Answered step by step

Verified Expert Solution

Question

1 Approved Answer

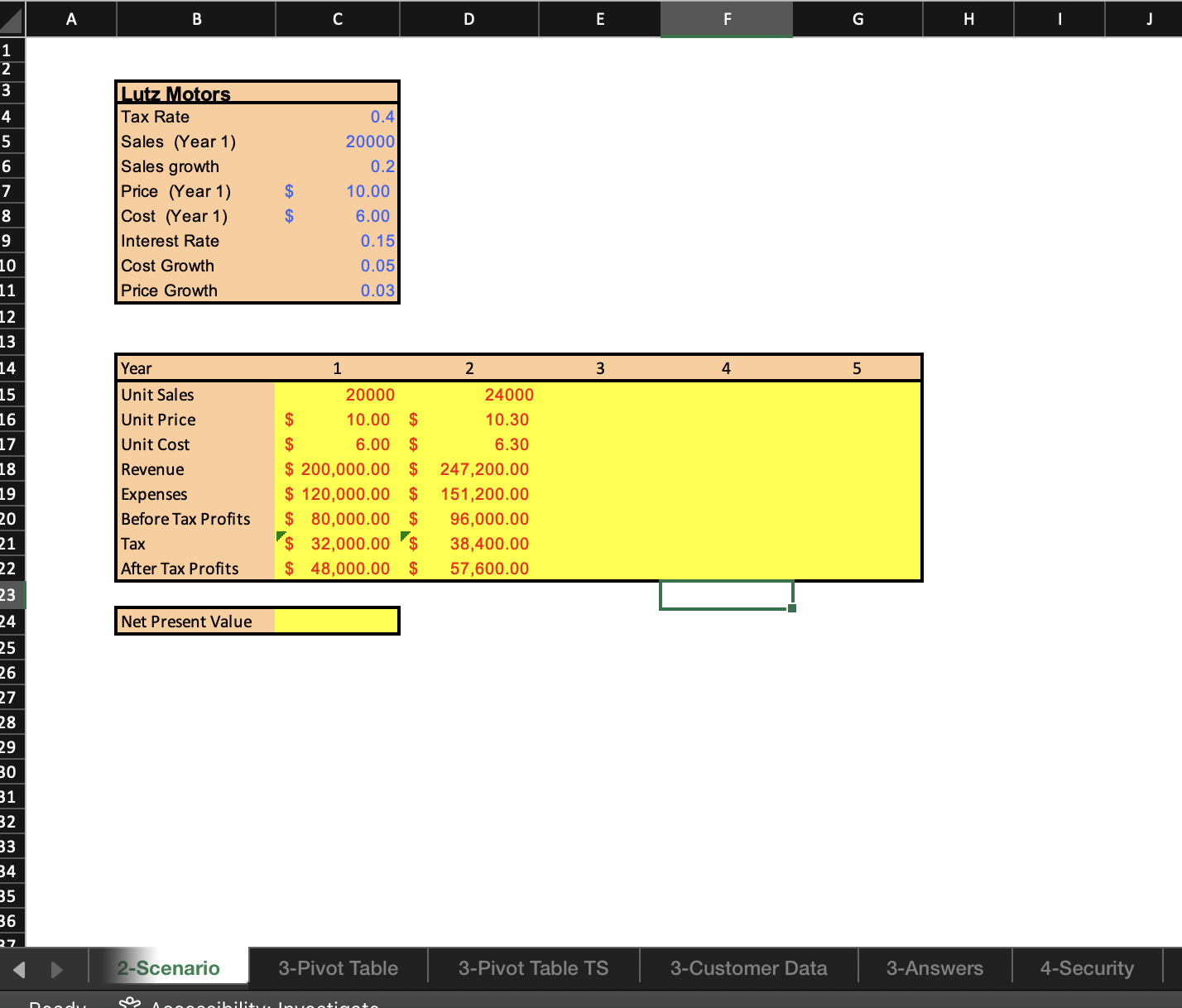

2 ) Profit Scenario Murry Lutz owns a small shop, Lutz Motors that sells and services vintage motorcycles. Murry is curious how his profit will

Profit Scenario

Murry Lutz owns a small shop, Lutz Motors that sells and services vintage motorcycles. Murry is curious how his profit will be affected by his sales over the next year.

Project Focus

Murry would like your help in creating the bestcase, worstcase, and mostlikely scenarios for his motorcycle sales over the next year. Using Scenario Manager, help Murry analyze the information provided in the worksheet titled Scenario. Generate a scenario summary for Murry and call it Summary. The result cell should be the cell which calculates the NPV see below

Instructions

While plugging values for Unit Sales, Unit Cost and Unit Price for year please ensure that the cells are mapped from the assumption area labeled Lutz Motors at the top of the worksheet ie you should use cell references rather than typing in or copying the values provided. This improves the design of the spreadsheet so that if the values in the assumption area change, the rest of the worksheet will be updated automatically.

While calculating the growth for Unit Sales, Unit Cost and Unit Price from years to please ensure that the necessary cells have absolute cell references F to make it easier to copy your formulas.

Scenarios should be set up by changing Sales, Sales Growth and Price. The values given below should be assumed for each scenario.

Bestcase: Sales Sales Growth Price $

Worsecase: Sales Sales Growth Price$

Mostlikely: Sales Sales Growth Price$

Calculate the Net Present Value. If you are not familiar with this function in Excel, research it in Excel through Help F Essentially, NPV provides the net present value of an investment, based on a discount rate, of a series of future payments and income.

In calculating the NPV in this problem, you have to provide two pieces of information see NPV formula

Rate: this is the Interest Rate

Values value value etc...: this is represented by the After Tax Profits for all years.

Necessary Formulas

RevenueUnit Sales x Unit Price

ExpensesUnit Sales x Unit Cost

Before Tax ProfitsRevenueExpense

TaxBefore Tax Profits x Tax Rate

After Tax ProfitsBefore Tax Profits Tax

Answer the formulas for year and also provide the formula for the net present value answer

give the excel answer for the questions and the formulas to compute on excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started