROI, Residual Income, and Performance Evaluation Marfar Industries produces metal stamping equipment. The company expanded vertically several years ago by acquiring Bent Press Company, one of its suppliers. Marfar decided to maintain Bent's separate identity and therefore established the Bent Press Division as one of its investment centers. Marfar evaluates its divisions on the basis of ROI. Management bonuses are also based on ROI. All investments in operating assets are expected to earn a minimum required rate of return of 11 percent. Bent's ROI has ranged from 14 percent to 17 percent since it was acquired by Marfar. During the past year, Bent had an investment opportunity that would have yielded an estimated rate of return of 13 percent. Bent's management decided against the investment because it believed the investment would decrease the division's overall ROI. Last year's income statement for the Bent Press Division is given below. The division's operating assets employed were $12,600,000 at the end of the year, which represents a 5 percent increase over the previous year-end balance. Instructions 1. Compute the following performance measures for the Bent Press Division: a. ROI where the investment base is the average operating assets (based on the beginning of the year plus the end of the year assets) divided by two. Break ROI into both capital turnover and return on sales. b. Residual income. 2. Would management of the Bent Press Division have been more likely to accept the investment opportunity it had last year if residual income were used as a performance measure instead of ROI? Explain your answer. 3. The Bent Press Division is a separate investment center within Marfar Industries. Identify the items Bent must be free to control if it is to be evaluated fairly by either the ROI or the residual income performance measures Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started