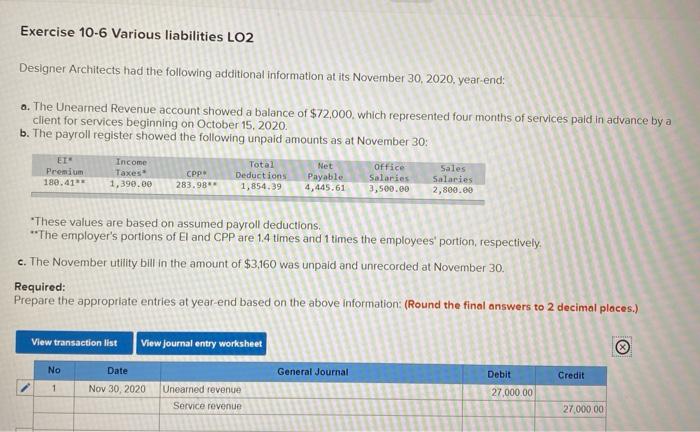

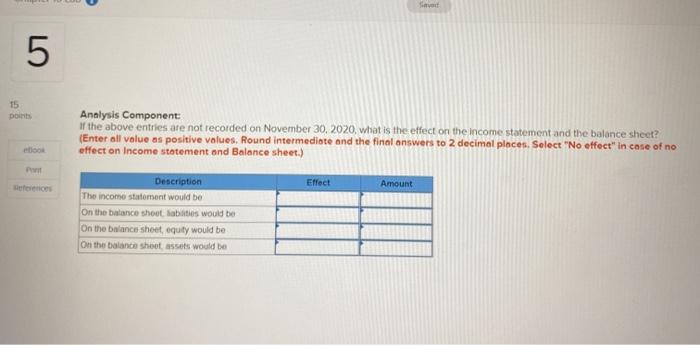

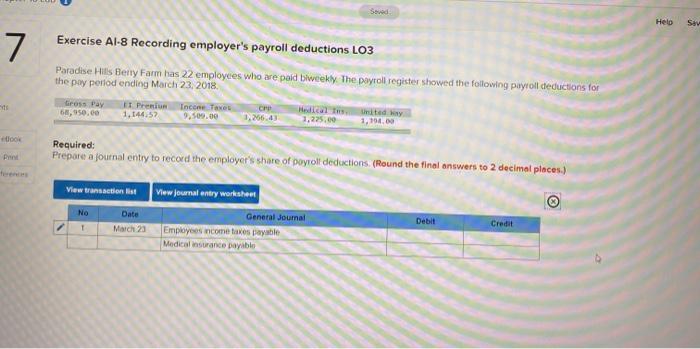

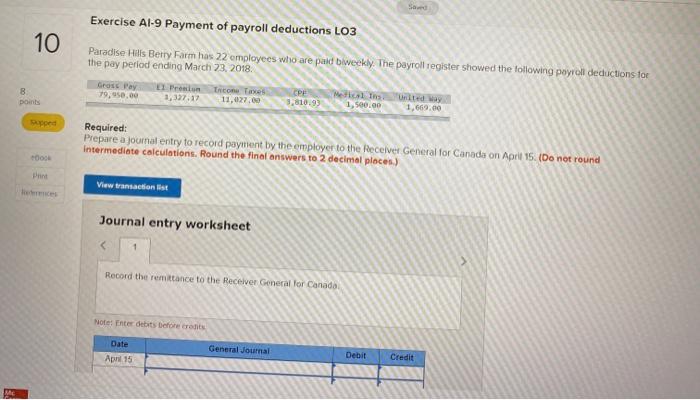

Exercise 10-6 Various liabilities LO2 Designer Architects had the following additional information at its November 30, 2020, year-end: a. The Unearned Revenue account showed a balance of $72,000, which represented four months of services paid in advance by a client for services beginning on October 15, 2020. b. The payroll register showed the following unpaid amounts as at November 30: ET Premium 188.413* Income Taxes 1,390.00 CPP 283.98** Total Deductions 1,854.39 Net Payable 4,445.61 Office Salaries 3,500.00 Sales Salaries 2,800.00 *These values are based on assumed payroll deductions "The employer's portions of El and CPP are 1.4 times and 1 times the employees' portion, respectively, c. The November utility bill in the amount of $3,160 was unpaid and unrecorded at November 30. Required: Prepare the appropriate entries at year-end based on the above information: (Round the final answers to 2 decimal places.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Nov 30, 2020 Unearned revenue Service revenue 27,000.00 27,000.00 5 15 point, Analysis Component If the above entries are not recorded on November 30, 2020, what is the effect on the income statement and the balance sheet? (Enter all value as positive values. Round intermediate and the final answers to 2 decimal places. Select "No effect" in case of no effect on Income statement and Balance sheet.) Effect Amount Description The income statement would be On the balance shoot sabities would be On the balance sheet equity would be On the balance shoot assets would be Helo Suv 7 Exercise Al-8 Recording employer's payroll deductions LO3 Paradise Hills Betty Farm has 22 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2018 Gross Pay E Premium Income Taxes 68,950.00 1.144.57 9,500.00 1.266 43 1,225.00 1,194.00 look Pend Required: Prepare a journal entry to record the employer's share of payroll deductions (Round the final answers to 2 decimal places.) View transaction ist View journal entry worksheet No 1 Date March 23 Debit Credit General Journal Employees income taxes payable Medical insurance payable Exercise Al-9 Payment of payroll deductions LO3 10 Paradise Hills Berry Farm has 22 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2018 Gross Pay 79,950.00 points E Premium 1,327,17 Income Taxes CPE 3,810.93 1,500.00 1,669.00 Bapped Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round Intermediate calculations. Round the final answers to 2 decimal places) 00 Print View transactions Journal entry worksheet